Whether you’re a stock-market investor, an worker of a non-public enterprise or a buyer of one of many hundreds of consumer-facing firms owned by private-equity funds, personal fairness is a part of your life.

It’s a world that is still out of the highlight a lot of the time, however one which has grown too huge to disregard.

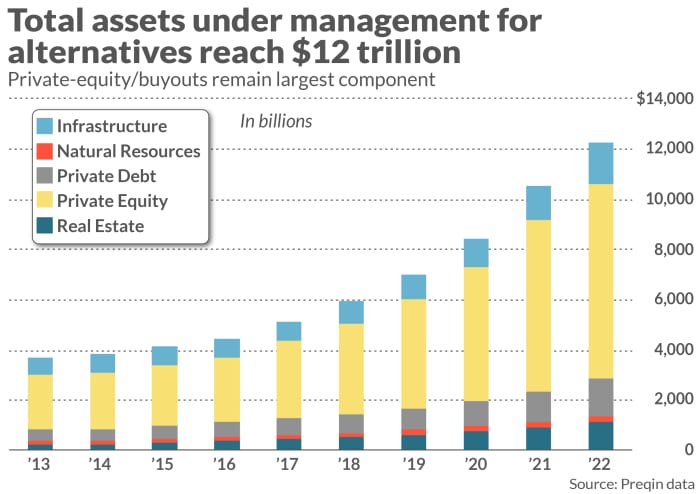

Assets beneath administration have tripled to $12 trillion in lower than a decade, making the world of different investments a big a part of the general economic system.

By comparability, the U.S. stock-market pantheon of two,800 New York Stock Exchange shares and three,300 Nasdaq shares ideas the scales at a mixed market capitalization of $46.2 trillion.

Alternative-investment property beneath administration have tripled since 2013, with private-equity funds as the most important part.

MarketWatch/Terrence Horan

Outside of these roughly 6,000 listed firms on the Nasdaq and the NYSE, the world of personal fairness is a serious participant within the bigger universe of personal firms, typically owned by households or different private-equity companies.

Private-equity companies are at present invested in about 14,300 firms within the U.S., in response to trade estimates.

About 21,000 companies within the U.S. have 500 or extra staff, in response to the Small Business & Entrepreneurship Council. Along with these bigger firms, the U.S. at present helps greater than 33 million small companies using 61.7 million individuals, in response to the Small Business Administration.

That’s a really huge sandbox outdoors of the smaller world of publicly traded firms.

To put the $12 trillion beneath administration in different investments into additional perspective:

- U.S. banks reported whole mixed property beneath administration of $23.47 trillion as of June 30.

- The U.S. Social Security Administration reported $2.83 trillion in trust-fund reserves in its 2023 report.

- Total U.S. retirement property for the U.S. have been $36.7 trillion, together with $13 trillion in particular person retirement accounts and $10.2 trillion in defined-contribution plans equivalent to 401(okay)s, as of June 30, in response to the Investment Company Institute.

Private-equity companies are sometimes concerned within the delivery of publicly traded firms by backing preliminary public choices. They additionally lead take-private offers that finish the lifetime of public firms on the NYSE or Nasdaq after they purchase all of the frequent inventory in a goal enterprise.

If you’re one of many roughly 19 million public staff within the U.S. working for a state or municipality, or in the event you work for a big studying establishment, a bit of your retirement plan’s cash is invested in private-equity funds, personal credit score funds and different alternate options.

