The inventory market, as measured by the S&P 500 Index

SPX,

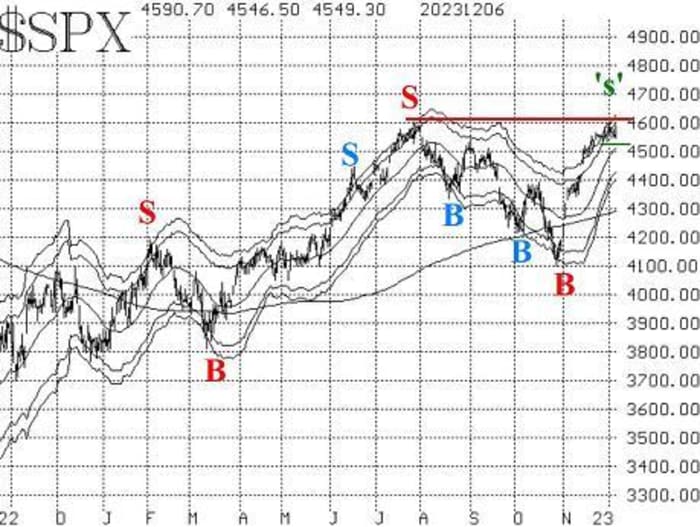

is making an attempt to work off the overbought “hangover” from its big November rally. So far, it has managed to take action in an orderly vogue. Yes, the rally bumped into resistance on the yearly 2023 highs close to 4600 on the index, however the pullback from there was modest. In truth, now we have not confirmed any promote alerts from our varied buying and selling programs but.

SPX had risen above its +4σ “modified Bollinger Band” (mBB) through the later levels of the rally. Since then, it has pulled again under the +3σ Band, and that created a “classic” mBB promote sign. However, we don’t commerce these. It is marked as ‘s’ on the accompanying chart of SPX. A confirmed McMillan Volatility Band (MVB) promote sign will happen if SPX pulls again to 4533 (horizontal inexperienced line on the chart), however to date that has not occurred. Not each “classic” promote sign turns into a confirmed MVB promote sign.

If that promote sign does happen, it might appear that SPX might retreat in direction of 4400 with out inflicting quite a lot of concern. A filling of the hole at 4420 would really be considerably helpful. However, an in depth under 4400 could be extraordinarily adverse and would trigger us to desert the “core” bullish standing that’s presently in place.

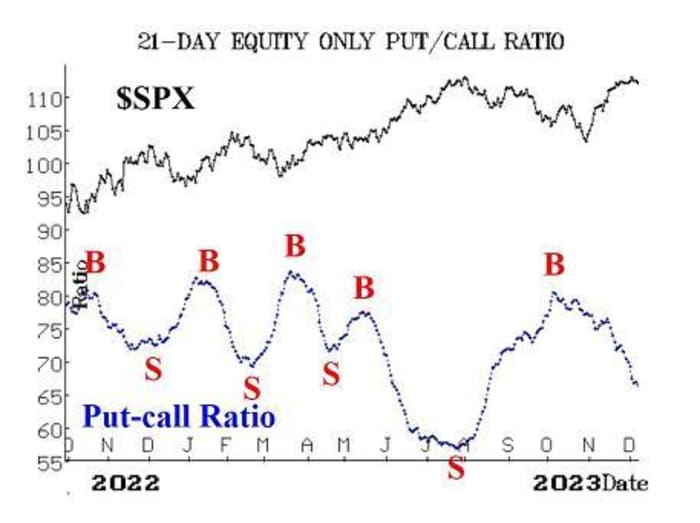

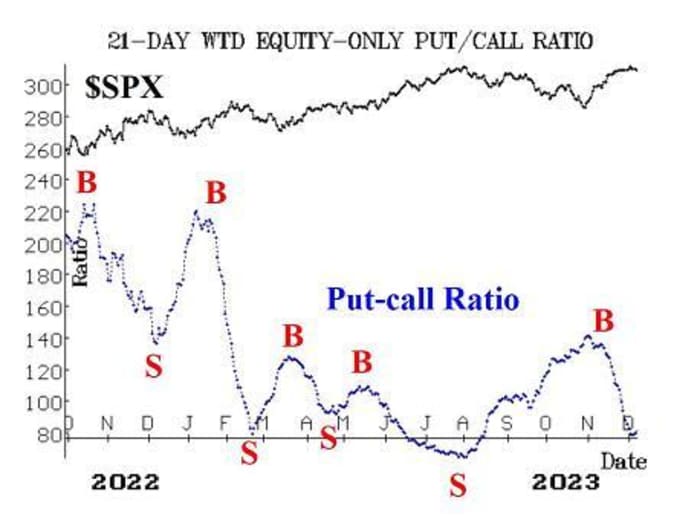

Equity-only put-call ratios proceed to say no, they usually each stay bullish for the inventory market. That will proceed to be the case till these ratios backside out and start to rise. One can see that there’s a small “hook” on the backside of the weighted chart these days, however our laptop applications that we use to research these charts “say” there isn’t any fear — that the purchase alerts for shares are nonetheless intact.

