U.S. shares stay in a powerful bull market regardless of latest choppiness, because the correlations between 11 S&P 500 sectors and the foremost index are sending some constructive indicators, in keeping with DataTrek Research.

The S&P 500’s sector correlations to the large-cap index have been beneath the typical since mid-April, which suggests buyers are extra centered on fundamentals than macroeconomic forces as they attempt to outperform by choosing what they hope shall be successful sectors and shares in a bull market, mentioned Nicholas Colas, co-founder of DataTrek Research.

“… by this measure U.S. large caps remain in good shape,” wrote Colas in a Tuesday notice. “Investors are still focused on fundamentals rather than macro issues, which is the way it should be. Yes, stocks got ahead of themselves at the end of July and likely still need some time before they turn higher again, but the correlation data says we remain in a longer-term bull market.”

Colas mentioned usually in bull markets, buyers hope to beat the broader inventory market by choosing high gainers and sectors, so company and business fundamentals matter greater than macroeconomic elements reminiscent of rates of interest, recession dangers and geopolitical considerations.

As a outcome, the correlation between the S&P 500 sectors and the index can be decrease than common as a result of bull markets have each winners and losers, so the index strikes up slowly, Colas mentioned.

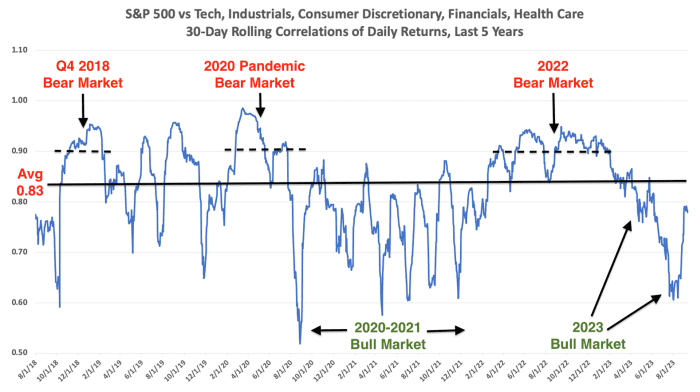

The following chart captures these dynamics. Over the final 5 years, the typical correlation of the 5 largest sectors within the S&P 500 to the index as a complete has been 0.83, in keeping with knowledge compiled by DataTrek.

A correlation worth near zero signifies a weak relationship between the 2 variables being in contrast, whereas a worth shut to 1 means a powerful correlation between them.

SOURCE: DATATREK RESEARCH

Colas mentioned if correlations run persistently beneath 0.83, a bull market is underway, but when they attain and maintain at 0.9 for quite a lot of weeks, meaning shares are in a bear market.

“By this measure, we are in a bull market right now. Correlations have been below average since mid-April 2023 and remain so even now,” mentioned Colas.

The S&P 500

SPX

formally exited its longest bear-market run since 1948 and entered the bull market in early June. The S&P 500 Consumer Discretionary Sector

XX:SP500.25

and the Communication Services Sector

XX:SP500.50

have superior 35.5% and 44.1% yr to this point, respectively, in contrast with the S&P 500’s 16.6% achieve thus far this yr, in keeping with FactSet knowledge. The S&P 500 Consumer Staples Sector

XX:SP500.30

was off 2.9%, whereas the Utilities Sector

XX:SP500.55

has dropped 10.6% over the identical interval.

See: U.S. shares are dealing with a triple menace that would result in extra losses forward

What has occurred this yr is a welcome change for the inventory market, however it’s a mirror picture of 2022 as bear markets supply only a few sturdy performers, so every little thing unravels on the identical time, Colas mentioned.

In a market downturn, buyers would attempt to protect capital by promoting “essentially everything” to keep away from additional losses when macroeconomic situations trump fundamentals of corporations, he mentioned.

Last yr, each S&P 500 sector misplaced cash on a complete return foundation aside from Energy

XX:SP500.10

and Utilities sectors as runaway inflation compelled the Federal Reserve to hike rates of interest seven instances a yr in a marketing campaign to get costs below management. The S&P 500 slumped 19.4% to endure its worst yr because the 2008 monetary disaster.

U.S. shares had been buying and selling principally decrease on Tuesday afternoon as buyers had been looking forward to the extensively anticipated studying on August inflation from the consumer-price index on Wednesday morning. The S&P 500 was shedding 0.4% and the Nasdaq Composite

COMP

was off 0.8%, whereas the Dow Jones Industrial Average

DJIA

was rising 0.1%.

MarketWatch reside protection: Apple Event: New iPhone 15, Apple Watch introduced

Source web site: www.marketwatch.com