Nuts and bolts

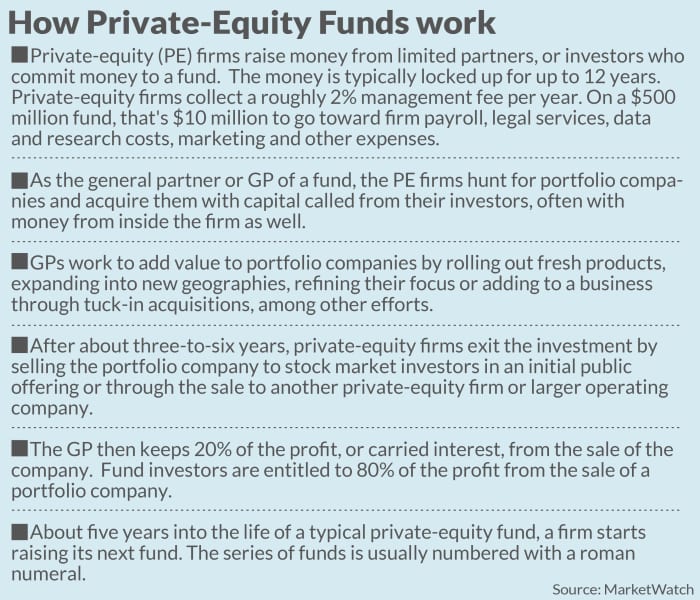

So what precisely is a private-equity fund and the way does it work?

Not not like an exchange-traded fund or a mutual fund, a private-equity fund holds a basket of firms. Traditional private-equity buyout funds are usually made up of 10 to fifteen firms, versus the handfuls or lots of of firms in an ETF, say, for the S&P 500

SPX

or the Nasdaq-100.

Private-equity funds are additionally much like shares, as a result of each inventory homeowners and private-equity fund homeowners buy fairness in firms. Private credit score funds resemble bonds in some methods, as a result of each characterize investments in debt.

Unlike cash invested in shares or bonds, nevertheless, cash put right into a fund is often locked up for a minimum of 10 years, though traders — often known as restricted companions, or LPs for brief — begin getting a few of their a refund inside just a few years because the agency sells, or exits, its portfolio firms.

Private-equity funds purchase firms, maintain them for just a few years, promote them after which pay out 80% of the income to the fund traders.

MarketWatch/Terrence Horan

Early within the lifetime of a fund, private-equity companies name in capital from their traders to purchase firms. The companies usually personal the businesses for 3 to 5 years after which promote them.

Every time a sale occurs, the LPs are entitled to 80% of any revenue from the sale of the corporate. The private-equity fund’s normal companions, or GPs — made up of private-equity executives — get 20% of the revenue, which known as carried curiosity. By the tip of the lifetime of a fund, all the businesses have been purchased and offered, with money dispersed to traders and the agency.

Once a agency deploys about 70% of the capital in a fund, about 4 to 6 years into the lifetime of the fund, it begins elevating capital for its subsequent fund.

Another subset of the choice investments has grown up across the sale of stakes in private-equity funds. If an investor needs to get out of a fund for no matter purpose, that investor is usually in a position to promote its stake to a different investor on the secondary market. This has grown into an enormous enterprise in its personal proper, with huge secondary funds made up of many stakes in private-equity funds. In one other twist, some funding outlets purchase up stakes in private-equity companies.

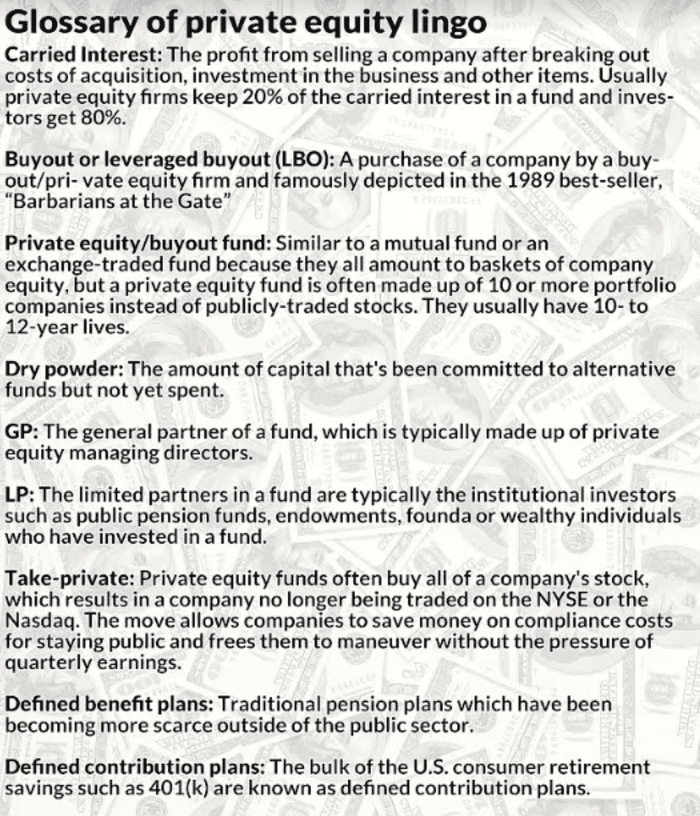

Here are some key definitions from the world of different investing.

