Something uncommon is occurring out there for copper that hasn’t been seen in practically 30 years. Some see it as one more signal that the worldwide financial system may very well be headed for a tough patch.

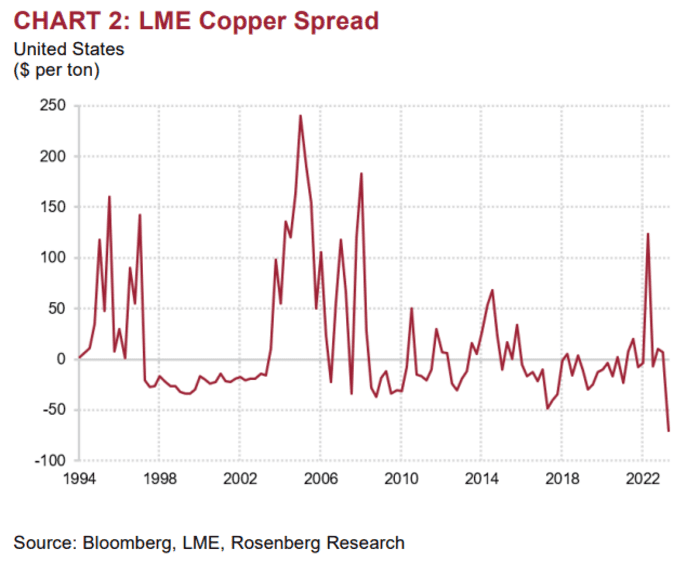

Declining costs within the spot marketplace for copper have pushed the unfold between the spot value and the worth of futures traded on the London Metals Exchange for supply three months out to its widest degree since 1994, placing the copper futures curve right into a state of utmost contango — a time period utilized by commodity futures merchants to explain when futures costs are buying and selling in extra of the spot value.

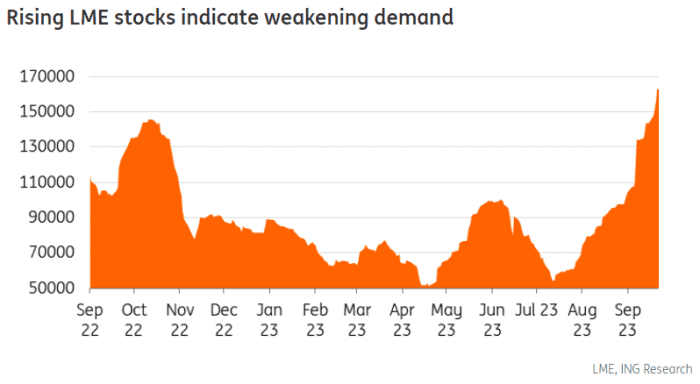

Prices have been declining over the previous few months as inventories have piled up at London Metals Exchange warehouses all over the world.

Falling demand is essentially an element of weak spot within the Chinese financial system, analysts say. But provided that China’s financial system is the world’s second largest, the ripple results may very well be felt as far-off as Europe, the U.S. and past.

ROSENBERG RESEARCH

According to the most recent knowledge from LME, 163,900 tonnes of copper are being saved in trade warehouses all over the world as of Sept. 22. That’s a rise of fifty% for the reason that begin of September, following a 50% enhance throughout the month of August. Inventories have been rising since mid-July, knowledge present.

ING

The implication is evident, commodity analysts say.

“This shows clear signals of weakening demand,” mentioned Ewa Manthey, a London-based commodity strategist at ING, in a be aware to purchasers. To make sure, Manthey famous that inventories stay low by historic requirements.

Dave Rosenberg, a former Merrill Lynch economist who’s now runs Rosenberg Research, additionally blamed weakening financial situations in China for the stoop in copper costs.

He additionally famous that costs may very well be reacting to a decline in world commerce.

Trade fell 3.2% on a year-over-year foundation in August, the steepest drop since August 2020, in keeping with the most recent figures from the World Trade Monitor, which is revealed by the Netherlands Bureau for Economic Policy Analysis.

Typically, declining commerce exercise is an indication of declining financial exercise extra broadly.

For years, copper has loved the sobriquet “Dr. Copper,” supposedly for its skill to smell out world financial developments earlier than they’re mirrored within the official knowledge. Copper has a wide range of makes use of in industrial and medical merchandise, to the electrical wiring in properties, together with roofing, plumbing and past. It’s some of the generally used industrial metals.

But some analysts have lately questioned copper’s predictive potential. Bank of America’s commodity analysis crew led by Michael Widmer and Francisco Blanch mentioned copper’s sensitivity to GDP progress has waned in a analysis be aware revealed final month.

“As a cyclical asset, copper demand has always been closely correlated with global GDP growth, but that sensitivity has been declining,” the Bank of America crew mentioned. “This reduced beta to GDP has already provided support to copper prices at around $8,500/t ($3.86/lb) in recent quarters and limited downside price pressures on the red metal in the midst of an industrial recession, a rare occurrence,” they add.

Copper costs for December supply

HG00,

HGZ23,

buying and selling on the New York Mercantile Exchange, which competes with LME, have been off 0.7% at $3.65 a pound on Tuesday, hovering round their lowest degree since late May, in keeping with FactSet knowledge.

Source web site: www.marketwatch.com