New York Community Bancorp’s inventory rose Thursday, outpacing good points in different monetary shares, a day after Soros Fund Management disclosed an elevated stake within the hard-hit regional financial institution.

Soros Fund Management acquired 1,036,180 shares of New York Community Bancorp to carry its stake as much as slightly below 1.48 million shares, based on a submitting made after Wednesday’s market shut.

New York Community Bancorp’s inventory

NYCB,

rose 5.2% to $4.88 a share because it continued its restoration a shock loss earlier this month that rekindled fears in regards to the power of U.S. regional banks.

The inventory is now up 14.3% prior to now week, after executives on the firm purchased inventory Friday at 1997 costs.

The inventory value is now properly above its 52-week low of $3.60 a share.

Even with the good points, nevertheless, the inventory stays at ranges not seen since 2000 previous to February’s swoon.

The SPDR S&P Bank ETF KBE rose 2.6% and the S&P Regional Banking ETF

KRE

rose 2.2%. The two indices are up by 3.4% and three.9% respectively, for the week.

Meanwhile, the financial institution disclosed it was planning to fulfill with institutional traders in February and March, based on a Thursday submitting.

The financial institution’s predominant messages in an investor presentation embody actively decreasing its industrial actual property focus and executing initiatives to assist long-term profitability.

The financial institution mentioned its administration and board have been shopping for inventory within the open market “as we strongly believe in the future of our institution.”

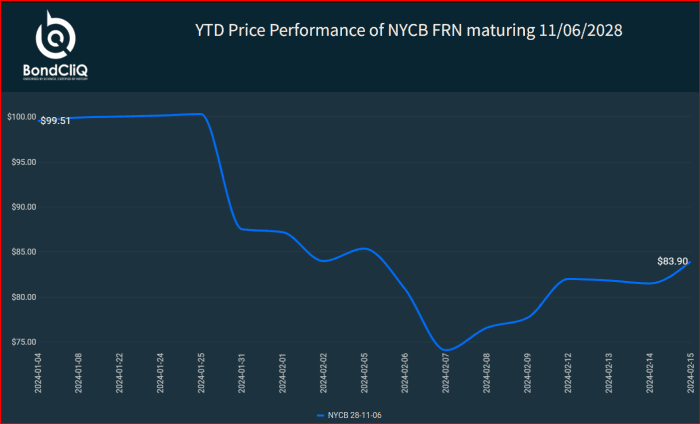

Along with New York Community Bank’s inventory value, its bond costs have additionally recovered in current days after falling to a low on Feb. 7.

NY Community Bancorp’s bond value has rebounded in current days.

BondCliQ Media Services

Also learn: Fed’s Barr says banking system is powerful regardless of New York Community Bancorp’s woes

Source web site: www.marketwatch.com