U.S. shares capped off a wild 2023 with a two-month dash that has carried the Dow to report highs and the S&P 500 index to inside a whisker of an analogous milestone.

But after such a strong advance, some portfolio managers and strategists are involved that the market may undergo its personal post-New Year’s Eve hangover as soon as the calendar turns to January 2024.

Instead of offering a tailwind for the market, a number of who spoke with MarketWatch frightened that the “January effect” would possibly work in reverse as buyers scramble to lock in positive aspects after the S&P 500 rose 24% in 2023, in keeping with FactSet information.

“Any time you have a big burst like that, I think you’re vulnerable to some profit-taking,” stated James St. Aubin, chief funding strategist at Sierra Investment Management, throughout an interview with MarketWatch. “It wouldn’t surprise anybody to see the market cool off a bit after a strong run.”

From excessive valuations, to bullish sentiment indicators, to financial information, to geopolitics and past, right here are some things that would journey up the market in January.

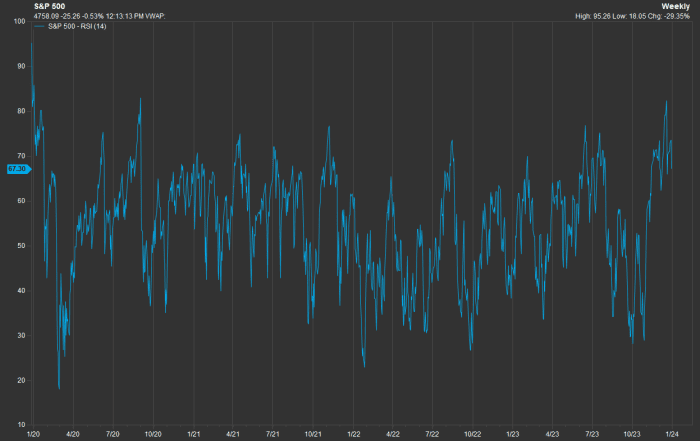

U.S. shares are already overbought

A technical gauge that’s broadly adopted by Wall Street portfolio managers and technical analysts has been screaming that U.S. shares are overbought for a month.

The 14-day relative power index on the S&P 500, a momentum indicator that’s supposed to assist put the magnitude of the index’s newest strikes into context, climbed as excessive as 82.4 on Dec. 19, its highest since 2020, in keeping with FactSet information.

FACTSET

Although the RSI has since pulled again, it continues to hover round 70, seen by analysts as the brink for when one thing may be thought of “overbought.”

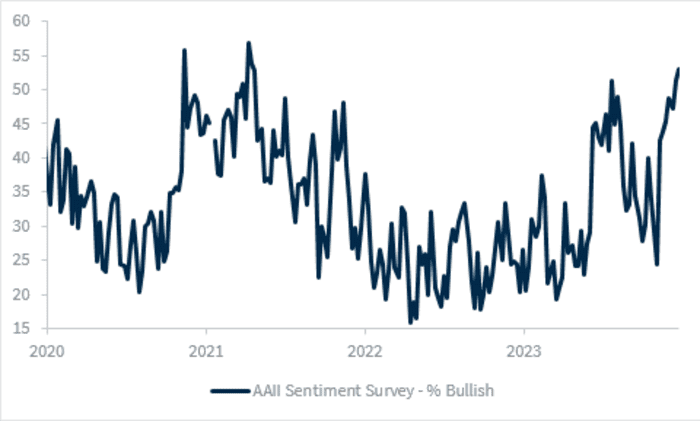

Sentiment has swung from extraordinarily bearish to extraordinarily bullish

In the span of simply two months, buyers have gone from extremely bearish to extremely bullish, in keeping with the American Association of Individual Investors’ weekly sentiment survey.

That ought to give buyers pause, for the reason that gauge is seen as a dependable counter-indicator. When sentiment turns into stretched in both path, it could sign that the market is about to show. Investors say that’s what occurred again in July, and likewise in October after the S&P 500 touched its 2022 bear-market nadir.

RAYMOND JAMES

According to the AAII survey revealed forward of the Christmas vacation, almost 53% of respondents stated they have been bullish, the very best since April 2021. That quantity got here down a bit this week, but it surely stays excessive relative to ranges from October.

The VIX is extraordinarily low

Wall Street’s favourite “fear gauge” is giving the all-clear. To some, that’s cause sufficient to fret.

The Cboe Volatility Index

VIX,

higher often called the Vix, measures implied volatility, or how risky merchants’ count on the S&P 500 to be over the approaching month primarily based on buying and selling exercise in choices contracts tied to the index.

In December, the Vix dropped beneath 12 for the primary time since earlier than the appearance of the COVID-19 pandemic.

Nancy Tengler, CEO and CIO of Laffer Tengler Investments, stated in emailed commentary that she is preserving a detailed eye on the Vix. Once volatility begins to climb, buyers ought to take into account taking some chips off the desk.

Progress on inflation may stall in January

Some buyers are already anxious concerning the subsequent U.S. inflation report, due Jan. 11.

The Cleveland Fed’s inflation nowcast has core CPI rising greater than 0.3% in December. If this proves correct, it might be the most popular inflation studying since May.

And even when core inflation is available in barely cooler, shares may not greet it with the identical enthusiasm they’ve proven previously.

“U.S. CPI for December will hopefully continue to show a disinflationary trend, although the question is: can we keep rallying on this same dynamic?” stated Larry Adam, chief funding officer at Raymond James, in emailed feedback.

Earnings season may disappoint

For three straight quarters starting with the ultimate three months of 2022, the most important U.S. corporations noticed their earnings shrink on a year-over-year foundation.

This “earnings recession” lastly got here to an finish within the third quarter, however the conundrum that buyers now face is whether or not corporations can handle to fulfill Wall Street’s lofty expectations for 2024.

The artificial-intelligence software program growth and the truth that the U.S. economic system averted a recession in 2023 has helped increase analysts’ confidence about earnings, strategists stated.

According to the bottom-up consensus estimate from FactSet, analysts count on S&P 500 combination earnings to extend by 11.7% for the calendar 12 months 2024.

“Markets have been baking in this 11.7% earnings growth figure for a while now. That’s a lot of optimism,” Goldman stated throughout an interview with MarketWatch.

And that’s not all…

To make sure, this record is hardly complete.

Politics and geopolitics additionally got here up lots in discussions with analysts. Investing professionals cited Taiwan’s upcoming presidential election, one other looming federal debt-ceiling showdown within the U.S., the start of the 2024 Republican presidential primaries, the continued conflicts in Gaza and Ukraine, and extra as potential threats to market calm.

Some expressed concern that the Treasury may spark a selloff in bonds and shares with its subsequent quarterly refunding announcement in early 2024.

But within the view of Cetera’s Goldman, a dynamic that Wall Street merchants name it “buy the rumor, sell the news” may signify a much bigger menace.

The considering works like this: buyers have already front-run aggressive Federal Reserve rate of interest cuts. So, if the Fed delivers, the frenzy to take earnings may drive shares decrease as an alternative of propelling the primary U.S. indexes to new highs. Put one other manner, many strategists consider buyers have already priced in fairly aggressive Fed price cuts.

So except the central financial institution finds a approach to ship one thing even larger than what Wall Street is anticipating, the primary U.S. fairness indexes may wrestle to proceed their advance.

“Markets are already buying the rumor that we’re going to have a better 2024, that the Fed is going to cut rates, that breadth is going to widen,” Goldman stated.

“Maybe we’re already seeing that priced in.”

Source web site: www.marketwatch.com