The U.S. marketplace for preliminary public choices is anticipated to stage a restoration in 2024 from the drought of the final two years, buoyed by expectations the Federal Reserve will swap to a rate-cutting cycle and enhance market circumstances.

A hoped-for rebound failed to totally take maintain in 2023 amid geopolitical uncertainty, interest-rate hikes and financial institution failures, in keeping with Renaissance Capital, a supplier of IPO-focused exchange-traded funds and pre-IPO institutional analysis.

“We are anticipating a significant rebound in the U.S. IPO market,” Renaissance analyst Angelo Bochanis informed MarketWatch. “Investors could also be inspired by the prospect of charge cuts, plus the [Renaissance] IPO ETF

IPO

gained 52% in 2023 and outpaced different benchmarks.”

The variety of potential candidates has additionally grown considerably over the previous two years, as many startups spent the IPO winter targeted on bettering revenue and money circulate, strikes aimed toward making them extra interesting to traders, he stated.

See additionally: IPO pipeline welcomes some worthwhile firms, elevating hopes for a rebound

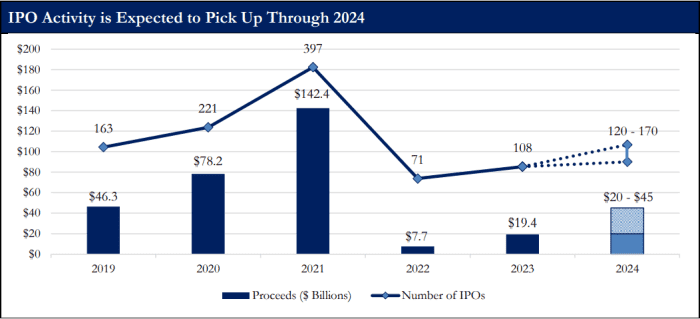

Renaissance is anticipating 120 to 170 offers in 2024 that can elevate between $20 billion and $45 billion. In comparability, 108 offers raised $19.4 billion in 2023.

“We’re expecting a return to normalcy, something more like the market before 2020,” Bochanis stated.

IPO exercise is anticipated to select up by 2024.

Renaissance Capital

Five of the largest offers on faucet this yr are firms that filed to go public in 2022 or earlier however which have stored their filings recent, which alerts they plan to hit the market as soon as circumstances look extra favorable.

The identical sentiment appears true of latest filers that opted to push their offers again to 2024, together with UL Solutions

ULS,

a testing, inspection and certification firm, and Chinese electric-vehicle firm Zeekr

ZK,

Both of these offers are anticipated to lift as much as $1 billion. Meanwhile, Renaissance is anticipating Kazakh fintech app Kaspi.kz

KSPI,

to lift as much as $1.5 billion.

For extra, see: Fintech Kaspi.kz is ready to be first Kazakh firm to listing within the U.S.

This week noticed filings from BrightSpring Health Service Inc., a home-healthcare service supplier, and KKR & Co. Inc.

KKR,

portfolio firm, that would elevate as much as $1 billion, in keeping with Bochanis.

And on Thursday, Finland-based Amer Sports Inc. filed with 21 underwriters, suggesting that deal shall be a large one. The proprietor of sports activities manufacturers Arc’teryx, Salomon, Wilson, Peak Performance and Atomic was acquired 5 years in the past by a Chinese consortium for about $5 billion.

For extra, learn: Amer Sports information preliminary public providing with 21 underwriters and $3.5 billion in 2022 income

Add in just a few smaller offers and 2024 appears set for a robust begin, which ought to set the market up properly for the yr forward, stated the analyst.

One key driver can be a reopening of the window for tech offers, a improvement traders had been hoping would materialize late final yr when chip maker Arm Holdings PLC

ARM,

hit the market in September.

Those hopes light after the deal gained virtually 25% on its first day of buying and selling however swiftly fell under its concern value within the aftermarket. The identical destiny greeted grocery-delivery app Instacart

CART,

and digital-ad firm Klaviyo Inc.

KVYO,

which made their much-hyped debuts across the identical time.

The lackluster efficiency was repeated by German sandal maker Birkenstock Holdings PLC, one other deal

BIRK,

that was extremely anticipated however remained under its $46 concern value for weeks. That inventory was buying and selling at $46.02 on Friday.

The non-public firms that will come to market this yr are unlikely to make the error of searching for overly rosy valuations, nevertheless. There was a big lower in non-public funding in 2023 and plenty of firms had been pressured to simply accept down rounds, Bochanis stated.