MarketWatch/Terrence Horan

While personal fairness has been on Wall Street’s map as a separate apply for the reason that Eighties, the trade was previously often called service provider banking. Banks would make investments off their very own steadiness sheets to purchase firms or different property and would typically line up traders both from inside the financial institution or elsewhere to supply capital.

After the worldwide monetary disaster of 2007-08, many banks spun off their private-equity models into impartial companies.

However, Goldman Sachs Group Inc.

GS,

has continued to run its service provider financial institution, which it folded into its Global Asset and Wealth Management unit.

Also learn: Goldman Sachs’s private-equity enterprise has been a ‘black box,’ however now it’s opening up

Image drawback

To make sure, the private-equity enterprise is just not at all times portrayed in a good gentle. Books such because the 1989 bestseller “Barbarians at the Gate” by Bryan Burrough and John Helyar, or the not too long ago launched “These Are the Plunderers” by New York Times author Gretchen Morgenson and financial-policy analyst Joshua Rosner, painting a world of wheeling and dealing by grasping executives who’re enriching themselves with little regard for the employees on the firms they aim. The titles of the books alone say as a lot.

Private-equity companies might make some huge cash, however they do quite a bit higher when their portfolio firms thrive from their investments, and never from looting them.

Some private-equity executives have complained that the trade has a picture drawback — one which enterprise capitalists have principally managed to keep away from by positioning themselves as thought leaders and pattern setters by investing in sizzling startups.

Others level out that the trade exhibits advantage as a result of it’s had a stable observe file of stewardship for main pension funds and different institutional traders.

“I disagree that private equity has a general, across-the-board image problem,” stated Kelly DePonte, managing director of Probitas Partners, a placement agency that helps alternative-investment managers elevate capital. “There are certainly bad actors in the industry — as there are in all industries — and certain academics and politicians are negatively focused on fees. But many investors look at returns net of fees as attractive, especially compared to other investments over the past decade.”

But there’s no query that the riches made within the trade might trigger some to wonder if the trade performs a good sport.

Stephen Schwarzman, CEO of Blackstone, the most important publicly traded private-equity agency, has an estimated web value of $35 billion.

jim watson/Agence France-Presse/Getty Images

Among the wealthiest executives within the U.S., Stephen Schwarzman, chief government of the most important publicly traded private-equity agency, Blackstone Inc.

BX,

earned about $1 billion in dividends from his firm’s inventory plus about $251 million in compensation in 2022 alone. Forbes journal estimates his present web value at about $35 billion.

By distinction, BlackRock Inc.

BLK,

Chief Executive Larry Fink, who runs the most important asset supervisor on the planet, with property beneath administration of $9.4 trillion, is value about $1 billion, in response to Forbes.

Private fairness has principally saved a low profile, with few family names within the enterprise.

When Mitt Romney, co-founder of huge private-equity agency Bain Capital, ran for president towards Barack Obama in 2008, he famously stated, “I like being able to fire people.” Romney made the comment within the context of his healthcare platform, as he defined the way it’s a great factor for individuals to have the ability to swap service suppliers if these suppliers should not assembly their wants, however the remark was typically cited as an interpretation of his job as a private-equity government.

One of the one extremely seen individuals on the planet of personal fairness proper now could be actuality TV star Kim Kardashian. She is at present on the helm of Skky Partners, a agency she co-founded with Carlyle Group Inc.

CG,

veteran Jay Sammons that’s taking purpose at investments in style, media, magnificence, media, hospitality and meals.

Kim Kardashian co-founded private-equity agency Skky Partners with Carlyle Group veteran Jay Sammons.

