Nvidia’s shares are up in premarket commerce Friday. End of message.

It appears the job of a macro-market analyst has by no means been simpler. As go Nvidia’s fortunes so goes the S&P 500

SPX.

AI thoughts management is already right here.

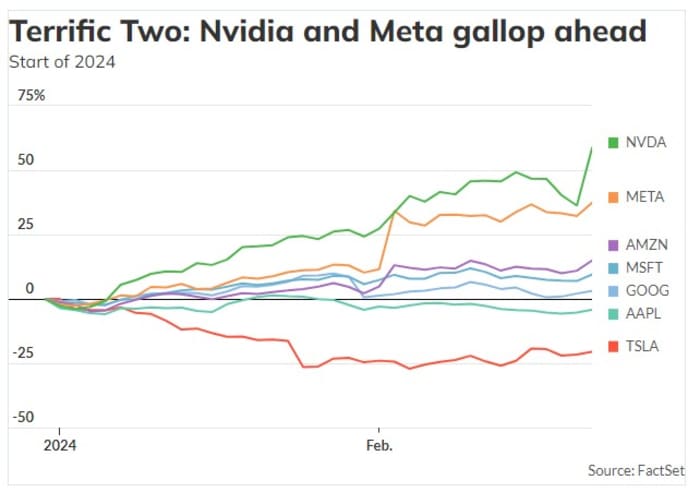

It wasn’t too way back that it was the Magnificent Seven who corralled, then drove sentiment. But that posse is not a coherent power.

“R.I.P. Magnificent Seven Era” is the title of a brand new notice from Jones Trading’s chief market strategist Mike O’Rourke, who says he got here up with the moniker for big-tech in spring 2023.

It’s right here we should always notice that some assume it was Bank of America’s Michael Hartnett who first used the Mag 7 description for Alphabet

GOOG,

Amazon.com

AMZN,

Apple

AAPL,

Meta Platforms

META,

Microsoft

MSFT,

Nvidia

NVDA,

and Tesla

TSLA,

No matter, O’Rourke’s new reasoning is apposite. Simply put, he thinks Nvidia and Meta ought to strike out on their very own given current occasions. The Terrific Two, maybe? …….Okay, certain, we are able to work on that.

“It was last April when we coined the term ‘Magnificent Seven’ to encapsulate the seven largest stocks in the S&P 500 as they drove 88% of the index’s gains in the first 4 months of 2023,” he writes within the notice revealed late Thursday. “Today’s events, along with others that unfolded thus far in February 2024, have sown the seeds for the end of that remarkable run.”

The $277 billion of market cap that Nvidia added Thursday is a file that beats the earlier$196 billion one set by Meta earlier this month, says O’Rourke.

“These two companies, along with these moves, are playing a prominent role in slaying the Magnificent Seven as we know them,” he provides. The important motive is that this outcomes season has proven a transparent divergence within the earnings efficiency of the Mag 7, he says.

For instance, Nvidia inventory is now buying and selling on 33 occasions readily achievable ahead earnings projections. “Historically, semiconductors are a cyclical business in which their multiple should shrink as they go higher, but this is a market that enthusiastically awards 35x plus multiples to Trillion Dollar enterprises,” says O’Rourke.

As for Meta, Mark Zuckerberg’s flirtation with the metaverse has been reined in, prices have been trimmed and the commonly extremely worthwhile firm is well-positioned to use AI, O’Rourke reckons. The ahead earnings a number of is 24.4, with solely Google within the Mag 7 sporting a decrease one.

“This earnings season has shown that Nvidia and Meta Platforms have both lower multiples and significantly faster growth than other Magnificent Seven names, and that is why other members will be deemed less attractive given their expensive multiple and megacaps status,” says O’Rourke.

As for Google’s mother or father, the inventory gives “a respectable combination of value and growth for this group, but hardly appetizing unless it delivers on AI.” And Amazon trades at greater than 40 occasions ahead earnings with 11% income development and 44% earnings per share development, however “neither metric tells the true picture of the company and the actual numbers are likely to be vastly different,” says O’Rourke.

Then there’s Microsoft, a $3 trillion firm buying and selling on greater than 35 occasions ahead earnings which can be solely anticipated to develop by 9.5% over the following 4 quarters.

Particularly ripe for ejection from the Mag 7 posse are Apple and Tesla, says O’Rourke. Apple shares are down since reporting earnings earlier this month, however nonetheless commerce on a a number of of 28 occasions ahead earnings which can be forecast to develop simply 1% this 12 months. “That is hardly enticing for a behemoth of this size,” he says.

Tesla faces a slowing EV sector and its earnings are forecast to barely decline whereas the shares nonetheless commerce on 65 occasions ahead earnings. The firm has solely maintained its Mag 7 standing due to a outstanding previous inventory efficiency, O’Rourke reckons.

And so R.I.P the Mag 7. “When the valuation and growth prospects become this distorted among leadership names, investors will start rotating towards the winners and maybe even look elsewhere for new opportunities,” says O’Rourke.

The period through which the Magnificent Seven “wholly drive S&P 500 gains has drawn to a close.”