“As these companies run out of cash and look to take on new investors, that also bodes well for IPOs picking up this year,” he stated.

The following are a number of the buzzier names that traders are awaiting.

Top candidates

Shein: The fast-fashion platform has seen a speedy rise in recognition, and it could quickly discover out whether or not it has the identical rabid following within the funding neighborhood. The firm reportedly filed confidentially for a U.S. IPO late final yr, with the Wall Street Journal noting that Shein, now primarily based in Singapore, fetched a roughly $66 billion valuation in a 2023 funding spherical however would probably search for the next mark with its IPO. Shein declined to touch upon its IPO plans.

See now: Why are Shein’s garments so low cost? Some buyers need the reply — and so do a number of critics.

Reddit: The social-media firm recognized for its message boards has been doing a little work to develop up and make itself extra engaging to traders. Reddit a number of years in the past did a “cleanout of earlier communities that were more problematic,” EquityZen analysis head Akshata Bailkeri informed MarketWatch. That might make the platform extra interesting to advertisers — and to Wall Street. The firm was valued at $10 billion after a 2021 funding spherical. Reddit declined to touch upon its IPO plans.

Stripe: No listing of IPO potentialities can be full with out perennial candidate Stripe. The payment-technology firm’s valuation has come down significantly lately, falling to $50 billion after a March 2023 funding spherical, whereas it was valued at $95 billion as of March 2021. Stripe introduced on a brand new chief monetary officer final summer season who boasts expertise at public firms, together with Palo Alto Networks Inc.

PANW,

and Confluent Inc.

CFLT,

Stripe declined to touch upon its IPO plans.

Plaid: Financial-technology firm Plaid employed an Expedia veteran as its chief monetary officer final yr, serving to to earn it a spot amongst 2024 IPO candidates. The firm, which permits financial-services firms to hyperlink with clients’ banking data, virtually bought scooped up by Visa

V,

a number of years again, however the two sides known as off the deal in January 2021 after antitrust pushback from the Justice Department. Plaid was valued north of $13 billion later that yr. “An IPO will be a milestone we consider in the future but have no immediate timeline to disclose,” a Plaid spokesperson stated.

ServiceTitan: Before the IPO market froze, software program firms had been among the many hottest names to check the general public markets. Nowadays, there are a variety of extra consumer-focused names inside the group of main candidates, however ServiceTitan is one software program firm that would make a public debut. The cloud-software firm focused at HVAC, plumbing, electrical and different service fields was final valued at $9.5 billion, in keeping with CBInsights. The firm didn’t instantly return a request for touch upon its IPO plans.

Fanatics: The firm sits on the intersection of practically all issues sports activities, with a betting enterprise, a commerce outfit and a collectibles platform amongst its companies. It has been beefing up its management group and introduced on former IAC/InterActiveCorp.

IAC,

CFO Glenn Schiffman to serve in the identical function at Fanatics in 2021. EquityZen’s Bailkeri famous that the corporate not too long ago introduced in a brand new head for its business enterprise, as properly. Appointment of a brand new management-team member is one issue Bailkeri appears to be like at when predicting whether or not firms are planning to go public. “While an IPO is clearly an available option to us at some point in the future, there has been no change to the timing,” a spokesperson stated. “Any public offering is just a moment in time as our focus remains on expanding our businesses and building the leading digital-sports platform over the next decade and beyond.”

Skims: The shapewear firm that counts Kim Kardashian as a co-founder may strive its hand on the public markets subsequent yr, in keeping with Bailkeri. That would imply “bucking a trend” within the IPO market: Many firms wait “quite a while,” typically a long time, to go public, however Skims is simply about 5 years outdated, she famous. Skims, like many different names on the listing, introduced on a brand new CFO in 2022: Andy Muir, who brings expertise working for Nike Inc.

NKE,

Skims didn’t instantly reply to a request for touch upon its IPO plans.

Liquid Death: IPO traders haven’t all the time been so type to consumer-oriented names, however a number of such firms may strive their luck within the yr forward. One on Bailkeri’s listing of potentialities is Liquid Death, which makes drinks together with Convicted Melon and Berry It Alive. “A lot of people are aware of the brand,” Bailkeri stated, and it may be simpler for firms with title recognition to generate investor pleasure. Plus, the corporate employed a chief business officer late final yr. Liquid Death declined to touch upon its IPO plans.

Source web site: www.marketwatch.com