For these obsessive about large, spherical numbers, the inventory market almost delivered one other thrill: Just earlier than Thursday’s closing bell, the S&P 500 briefly traded above the 5,000-point threshold for the primary time ever.

The S&P 500

SPX

hit an intraday excessive of 5,000.40 within the final minute of buying and selling earlier than closing at 4,997.91, its ninth file end up to now in 2024.

Professional traders don’t pay a whole lot of consideration to 1,000-point thresholds. In themselves, they maintain no technical significance for analysts.

However, they’re usually cited as “psychological” hurdles. As such, clearing them might be seen as including to optimistic sentiment. Conversely, failure to convincingly transfer by means of them might be blamed for slowing a rally.

“There have been times in history when these big round numbers put a ceiling on the market,” recalled technical analyst Mark Arbeter, president of Arbeter Investments.

For occasion, when the Dow Industrials nearly reached 1,000 in January 1966, the index didn’t break forcefully above 1,000 till early 1983. The S&P 500 broke over 100 in 1968 however by no means actually busted by means of till 1980, Arbeter informed MarketWatch.

“There have been times when we break above these big numbers for a short period of time, and then we finally get the pullback or correction. With the market so extended, that is what I am looking for,” he stated.

To be certain, topping a 1,000-point milestone is extra spectacular for the S&P 500 than it’s for the Dow Jones Industrial Average

DJIA

on a percentage-point foundation. A transfer above the 39,000-point threshold for the blue-chip gauge takes a mere 2.6% rise from 38,000; the transfer from 4,000 to five,000 for the S&P 500 represents a acquire of 25%.

But milestones for the S&P 500 are inclined to garner much less consideration than these for the Dow, despite the fact that the S&P 500 is by much more related, because it represents a a lot greater portion of the investible U.S. inventory market. While the Dow, which dates again to 1896, stays the measuring stick of the U.S. inventory market by the general public general, the S&P 500, which launched in 1957, is seen by funding professionals because the true large-cap benchmark.

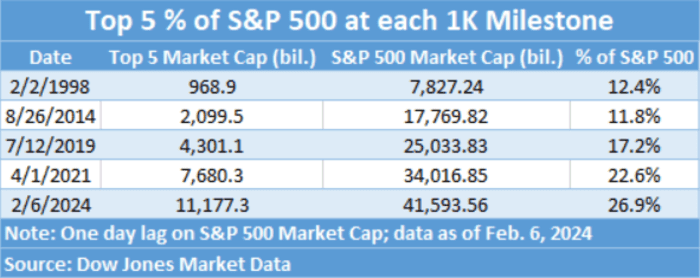

If the S&P 500 takes one other run at 5,000 and efficiently closes above it on Friday, it will mark 719 buying and selling days, or greater than two-and-a-half years, for the reason that S&P 500 cleared the 4,000 degree on April 1, 2021, in response to Dow Jones Market Data. It could be the index’s longest stretch between 1,000-point milestones for the reason that 1,227 buying and selling days, or almost 5 years, between its 2,000 and three,000 level ranges, from August 2014 to July 2019.

Dow Jones Market Data

And sure, market management is remarkably concentrated — a rising concern for traders frightened concerning the sustainability of the current stock-market rally. Dow Jones Market Data notes that the top-five firms by market capitalization make up extra of the S&P 500 than they did at some other 1,000-point milestone.

Related: Stock-market traders worry a megacap meltdown. Here’s what historical past says.

Source web site: www.marketwatch.com