Getty Images

Politicians together with Democratic Sen. Elizabeth Warren have criticized private-equity companies as loading up their portfolio firms with debt after which shedding staff. In 2021, Warren filed a invoice known as the Stop Wall Street Looting Act, however the laws has by no means made it out of Congress.

Instead, private-equity companies final 12 months managed to maintain carried curiosity taxed on the similar stage as capital beneficial properties quite than as revenue, a transfer that saved the trade tens of billions of {dollars} in potential tax will increase.

Also learn: We anticipate it to be eliminated’: Democrats’ push to shut ‘carried interest loophole’ in jeopardy as Sinema seeks to dam effort

Stewards of capital for retirement funds

While personal fairness has a status for extreme income and “looting” on one aspect, pension funds and different managers of retirement capital have been pouring increasingly cash into the asset class.

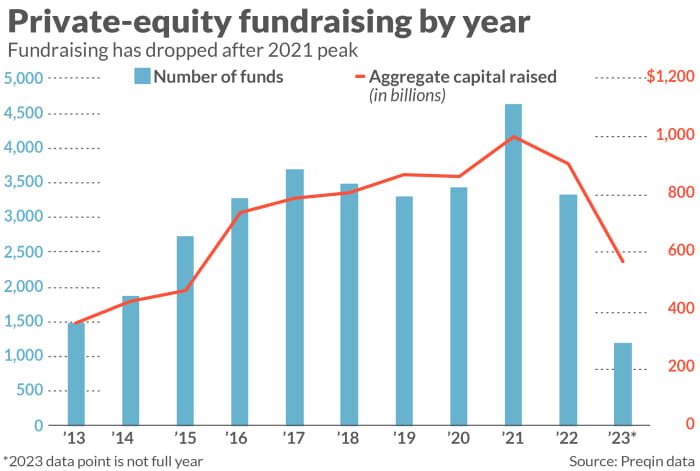

The cash raised by private-equity funds peaked at greater than $1.1 trillion in 2021. While it has been affected by rocky monetary markets in 2022 and 2023, the trade nonetheless has extra money than it has been in a position to deploy.

Private-equity fundraising has fallen in 2022 and 2023 as deal making has slowed.

MarketWatch/Terrence Horan

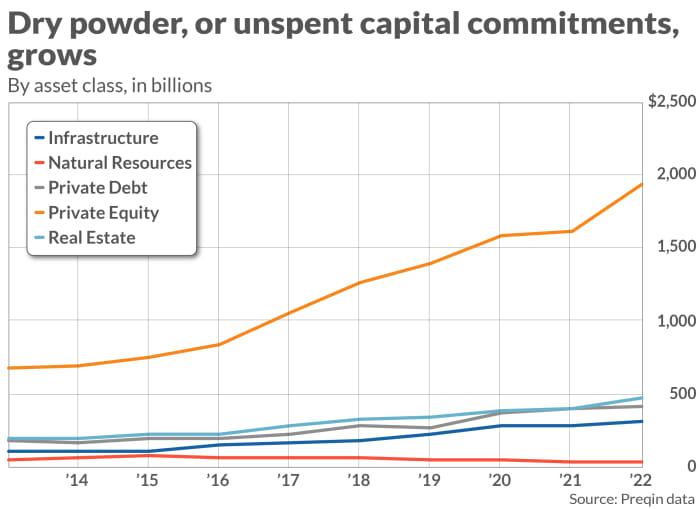

Private-equity companies typically face a difficulty that few would contemplate an issue: an excessive amount of cash ready to be put to work. This cache of so-called dry powder rose to almost $2 trillion in 2022.

Private-equity companies have constructed up unspent capital, known as dry powder.

MarketWatch/Terrence Horan

At final verify, about 12 million individuals within the U.S. work for firms backed by private-equity companies, and so they earn an estimated $1 trillion in wages, in response to knowledge from the American Investment Council, a commerce group for private-equity companies. The total U.S. private-equity sector accounts for about 6.5% of U.S. gross home product, or about $1.7 trillion, in response to the AIC.

