Trillions of {dollars} value of bonds and loans deemed higher-risk by credit score companies are set to come back due earlier than the tip of 2025, making a “maturity wall” that might doubtlessly inject extra panic into markets, based on a report by a staff of worldwide credit score strategists at Morgan Stanley.

Approaching deadlines may ratchet up the stress on many debtors seen as much less creditworthy, particularly as large banks grow to be extra picky about extending credit score throughout an period of upper rates of interest. Plus, as extra time passes with out securing refinancing, stress on bond costs may intensify.

See: Fed Data on Banks Show Tighter Loan Standards. What It Means for Interest Rates.

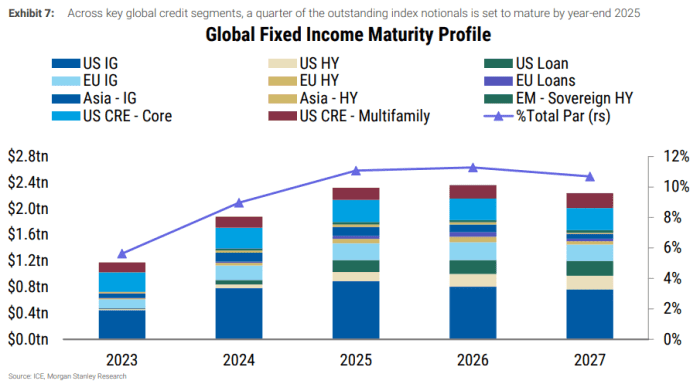

Morgan Stanley strategists mentioned $5.3 trillion of public bonds and institutional loans from U.S., European and emerging-market debtors are set to mature via the tip of 2025, making a “maturity wall” that might exacerbate considerations about rising rates of interest and banks’ unwillingness to underwrite extra dangerous debt.

That determine is equal to 26% of the worth of bonds included in indexes that observe investment-grade and high-yield bonds, together with leveraged loans and different credit score merchandise.

Even these debtors that do handle to roll over their debt may face issues sustaining it going ahead, with rates of interest hovering since early 2022 as central banks, together with the Federal Reserve, have confronted the worst wave of inflation in a long time.

“As banks solve for a higher cost of capital, credit conditions are set to tighten at a time when maturity walls in debt markets are also coming into focus,” based on a be aware penned by a bunch of 14 Morgan Stanley credit score analysts.

While funding grade company debtors might be insulated from potential difficulties associated to refinancing maturing bonds, debtors who relied on high-yield bonds and leveraged loans, financial institution loans made to corporations that have already got heavy debt burdens, may battle.

MORGAN STANLEY

Investment banks underwrite bonds and sometimes promote them on to asset managers, insurance coverage corporations and different prospects, whereas generally holding slices of the danger on their books. Higher rates of interest improve the debt burden shouldered by corporations, making it harder for some debtors to sustainably service their money owed.

Perhaps probably the most urgent threat stems from lower-quality business actual property debtors within the U.S. Their lenders are primarily smaller and medium-size banks, that are already overexposed to these kind of debtors, the Morgan Stanley staff mentioned.

MORGAN STANLEY

Looming “maturity walls” will influence distinct corners of the credit score markets in another way. For instance, refinancing wants are already “front and center” for U.S. business actual property, the Morgan Stanley staff mentioned. This means imminent default dangers for lower-rated debtors probably has been labored into the value of these bonds.

See: The $1 trillion ‘wall of worry’ for business actual property that spirals via 2027

One method to commerce woes in business actual property, they mentioned, could be to wager towards AAA-rated business mortgage-backed securities as a hedge that may repay if credit score spreads surge, sending costs of even high-quality bonds tumbling. In bond buying and selling, a variety is the distinction between the yield of a given bond and its benchmark risk-free safety, sometimes a Treasury be aware. Bond yields transfer inversely to bond costs, rising as costs fall.

Leveraged loans and high-yield, or “junk,” bonds within the U.S. might be extra susceptible to a selloff as time passes, since the marketplace for issuing recent high-yield debt has dried up over the previous 12 months, doubtlessly making it harder for these debtors to roll over their bonds and loans.

“…This runway is getting shorter given little progress made over the past year,” the Morgan Stanley staff mentioned about high-yield U.S. credit score.

Related: A $1.8 trillion wall of company debt coming due may price jobs, Goldman warns

Investors have been more and more centered on bond markets recently, with some market strategists blaming rising 10-year and 30-year Treasury yields for a pullback within the S&P 500

SPX

and Nasdaq Composite

COMP.

Both indexes fell for the second week in a row Friday, the longest streak of losses for the highflying Nasdaq since December.

U.S. shares bounced again on Monday, with the S&P 500

SPX,

Nasdaq and Dow Jones Industrial Average

DJIA

ending larger after a stretch of losses. Meanwhile, the yield on the 10-year Treasury be aware

BX:TMUBMUSD10Y

rose almost 3 foundation factors to 4.193%, whereas the yield on the 30-year bond

BX:TMUBMUSD30Y

rose almost 2 foundation factors to 4.288%. Yields on each are nearing their highs of 2023.

Source web site: www.marketwatch.com