Market breadth has been simply constructive sufficient to maintain our breadth oscillators on purchase alerts. They are edging decrease, although, and even one sturdy day of adverse breadth might conceivably generate promote alerts from these oscillators. We require no less than a two-day affirmation of any breadth sign, although, so we’re not going to behave on any new sign instantly.

There has been a brand new confirmed purchase sign this week: New Highs on the NYSE numbered greater than 100 for 3 days in a row. The purchase sign occurred on the shut on December 1st, (the second consecutive day of greater than 100 New Highs).

This purchase sign will stay in place till New Lows on the NYSE exceed New Highs for 2 consecutive days. One would possibly assume that this new purchase sign is arriving somewhat late to the sport, however again in September, a promote sign from this indicator occurred effectively after the market had peaked in late July. Even so, the market continued down from there, so the sign was a worthwhile one. This new purchase sign might simply slot in that very same mould, so we’re going to add to lengthy positions due to this.

VIX

VX00,

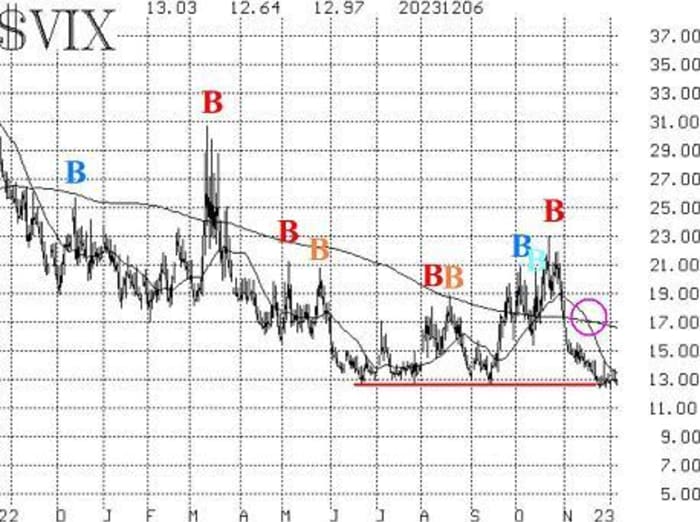

VIX

has remained mired at an especially low degree, at or under 14. It just lately traded at its lowest degree since January 2020. Just as a result of VIX is low just isn’t a promote sign. A promote sign would come up if VIX begins to leap larger from right here. So far, that hasn’t occurred, and the pattern of VIX purchase sign that was generated in mid-November remains to be in place.

The assemble of volatility derivatives stays bullish in its outlook for shares. The time period constructions of the CBOE Volatility Indices and of the VIX futures stay upward-sloping. Furthermore, the VIX futures are buying and selling at wholesome premiums to VIX. The solely entity that’s barely out of line within the time period constructions is the nine-day volatility Index (VIX9D), which is barely elevated in entrance of Friday’s unemployment Report.

Overall, we’re sustaining our “core” bullish place, and we are going to commerce different confirmed alerts round that. One might need thought that new alerts could be promote alerts, however the one new confirmed sign that now we have is one other purchase sign — from “New Highs vs. New Lows.”

New purchase sign

In the commentary above, we defined that New Highs on the NYSE exceeded greater than 100 points for 3 consecutive days (and New Highs outnumbered New Lows on every of these days). The second day, December 1st, was sufficient to generate the purchase sign. So, we’re including a comparatively long-term name bull unfold to our positions, since that is extra of an intermediate-term indicator.

Buy 1 SPY Feb (16th) at-the-money name and promote 1 SPY Feb (16th) name with a putting worth 20 factors larger.

We will cease out of this place if New Lows on the NYSE exceed New Highs for 2 consecutive buying and selling days. Otherwise, there isn’t any worth cease based mostly on SPX.