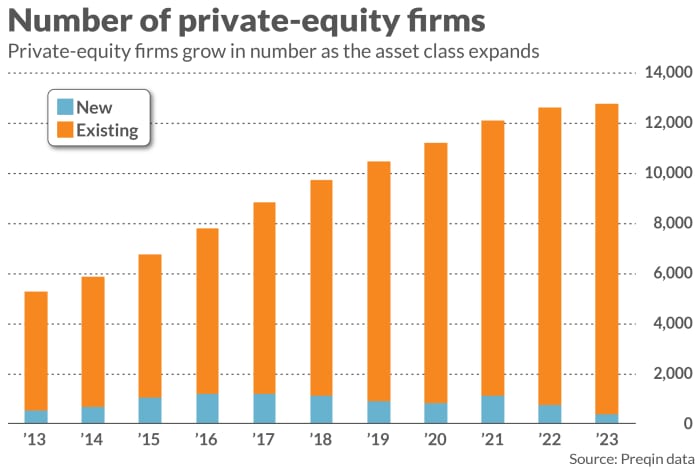

The whole variety of private-equity companies topped 12,000 eventually verify, up from fewer than 6,000 in 2013, in response to investment-data firm Preqin.

While the median enterprise backed by personal fairness has 69 staff, many bigger, extensively identified firms equivalent to Uber Technologies Inc.

UBER,

Airbnb Inc.

ABNB,

Yeti Holdings Inc.

YETI,

Dunkin, Safeway, PetSmart, Hilton Hotels, Toys R Us, RJR Nabisco and Kinder Morgan have been backed by private-equity companies.

The variety of private-equity companies has greater than doubled since 2013.

MarketWatch/Terrence Horan

If you personal inventory, you’ve in all probability seen a few of your publicly traded firms being devoured up by take-private leveraged-buyout offers led by private-equity companies. A historic case could be KKR & Co.’s

KKR,

$25 billion buyout of RJR Nabisco, which put personal fairness firmly on Wall Street’s radar in 1988 as one of many largest-ever mergers on the time.

A more energizing instance is that of retailer Chico FAS

CHS,

which is being acquired for $1 billion by Sycamore Partners, a private-equity agency that manages a portfolio of retail manufacturers equivalent to Staples, Hot Topic, the Limited, Talbots, Dollar Express and Nine West.

This transaction sort has drawn criticism as a result of leveraged buyouts typically contain loading up the goal firm with costly debt. If the corporate manages to match progress projections on the time of the deal, this isn’t often an issue.

In some circumstances, nevertheless, a selected trade or a person firm might fall on laborious instances, leaving private-equity portfolio firms with weak steadiness sheets or going through chapter.

One high-profile instance was the buyout of Toys R Us, which was acquired for $7.5 billion by Bain Capital, Vornado Realty Trust and KKR & Co. in 2005. Prior to the deal, Toys R Us had lower than $2 billion in debt, however after the deal closed, that determine grew to $5 billion.

Impacted by steep debt funds and competitors from retailing giants equivalent to Walmart Inc.

WMT,

and on-line rivals equivalent to Amazon.com Inc.

AMZN,

Toys R Us went bankrupt, leading to about 33,000 layoffs in 2018.

Employees at Toys R Us gained a $2 million severance settlement a 12 months later, whereas individually, KKR & Co. and Bain Capital dedicated a mixed $20 million to launch the TRU Financial Assistance Fund in late 2018.

Such a transfer would have gained assist from one of many largest investor teams in private-equity funds, public pension funds.

Several private-equity companies are publicly traded

While public pension funds and different institutional traders proceed to plow cash into different investments, most 401(okay) plans for people should not tapping into personal fairness.

For now, private-equity companies proceed to increase their attain to people principally by way of the registered funding adviser community for reasonably to extraordinarily rich people with a minimum of $1 million in property outdoors of their major house.

A particular sort of fund known as a 40 Act Fund is a publicly filed automobile that invests cash from people into personal fairness. One bigger instance of this fund sort is the Partners Group Private Equity (Master Fund) LLC, with $13.6 billion in web property for the fiscal 12 months that ended March 31.

Getting entry to the funds themselves permits traders to realize from the roughly 80% of the revenue of buyout and different offers.

