“Further evidence that a recession is not just possible but probable.”

The U.S. inventory market could also be at an all-time excessive, however the “Wall Street – Main Street disconnect” stays wider than ever — and that spells hassle forward.

Specifically, there’s a dramatic distinction in views concerning the well being of the U.S. financial system. On the one hand is Wall Street celebrating the inventory market’s new information, with many believing the Federal Reserve has prevented a recession by executing a “soft landing.”

Yet the common American is rather more pessimistic. I obtain quite a few emails from readers describing vital and sudden slowdowns of their explicit industries and widespread fears of their communities of how a lot worse it may turn out to be in coming months. And the information affirm what they’re saying.

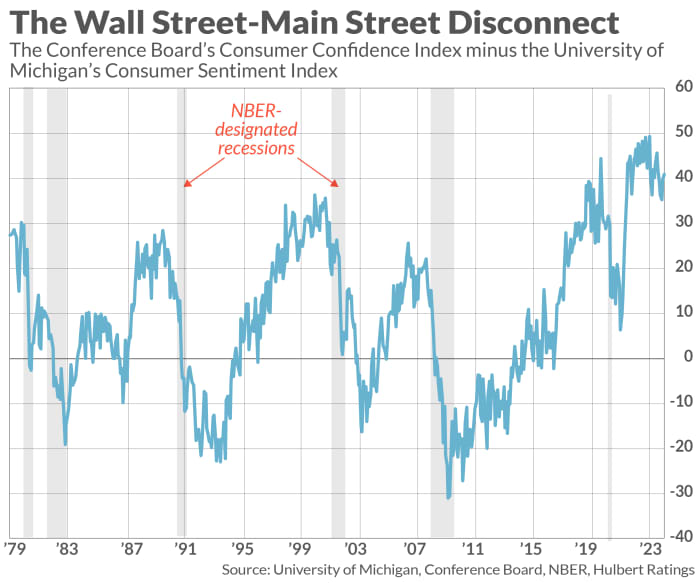

One indicator that does a creditable job of capturing this disconnect is the distinction between the Conference Board’s Consumer Confidence Index (CCI) and the University of Michigan’s Consumer Sentiment Index (UMI). The CCI extra closely displays shoppers’ attitudes towards the general financial system, and so is extra strongly correlated with the inventory market and news headlines about “soft landings” and the like. The UMI, in distinction, is extra closely weighted towards shoppers’ rapid private circumstances.

As you possibly can see from the chart above, whereas this unfold has narrowed barely from its report excessive from a yr in the past, it however stays larger than ever traditionally. (Monthly knowledge for the unfold prolong again to 1978.) The chart additionally reveals U.S. recessions, shaded in grey, in response to the calendar maintained by the National Bureau of Economic Research.

As you can also see, a recession quickly occurred on every prior event when the unfold started to retreat from a brand new excessive. While it’s totally doable that the U.S. will keep away from a recession this time round, we shouldn’t neglect that the 4 most harmful phrases in investing are “it’s different this time.”

James Stack, editor of the InvesTech Research e-newsletter, who tracks the unfold between the CCI and the UMI, lately summarized the financial tea leaves by writing that “it looks like a disastrous train wreck waiting to happen.” He reminds us that in August 2007, simply two months earlier than that yr’s bull-market excessive and 4 months earlier than the start of the worst recession for the reason that Nineteen Thirties, Janet Yellen, then-president of the Federal Reserve Board of San Francisco and at the moment secretary of the Treasury, reported that the financial system appears to be “on a glide path for the proverbial soft landing.” (Full disclosure: Stack’s e-newsletter isn’t a kind of that pay a flat payment to have its efficiency audited by my agency’s performance-tracking service.)

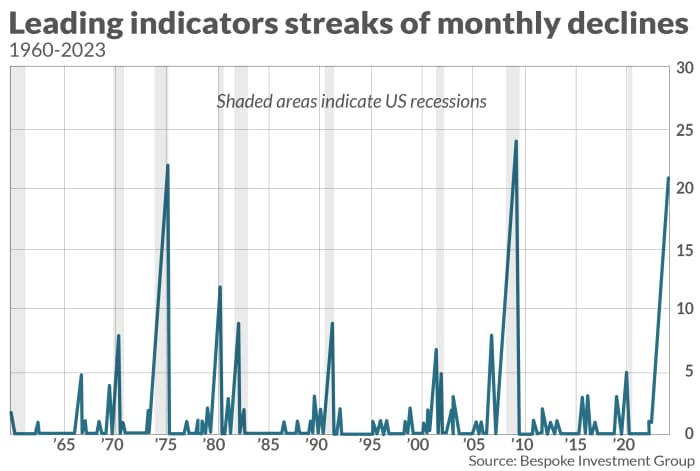

Further proof {that a} recession isn’t just doable however possible comes from the Conference Board’s Index of Leading Economic Indicators (LEI). The newest studying of this index, launched earlier this week, is the twenty first month in a row during which the LEI has declined — the third-longest streak on report. A recession occurred after each different streak of comparable magnitude, as you possibly can see from the chart above, courtesy of information from Bespoke Investment Group.

The backside line? It’s not wholesome for Wall Street to be celebrating whereas so many people are gloomy.

Mark Hulbert is an everyday contributor to MarketWatch. His Hulbert Ratings tracks funding newsletters that pay a flat payment to be audited. He will be reached at mark@hulbertratings.com

More: Recession was inevitable, economists stated. Here’s why they had been fallacious.

Also learn: Here’s what large consumer-sentiment good points imply for the inventory market — and this one is uncommon

Source web site: www.marketwatch.com