What an unimaginable rally it was final week, in an enormous sprint for trash as bond yields tumbled. The principally profitless tech shares of the ARK Innovation ETF

ARKK

rallied 19% final week, and the regional banks within the SPDR S&P Regional Banking ETF

KRE

surged 12%.

Also having fun with sturdy positive factors was a gaggle of so-called lottery shares this column profiled in July, although these ranks included WeWork

WE,

which can head to zero … which is why they’re known as lottery shares.

You’d most likely not anticipate the bearish strategist Mike Wilson of Morgan Stanley to be impressed, and guess what, he wasn’t.

“We think last week’s rally in stocks was mainly a function of the fall in back-end Treasury yields,” says Wilson. And that drop, he stated, was pushed extra by lower-than-expected coupon issuance and weaker financial information than something Jerome Powell stated. Continuing claims at the moment are up greater than 35% from the cycle trough, and the unemployment price is up 0.5% from its lows, which have been essential thresholds in previous cycles.

Wilson notes that earnings revision breadth continues to be in unfavorable territory. “This year’s earnings recession continues to play out, particularly at the stock level. This is one key reason why broader indices and the average stock’s performance within the S&P 500 have been weaker this year,” he says. And the weak financial information solely bolster the financial institution’s view that the earnings recession just isn’t but over.

So what occurs now? For asset house owners and allocations, the prospect of including extra threat at present ranges is much less enticing than fixed-income alternate options. “We think this group is more likely to be sellers into strength at this point,” he says.

In all, Wilson says the rally ought to “fizzle out over the next week or two” because it turns into clear the expansion image doesn’t assist both Fed cuts or a major acceleration in earnings per share development.

Bolstering the view on the Fed aspect — Barclays continues to be calling for an additional Fed price hike, although in January as an alternative of December.

The market

After the most important week for the S&P 500

SPX

in near a yr, a acquire of 5.9%, U.S. inventory futures

ES00,

NQ00,

nudged greater. The yield on the 10-year Treasury

BX:TMUBMUSD10Y

was rising once more. Crude-oil futures

CL.1,

traded greater.

For extra market updates plus actionable commerce concepts for shares, choices and crypto, subscribe to MarketDiem by Investor’s Business Daily.

The buzz

Berkshire Hathaway

BRK.B,

launched outcomes over the weekend that confirmed the Warren Buffett-run firm with a $157 billion money pile.

Tesla

TSLA,

CEO Elon Musk reportedly advised staffers in Germany the automobile maker will produce a low-cost automobile there.

South Korea reinstated a short-selling ban, sending shares of firms together with Posco

005490,

PKX,

greater. The iShares MSCI South Korea ETF

EWY

rose 6%.

Ryanair

RYAAY,

shares jumped because the airline proposed its first dividend.

The Fed’s senior mortgage officer survey comes out at 2 p.m. Lisa Cook, a Fed governor, is because of communicate at 11 a.m.

Best of the online

Ken Griffin criticizes proposals to clamp down on commerce his agency is making.

WeWork chapter would deal one other blow to New York workplace market.

Trump and allies plan to punish critics and opponents ought to he win a second time period.

Top tickers

Here had been the highest stock-market tickers as of 6 a.m. Eastern.

| Ticker | Security title |

|

TSLA, |

Tesla |

|

AMC, |

AMC Entertainment |

|

NVDA, |

Nvidia |

|

NIO, |

Nio |

|

AAPL, |

Apple |

|

GME, |

GameStop |

|

PLTR, |

Palantir Technologies |

|

AMZN, |

Amazon.com |

|

MULN, |

Mullen Automotive |

|

MSFT, |

Microsoft |

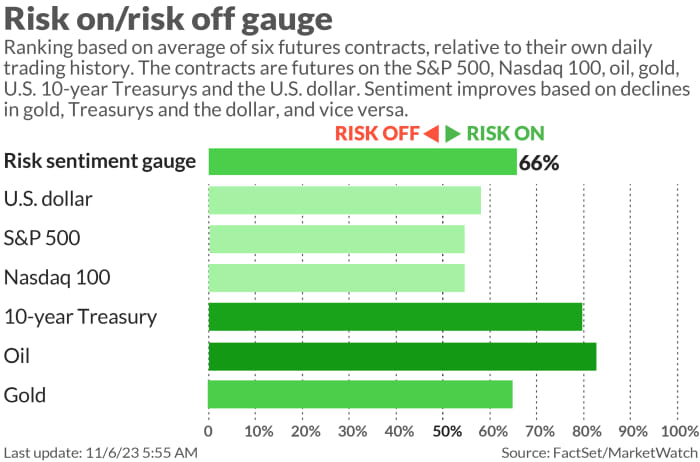

The chart

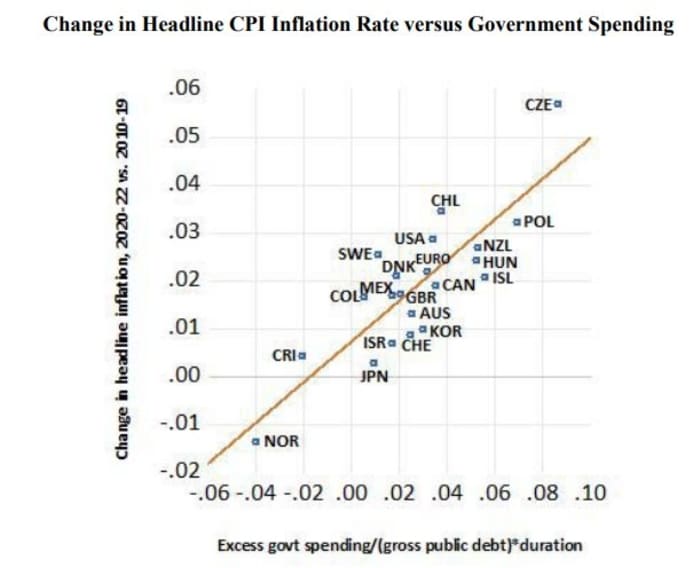

From a brand new analysis paper by Robert Barro of Harvard University and Francesco Bianchi of Johns Hopkins University, this reveals the affect of presidency spending on inflation. The spending variable is common authorities major spending to GDP, divided by the ratio of gross public debt to GDP and the estimated period of debt. “We show that, unlike monetary policy going back to the early 2000s, the large recent fiscal interventions related to the COVID crisis ‘succeeded’ in generating high inflation,” the authors say.

Random reads

Here was House Speaker Mike Johnson’s reply to the query of why he doesn’t listing having a private checking account on his public disclosure types.

Colonel Sanders cursed this workforce for 38 years.

The “loneliest sheep” within the U.Okay. has been rehomed, so naturally individuals are offended about it.

Need to Know begins early and is up to date till the opening bell, however enroll right here to get it delivered as soon as to your electronic mail field. The emailed model might be despatched out at about 7:30 a.m. Eastern.

Source web site: www.marketwatch.com