New advice: Potential MVB promote sign

As famous available in the market commentary above, SPX had fallen under its +3σ “modified Bollinger Band.” That created a “classic” mBB promote sign. But additional affirmation is required to generate a full-fledged McMillan Volatility Band (MVB) promote sign. Specifically, on this case, SPX must commerce at 4533 or decrease.

IF SPX trades at 4533 or decrease, THEN purchase 1 SPY Jan (19th) at-the-money put and promote 1 SPY Jan (19th) put with a putting worth 20 factors decrease.

If this place is taken, then the MVB promote sign could have a goal of the decrease -4σ Band, and it might be stopped out by an in depth above the +4σ Band. As with all of our unfold positions, this one needs to be rolled (down) if SPX trades on the decrease strike.

New put advice: Goldman Sachs Group (GS)

We are repeating this advice from final week, regardless that GS

GS,

is barely larger in worth. The put-call ratio remains to be on a promote sign, and if GS had been to interrupt under 329, it might be technical affirmation of that promote sign. Last week’s advice follows:

The weighted put-call ratio of GS has generated a promote sign. The inventory appears to be having bother extending latest beneficial properties, however that alone just isn’t sufficient to take a bearish place. However, if it falls under assist at 330 and closes the hole there, then the promote sign could be heeded.

IF GS closes under 329, THEN purchase 1 GS Jan (19th) 330 put and promote 1 GS Jan (19th) 305 put

GS: 342.38

GS choices usually are not costly, so this unfold ought to value about five- or six factors. If the place is taken, we are going to maintain so long as the GS weighted put-call ratio is on a promote sign.

Follow-up motion:

All stops are psychological closing stops except in any other case famous.

We are utilizing a “standard” rolling process for our SPY spreads: in any vertical bull or bear unfold, if the underlying hits the quick strike, then roll your complete unfold. That could be roll up within the case of a call-bull unfold or roll down within the case of a bear-put unfold. Stay in the identical expiration and hold the space between the strikes the identical except in any other case instructed.

Long 3 XLE Dec (15th) 85 places: We will maintain so long as the weighted put-call ratio of XLE

XLE

stays on a promote sign.

Long 1 SPY Dec (29th) 456 name: This SPY

SPY

unfold was purchased in keeping with the CBOE Equity-only put-call ratio purchase sign. It has been rolled up a number of occasions. Roll the decision up if it turns into no less than 8 factors in-the-money. We are holding with out a cease for now.

Long 3 ES Dec (15th) 60 calls: We will maintain this place so long as the weighted put-call ratio chart for ES

ES,

stays on a purchase sign.

Long 4 XLP Dec (29th) 70 calls: Raise the XLP

XLP

cease to 69.50.

Long 1 SPY Dec (29th) 457 name: This place was initially an extended straddle. It was rolled up and the places had been offered. Continue to roll the decision up if it turns into 8 factors ITM. This is, in essence, our “core” bullish place.

Long 5 AVPT

AVPT,

Dec (15th) 7 calls: The trailing closing cease stays at 7.75.

Long 2 TECH Jan (19th) 60 calls: We will maintain so long as weighted put-call ratio is on a purchase sign. If TECH

TECH,

trades at 70, roll as much as the Jan (19th) 70 calls.

Long 4 KHC Jan (19th) 32.5 calls: We will maintain so long as weighted put-call ratio is on a purchase sign. If KHC

KHC,

trades at 37.5, roll as much as the Jan (19th) 37.5 calls.

Long 2 IWM Jan (19th) 184 calls: This is our post-Thanksgiving seasonal place. We will maintain IWM

IWM

with out a cease, since it is a somewhat lengthy seasonal interval extending by way of the primary two buying and selling days of 2024. We rolled the decision up as soon as. Roll up once more if the decision turns into six factors in-the-money (i.e., at 190).

All stops are psychological closing stops except in any other case famous.

Send inquiries to: lmcmillan@optionstrategist.com.

Lawrence G. McMillan is president of McMillan Analysis, a registered funding and commodity buying and selling advisor. McMillan could maintain positions in securities really useful on this report, each personally and in shopper accounts. He is an skilled dealer and cash supervisor and is the writer of the best-selling e-book, Options as a Strategic Investment. www.optionstrategist.com

©McMillan Analysis Corporation is registered with the SEC as an funding advisor and with the CFTC as a commodity buying and selling advisor. The data on this publication has been fastidiously compiled from sources believed to be dependable, however accuracy and completeness usually are not assured. The officers or administrators of McMillan Analysis Corporation, or accounts managed by such individuals could have positions within the securities really useful within the advisory.

Source web site: www.marketwatch.com