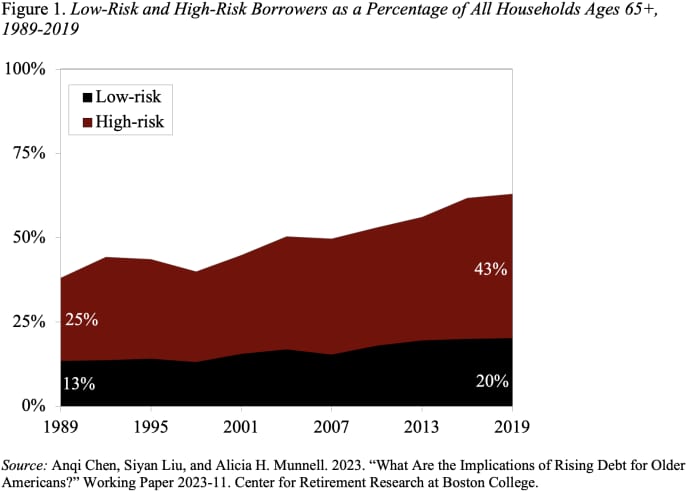

Policy makers and researchers have been fretting that the share of older Americans with debt has risen from 38% to 63% since 1990.

Having debt, nevertheless, doesn’t must be a nasty factor. For instance, households that take out a low-interest mortgage to purchase a house, which generally appreciates, are probably making a savvy alternative. In distinction, households that carry unpaid credit-card balances may see their debt snowball, resulting in monetary misery.

In a current examine, my colleagues and I attempted to kind out what share of households with debt had been at “high risk” and “low risk” of economic hardship and whether or not these at excessive danger usually appeared the identical or fell into distinct teams.

Read: I’m in my 60s with nearly $1 million. My house is paid off. I’d like to maneuver however am afraid of the excessive costs elsewhere: ‘Will I be OK?’

The first step was figuring out what number of of those households had been at excessive danger. The elements—secured vs. unsecured debt, debt payment-to-income ratio, and debt-to-assets ratio — are generally utilized by lenders and different researchers (see Table 1). Households with any revolving credit-card debt are categorized as “high risk” since many of those debtors may expertise unhealthy outcomes, though the opposite debt measures wouldn’t seize them.

The outcomes of the classification train present that total development is pushed by high-risk households (see Figure 1).

In enthusiastic about coverage options, it’s important to determine how these high-risk households obtained in hassle. To do this, we used a method that exposed 4 clear subgroups of high-risk debtors.

- The largest group (33%) consists of “financially constrained” households, which have low ranges of wealth, are sometimes overleveraged, and wrestle with the necessities. This group is borrowing simply to get by.

- The second subgroup (26%) consists of “credit-card borrowers,” which incorporates middle-wealth households with no obvious must borrow.

- The third subgroup (19%) is low/middle-wealth households whose housing debt funds devour over 40% of their revenue. This group can also be disproportionately nonwhite.

- The final group (23%) is “wealthy spenders.” Despite being within the high third of the wealth distribution, a few quarter of their revenue goes to debt funds, about 80% have credit-card debt, and over a 3rd have second properties.

What will be executed to cut back the monetary vulnerability of high-risk debtors? Given their various traits, no one-size-fits-all resolution exists.

- Debt counseling and consolidation could assist the “financially constrained” households, however many wrestle to fulfill primary wants, in order that they want extra assets.

- “Credit-card borrowers” may gain advantage from conventional monetary counseling and laws requiring credit-card issuers to supply higher data to shoppers.

- Households with “too much house” would greatest be served by packages that scale back their housing burden, corresponding to refinancing or downsizing.

- Finally, since many “wealthy spenders” have a second dwelling, promoting it’s one approach to handle their debt.

The key takeaways from this examine are: 1) the rising debt amongst older households just isn’t a benign phenomenon; and a couple of) the varied traits of high-risk debtors require quite a lot of coverage responses.

Read extra from MarketWatch Retirement:

‘What I wasn’t ready for was actuality.’ How do retirees survive on Social Security alone?

How to make use of a ‘spend down’ to qualify for Medicaid

It’s time for Medicare’s open enrollment. Don’t miss this essential step.

Source web site: www.marketwatch.com