Markets

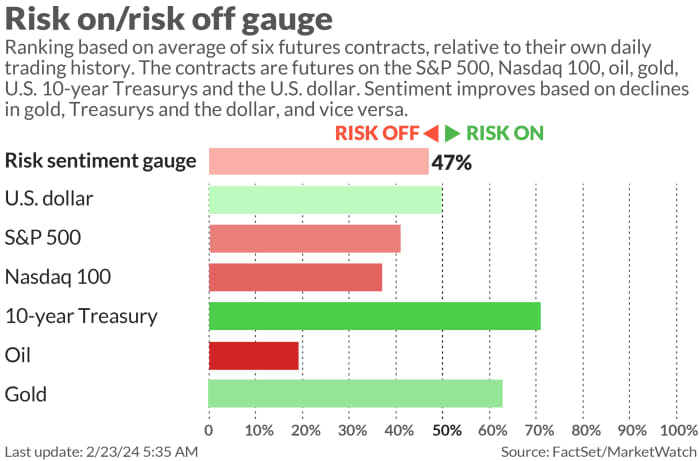

U.S. stock-index futures

ES00,

YM00,

NQ00,

are little modified as benchmark Treasury yields

BX:TMUBMUSD10Y

transfer larger. The greenback

DXY

is flat, whereas oil costs

CL.1,

fall and gold

GC00,

trades round $2,020 an oz..

| Key asset efficiency | Last | 5d | 1m | YTD | 1y |

| S&P 500 | 5,087.03 | 1.14% | 3.94% | 6.65% | 26.79% |

| Nasdaq Composite | 16,041.62 | 0.85% | 3.42% | 6.86% | 38.40% |

| 10 12 months Treasury | 4.349 | 6.45 | 20.55 | 46.77 | 39.56 |

| Gold | 2,027.80 | 0.12% | 0.48% | -2.12% | 11.54% |

| Oil | 77.55 | -0.88% | -0.87% | 8.72% | 1.44% |

| Data: MarketWatch. Treasury yields change expressed in foundation factors | |||||

For extra market updates plus actionable commerce concepts for shares, choices and crypto, subscribe to MarketDiem by Investor’s Business Daily.

The buzz

Warner Bros. Discovery

WBD,

will launch outcomes earlier than the opening bell.

Intuitive Machines

LUNR,

inventory is surging 37% in premarket after the space-exploration firm’s Odysseus spacecraft turned the primary industrial lander to efficiently attain the moon.

Block

SQ,

delivered a shock revenue after the market closed Thursday and shares of the Square mother or father firm are leaping 13%. Booking Holdings

BKNG,

outcomes weren’t so effectively obtained and the inventory is off 9%.

There aren’t any notable U.S. financial information factors launched this Friday. Even Fed officers appear to be taking a break day from chatter.

Best of the net

How German soccer followers took on buyers and gained.

As buying and selling frenzies grip penny shares, criticism of Nasdaq grows.

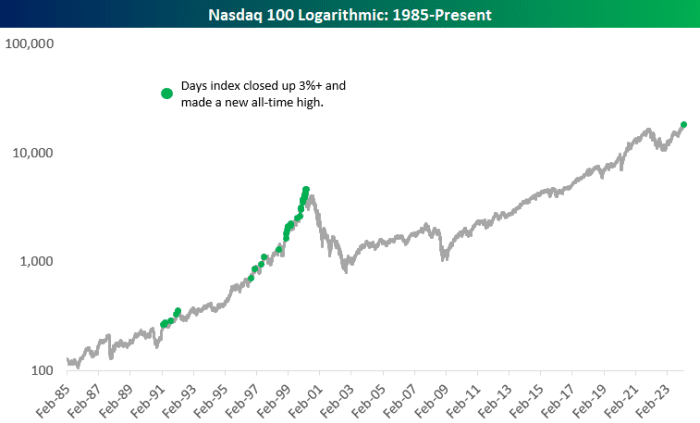

The chart

The Nasdaq 100

NDX

jumped 3% to a brand new excessive on Thursday. The chart beneath from Bespoke Investment has inexperienced blobs exhibiting all of the occasions that has occurred —the earlier one occurring on 3/2/2000.

Source: Bespoke Investment Group

“March 2000 certainly wasn’t a good day to suddenly turn bullish on the Nasdaq,” says Bespoke.

Top tickers

Here have been essentially the most lively stock-market tickers on MarketWatch as of 6 a.m. Eastern.

| Ticker | Security title |

|

NVDA, |

Nvidia |

|

TSLA, |

Tesla |

|

SMCI, |

Super Micro Computer |

|

LUNR, |

Intuitive Machines |

|

AMD, |

Advanced Micro Devices |

|

AAPL, |

Apple |

|

AMZN, |

Amazon.com |

|

NIO, |

NIO ADR |

|

CVNA, |

Carvana |

|

PLTR, |

Palantir Technologies |

Random reads

Predictable issues. MLB’s see-through pants.

It’s a canine’s (not fairly so lengthy) life.

I really like the odor of productiveness within the morning.

Need to Know begins early and is up to date till the opening bell, however enroll right here to get it delivered as soon as to your e mail field. The emailed model might be despatched out at about 7:30 a.m. Eastern.

Source web site: www.marketwatch.com