When you purchase inventory in a private-equity agency, the inventory’s worth is partly primarily based on the 20% carried curiosity that the administration firm will get on private-equity offers, not on the lion’s share of the income.

But if the 20% will suffice, particular person traders might purchase shares of a number of private-equity companies with inventory listings within the U.S.

Blackstone Inc. was the primary main U.S. private-equity agency to go public, in 2007. Nowadays, shares can be found from many different main companies, together with Brookfield Corp

BN,

Apollo Global Management Inc.

APO,

Carlyle Group Inc.

CG,

KKR, TPG Inc.

TPG,

and others.

Many of the most important private-equity companies, nevertheless, should not publicly traded. Some of these embody Thoma Bravo, GTCR, Lone Star Funds, Bain Capital, Vista Equity Partners, Global Infrastructure Partners, TA Associates, Warburg Pincus, General Atlantic, Advent International, Cerberus Capital Management, Fifth Street and Silver Lake.

Many specialty finance shares, equivalent to business-development firms, lend to personal firms or participate in different different companies. Some examples of lenders embody Ares Management Corp.

ARES,

FS KKR Capital Corp.

FSK,

and Blue Owl Capital Inc.

OWL,

Blue Owl additionally invests in possession stakes in private-equity companies.

Other public firms with publicity to personal markets embody Hamilton Lane Inc.

HLNE,

StepStone Group Inc.

STEP,

and PJT Partners Inc.

PJT,

Many of those company private-equity companies have diversified past private-equity buyout funds into credit score, secondary, real-estate and infrastructure funds, to call just a few. Private-equity funds stay the most important part of that pie.

In an indication that non-public fairness could also be prepared for prime time when it comes to inventory investing, Blackstone this 12 months reached a few milestones: It hit $1 trillion of property and was not too long ago named a part of the S&P 500.

Other private-equity companies with publicly traded inventory might quickly be part of the S&P 500, so traders could also be listening to extra from the sector as time goes on.

Key as to if investor curiosity in personal fairness continues would be the efficiency of the asset class, which has been boosted by the previous period of low rates of interest, which ended final 12 months with a sequence of speedy price hikes by the U.S. Federal Reserve and different central banks.

“These low interest rates were a boon to private-equity investment volume and returns and hit the attractiveness of investment-grade bonds,” stated DePonte of Probitas Partners. “On a going-forward basis, we are likely to see higher interest rates, returning more toward historical norms — with more stress on private-equity returns and leverage.”

Calpers is a fan of alternate options

Private-equity and different different investments have made up a good portion of the retirement financial savings of 34 million individuals within the U.S., particularly from public pension funds.

One of the most important examples is the California Public Employees’ Retirement System, or Calpers. About $59.7 billion of its property beneath administration, or 12.9% of its whole portfolio of $463 billion, is invested in personal fairness, and $10.3 billion, or 2.2%, is invested in personal debt.

As huge as public pension funds are, they solely account for about $7.7 trillion of U.S. retirement property, which totaled $35.4 trillion as of March 31, in response to figures from the Investment Company Institute.

As the most important single piece, particular person retirement accounts account for $12.5 trillion, adopted by $9.8 trillion for defined-contribution plans, together with 401(okay) plans.

For now, a big portion of the shopper enterprise for personal fairness comes from the world of institutional traders, together with public pension funds, endowments and foundations, sovereign-wealth funds and household places of work.

Some rich people who meet the U.S. standards for investing in private-equity funds as so-called accredited traders additionally participate.

The purpose of those traders is to steadiness their portfolios of public shares and bonds with private-market returns from the alternate options. Such holdings improve diversification by providing entry to personal firms that usually develop at a sooner price than bigger public firms.

A December 2022 examine by the Georgetown University Center for Retirement Initiatives concluded that target-date funds with alternate options included produced “positive” advantages.

“The amount of annual retirement income that can be generated by converting a participant defined contribution [such as 401(k) plans] has the potential to improve by 17% in the expected case and by 11% in a worst-case or downside outcome,” in response to the examine’s government abstract.

Source web site: www.marketwatch.com