It might sound at occasions that buyers care extra about Jensen Huang than Federal Reserve Chair Jerome Powell.

Huang is the longtime CEO of chip maker Nvidia Corp.

NVDA,

which stole the present final week by blowing away already lofty earnings expectations and main shares to new rounds of all-time highs, whilst nagging worries over resurgent inflation continued to percolate within the background. Huang declared that the factitious intelligence trade, of which Nvidia is a main provider of essential chips, has reached a “tipping point” that can see the know-how go “mainstream.”

Deep Dive: After Nvidia’s newest blowout, listed below are 20 AI shares anticipated to rise as a lot as 44%

That could lead buyers to wonder if they’re losing their power fretting over the financial cycle and the timing of Federal Reserve rate of interest cuts. Should they as an alternative embrace a rally led by know-how shares that’s began to broaden out to different sectors, enhanced by the potential for advances in synthetic intelligence to deliver a couple of generational productiveness enhance that can raise company earnings and cap inflation pressures?

That’s a fairly image, however one that’s unlikely to come back collectively so seamlessly.

“I think investors will obsess over inflation metrics again,” Michael Arone, chief funding strategist at State Street Global Advisers, advised MarketWatch in a cellphone interview.

It so occurs that the Federal Reserve’s favored inflation metric, the core studying of the personal-consumption expenditures index is due Thursday morning. The January knowledge comes after markets had been beforehand rattled by hotter-than-expected consumer-price index and producer-price index readings.

Investors know — and the Fed has emphasised — that one month’s knowledge doesn’t make a development, Arone stated, however it will likely be necessary for inflation to renew a development again down towards the central financial institution’s 2% goal. If that begins to look in critical jeopardy, market volatility will finally be in retailer.

Read: Wall Street is bracing for extra robust U.S. financial and inflation knowledge subsequent week

Investors got here into 2024 pricing in six to seven quarter proportion level price cuts over the course of the 12 months, starting in March. As the info got here in and the Fed pushed again on these expectations, markets now see a considerably better-than-50% probability cuts will start in June and that the Fed will ship solely three or 4 by year-end, in line with the CME FedWatch instrument.

Should inflation show sticky or begin to climb, buyers may finally be pressured to countenance no price cuts in 2024 and even the surface prospect that the Fed might want to hike but once more. That could be a significant shock, Arone stated, seemingly sending shares right into a correction and considerably pushing up Treasury yields.

Barring that, Arone, is upbeat, and sees prospects for the rally to proceed broadening out after the previous week additionally noticed energy in sectors exterior tech and shopper providers. A continued rally would give buyers the chance to construct publicity to small-caps and worth shares.

Stocks prolonged their climb final week, with the S&P 500

SPX

and the Dow Jones Industrial Average

DJIA

reaching new highs. The tech-heavy Nasdaq Composite

COMP

briefly flirted with its first document shut in additional than two years on Thursday and once more Friday earlier than pulling again, however nonetheless ended the week up 1.4%.

Of course, the megacap-led tech rally isn’t a brand new phenomenon. Nvidia and its cohort of heavyweight AI beneficiaries led a 2023 stock-market rally that grew more and more — and worryingly — concentrated.

The “most necessary occasion in world inventory markets final 12 months was nothing macro however the Microsoft

MSFT,

funding in ChatGPT-maker OpenAI,” argued Christopher Wood, international head of fairness technique at Jefferies, in a notice final week.

“This was the catalyst for the AI thematic to start driving market psychology and, crucially, gave the most important sector in the world’s largest stock market a new story which is secular not cyclical,” he wrote.

A have a look at how large one-day beneficial properties have contributed to the inventory market’s year-to-date rally illustrates the position that tech sector energy performs.

The S&P 500 was up 6.7% for the 12 months so far by means of Thursday, with simply 5 buying and selling days accounting for that acquire, famous Nick Colas, co-founder of DataTrek Research, in a notice.

That consists of Thursday’s 2.1% rise, pushed by Nvidia’s earnings, and 4 days with beneficial properties of 1% to 1.4%, together with a Jan. 8 rise following an announcement of recent chips by Nvidia; a Jan. 19 acquire led by chip shares following earnings steerage from Taiwan Semiconductor

TSM,

; a Feb. 1 bounce following a selloff impressed by remarks from Powell; and a Feb. 2 rally pushed by Meta Platform Inc.’s

META,

20% surge.

The lesson is that the market is shrugging off the prospect of rates of interest remaining increased for longer to give attention to Big Tech’s earnings leverage, Colas wrote. “This is classic ‘midcycle’ market behavior. Investors can live with higher interest rates if (but only if) there is a promising development in an important sector.”

Meanwhile, the diploma of that promise stays up for debate.

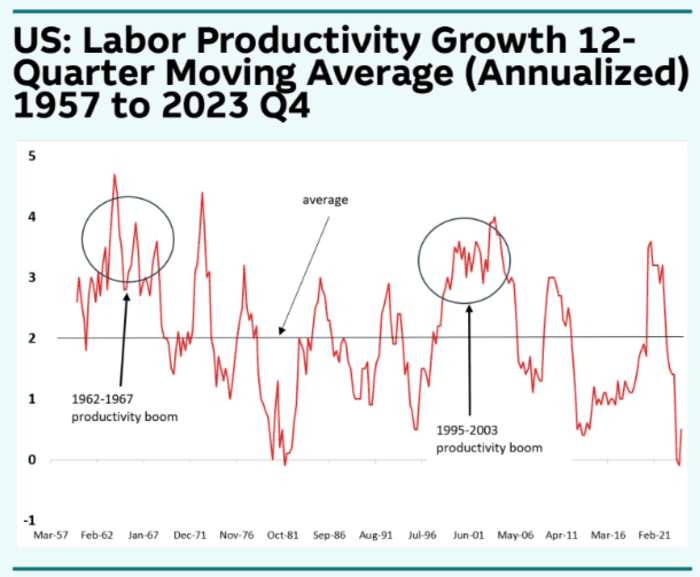

“Of course, many ‘new paradigms’ about U.S. productivity growth have been proffered by market pundits in the past 125 years. Not all of them have panned out, and there were really only two episodes (the mid-1960s and the mid-1990s) in which productivity growth in the U.S. stayed high sustainably,” stated Thierry Wizman, international FX and charges strategist at Macquarie, in a notice (see chart beneath).

Macquarie

“But what matters is not so much whether this new AI-driven paradigm

pans out; it matters whether people believe it will pan out, if it is to

change macro dynamics,” he stated.

Such a change may carry a sting.

The hazard is {that a} new progress paradigm leads the Fed to conclude that the so-called impartial price — the extent at which the official rate of interest neither enhances nor sustains progress — is increased than it at the moment thinks, opening the door to additional hikes.

Meanwhile, buyers are targeted on whether or not AI will proceed to drive robust outcomes for main know-how suppliers and if it can enable firms that finally use these merchandise to turn out to be more and more productive and extra worthwhile, stated Jose Torres, senior economist at Interactive Brokers, in a notice.

With many firms exterior the tech sector providing cautious steerage, it doesn’t appear like the sensible elements of AI are but supporting mixture earnings, he stated.

“Only time will tell if Nvidia CEO Jensen’s optimism is warranted,” Torres wrote, “and while bulls have been energized by his comments and Nvidia’s quarterly results, bears are praying that AI may be more fluff than substance.”

Source web site: www.marketwatch.com