The Nasdaq Composite skilled one thing pretty uncommon throughout Monday’s rebound. According to 1 analyst, it’s one more reason to be cautious about shares’ nascent rebound this week.

The tech-heavy index

rose 1.6% on Monday, its strongest exhibiting since July 28. But the Nasdaq Exchange’s advance-decline line, a measure of the variety of shares listed on the trade that completed greater in contrast with the quantity that closed decrease, continued to deteriorate. According to Bloomberg information cited by BTIG’s Jonathan Krinsky, the trade’s advance-decline line was detrimental 175 on Monday.

It’s unusual for the Nasdaq to see such a big improve whereas a majority of its elements fall, even throughout a 12 months like 2023 by which a handful of megacap expertise shares have obtained tons of consideration within the monetary press for his or her outsize contributions to the yearly features of the S&P 500 and Nasdaq.

Gains for the so-called Magnificent Seven shares even prompted the Nasdaq to rebalance the Nasdaq 100, its hottest index, to reduce its dependence on a handful of megacap shares.

See: Here are 4 of the largest modifications to the Nasdaq 100 from Monday’s particular rebalancing

That group is made up of Tesla Inc.

TSLA,

Nvidia Corp.

NVDA,

Meta Platforms Inc.

META,

Microsoft Corp.

MSFT,

Amazon.com Inc.

AMZN,

Apple Inc.

AAPL

and Alphabet Inc.’s Class A

GOOGL

and Class C

GOOG

shares.

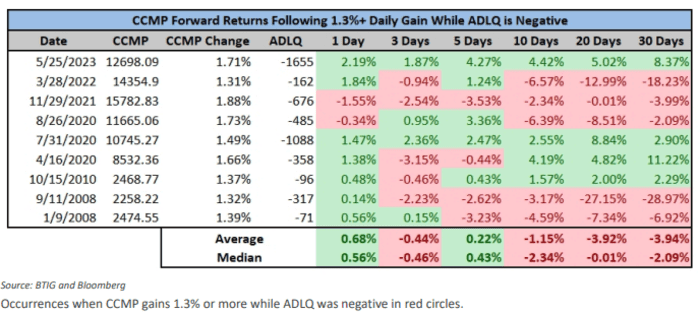

By Krinsky’s rely, there have solely been 9 different cases for the reason that starting of 2007 when the Nasdaq Composite gained 1.3% whereas the variety of declining shares outnumbered these on the rise. He lists them within the chart beneath.

BTIG

Returns for the Nasdaq over the 30 days following every of these instances have been decidedly blended. But among the many most up-to-date examples previous to Monday, the index was decrease 30 days later 3 times out of 4. After an instance on March 28, 2022, the index proceeded to fall 18.2% over the next 30 days. On the opposite hand, the index gained 8.4% in the course of the 30 days following May 25, 2023, the latest instance previous to Monday.

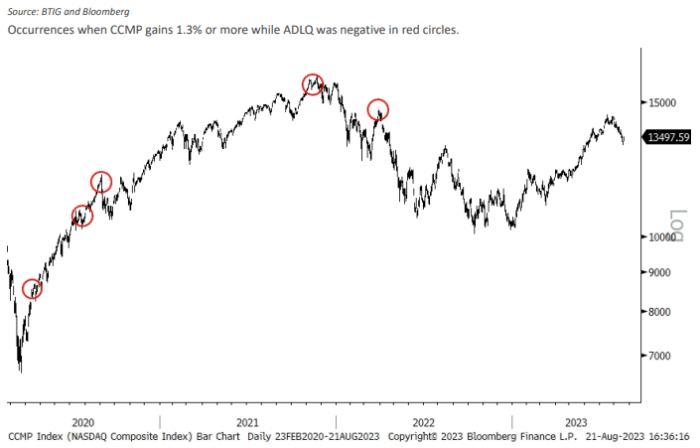

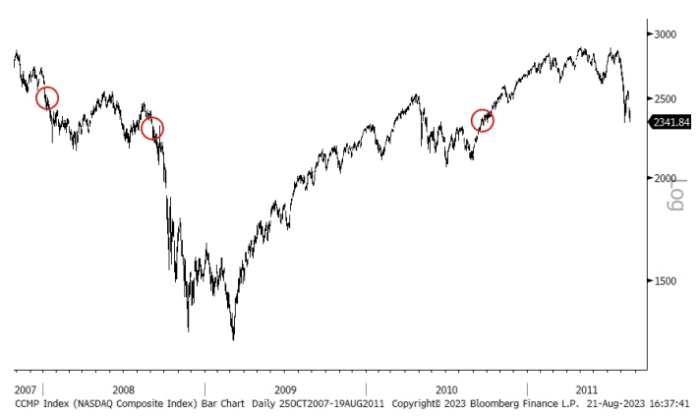

Krinsky maps out these strikes within the charts beneath.

BTIG

Uncredited

So what can traders be taught from all this? The Nasdaq’s Monday advance was largely an element of sturdy features in a handful of shares. Nvidia gained 8.5%, its largest such achieve since May 25, FactSet information present. That’s the day after the chip maker and artificial-intelligence darling’s blockbuster earnings report from final quarter that resulted within the inventory logging one of many largest every day will increase in market capitalization for any inventory ever within the historical past of recent U.S. monetary markets.

Tesla Inc. gained 7.3%, its finest every day achieve since March 21. Apple, Microsoft and a number of other different members of the group additionally noticed sturdy features relative to the weak spot within the area seen over the previous month.

Krinsky informed MarketWatch in a cellphone name that Monday’s features in Nvidia and Tesla had been possible pushed by merchants frontrunning Nvidia’s upcoming quarterly earnings report, which is due out Wednesday after markets shut. If it wasn’t for this buying and selling, it’s possible that rising Treasury yields would have pressed more durable on shares.

“They’re buying what worked after Nvidia’s last earnings report, which was a lot of the Magnificent Seven stocks,” Krinsky mentioned.

“I would have thought a new high on 10-year yields would have dampened the enthusiasm a bit,” he added.

The yield on the 10-year Treasury notice

jumped 8.8 foundation factors on Monday to 4.339%, its highest end-of-day stage since Nov. 6, 2007, FactSet information present. Bond yields transfer inversely to costs.

The yield on the 10-year notice was marginally decrease Tuesday in latest buying and selling, whereas the S&P 500

was up 0.1% at 4,402. The Nasdaq Composite

was buying and selling 0.4% greater round 11:30 a.m. Eastern time on Tuesday, at 13,546. The Dow Jones Industrial Average

was off by 85 factors, or 0.3%, to 34,377.

Both the S&P 500 and Nasdaq logged three consecutive weekly declines by way of Friday’s session, the longest such streak of losses for the Nasdaq since December, FactSet information present.

Source web site: www.marketwatch.com