With a shock oil manufacturing lower now below traders’ belts, consideration is shifting to knowledge, mainly Good Friday’s jobs numbers, which might present the subsequent huge catalyst for equities as earnings season looms as soon as once more.

JPMorgan, although, is not going to be steered from its bearish path. The financial institution kicked off the week by saying U.S. shares weren’t definitely worth the threat, and strategist Marko Kolanovic has now doubled down with a contemporary warning:

“We expect a reversal in risk sentiment and the market retesting last year’s low over the coming months,” he mentioned late Monday. While his is hardly the one cautious voice on Wall Street, observe Kolanovic was a bull for a lot of 2022, which ended up being a horrible 12 months for shares.

Read: 2023 has been tough up to now. Use it as a wake-up name in your retirement planning.

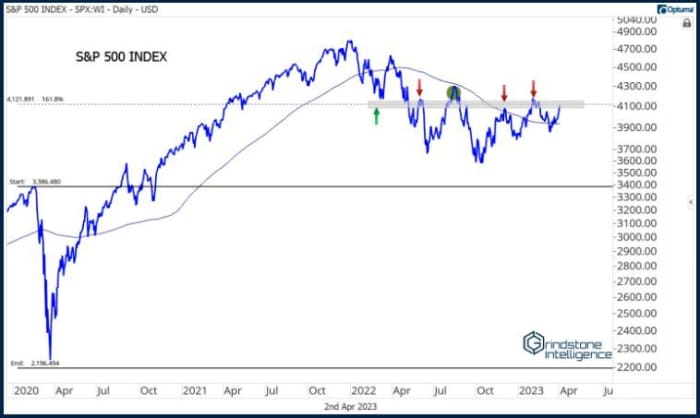

Where shares go from right here is all down to a couple key ranges, says our name of the day, from cash supervisor Grindstone Intelligence.

Austin Harrison, chief market strategist of the Kansas City-based outfit, says that for a lot of 2023, whether or not to purchase shares or promote them and discover different investments has been a close to inconceivable name, even after main indexes have bounced off October lows.

For that cause, technicals matter so much proper now, he says.

“The S&P 500

SPX

is attempting to get via the 4100-4200 stage for the fifth time. This has been our line within the sand all 12 months, and there’s no cause to vary that strategy now. It’s the 161.8% retracement from the 2020 decline, and it additionally marked a key low early final 12 months, earlier than the bear market actually received going. It’s been resistance for 10 months,” he informed shoppers in a observe.

If the S&P 500 can rise above these February highs, Harrison mentioned he’ll be far more satisfied of a brand new bull market below means.

It’s an identical story for the Nasdaq Composite

COMP,

the place they’re centered on the 11800-12200 resistance stage. “These aren’t just numbers we’re pulling out of a hat – 12000 is the 161.8% Fibonacci retracement from the entire COVID selloff. The market respects these Fib levels, so we do, too,” he mentioned, referring to horizontal traces that chart watchers use to establish factors of assist and resistance.

Harrison mentioned that the Fibonacci stage for the Nasdaq additionally marks the purpose the place “growth stocks peaked relative to value. In September 2020, growth stocks, which dominate the Nasdaq, ended a near 15-year run of outperformance relative to value,” he mentioned.

While one other robust week like final one’s will put these huge indexes above Grindstone’s key ranges, he’s nonetheless cautious of weak breadth — when the variety of declining shares are above these gaining.

The strategist factors out that almost all shares have lagged behind index returns this 12 months by a large margin — the S&P 500 has outperformed the equal-weighted index by round 6% since mid-January. That could also be nothing to get too alarmed about because it merely means greatest shares — growthy ones — are rising sooner than smaller ones, mentioned Harrison.

One piece of excellent news currently — the Dow industrials

DJIA

has made it again above 33,000, Harrison mentioned.

But backside line, the strategist is staying impartial on shares till the S&P 500 is above 4,200 and the Nasdaq has “comfortably cleared” 12,220 — opening the door to “higher stock prices.”

“That doesn’t mean we need to be indiscriminately buying everything we see — we still want to be selective. But unless the situation in value deteriorates further, there just isn’t much technical evidence to support a bearish approach.”

Read: What ‘unprecedented’ volatility within the $24 trillion Treasury bond market seems like

The markets

Stocks

DJIA

SPX

COMP

are struggling for traction in early motion, whereas Treasury yields

BX:TMUBMUSD10Y

BX:TMUBMUSD02Y

rise. Oil costs

CL

proceed to rise, with U.S. crude

CL

buying and selling simply above $81 a barrel. The British pound

GBPUSD

has busted previous $1.25, with the euro

EURUSD

additionally increased, because of greenback

DXY

weak point.

Read: Soaring oil costs: 6 issues traders must know in regards to the shock OPEC+ manufacturing cuts

For extra market updates plus actionable commerce concepts for shares, choices and crypto, subscribe to MarketDiem by Investor’s Business Daily.

The buzz

JPMorgan

JPM

CEO Jamie Dimon says the banking disaster is “not over yet,” and predicted “repercussions for years to come,” however nonetheless says it’s nothing like what was seen in 2008.

AMC

AMC

inventory is down 28% after the movie-theater operator mentioned it has settled a shareholder lawsuit over a inventory conversion. This will pave the way in which for AMC to transform its AMC Preferred Equity , or APE

APE,

models into shares of widespread inventory, proceed with a 10-to-1 reverse inventory cut up and lift capital. APE shares are up 20%.

Rocket launch supplier Virgin Orbit

VORB

has filed for chapter 11 chapter safety and can search a sale, after shedding most of its employees following a failed launch in January. The inventory is down 23% in premarket.

Factory orders and job openings are due at 10 a.m., adopted later by a speech from Cleveland Fed President Loretta Mester at 6 p.m.

A decide has barred recording tools and gadgets at former President Donald Trump’s anticipated arraignment in New York in a while Tuesday. Here’s a rundown of what’s going to occur subsequent.

Best of the online

“I am truly sorry.” Credit Suisse chairman Axel Lehmann faces down sad shareholders on the financial institution’s AGM farewell gathering.

LSU’s Angel Reese has extra NIL sponsors than another school basketball participant, male or feminine

The chart

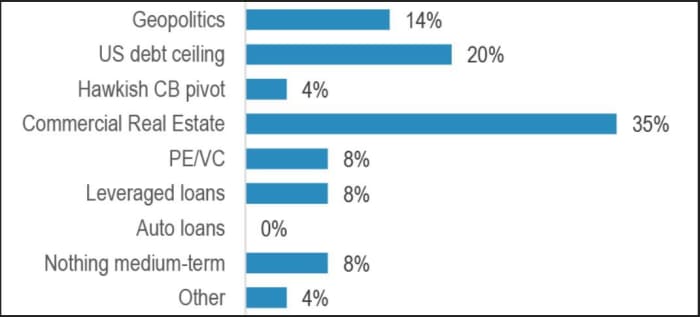

“Beyond the banking crisis, what do you believe is the likely cause of the next market crisis?” That was the query posed by JPMorgan’s most up-to-date shopper survey, and right here’s the reply:

JPMorgan

The prospect of economic actual property being the subsequent shoe to drop has been the topic of a lot chatter because the banking fallout. One economist has warned of a “real mess,” to come back however simply wanting monetary catastrophe. And amid all of the warning, there are nonetheless a handful of economic REIT shares that analysts love.

The tickers

These have been the top-searched tickers on MarketWatch as of 6 a.m.:

| Ticker | Security title |

| TSLA | Tesla |

| AMC | AMC Entertainment |

| APE | AMC Entertainment Holdings most well-liked shares |

| BBBY | Bed Bath & Beyond |

| GME | GameStop |

| AAPL | Apple |

| MULN | Mullen Automotive |

| NIO | NIO |

| BABA | Alibaba |

| FRC | First Republic Bank |

Random reads

When squirrels take over your kitchen.

Dungeons & Dragons: How to observe the movie like a professional.

Staplers should go: The newest in cost-cutting by huge tech.

Need to Know begins early and is up to date till the opening bell, however join right here to get it delivered as soon as to your e mail field. The emailed model might be despatched out at about 7:30 a.m. Eastern.

Listen to the Best New Ideas in Money podcast with MarketWatch reporter Charles Passy and economist Stephanie Kelton.

Source web site: www.marketwatch.com