The unrelenting rise in U.S. Treasury yields that’s roiling world monetary markets despatched the shares of rate-sensitive homebuilder shares decrease on Tuesday in a continuation of the current pattern.

The transfer comes because the housing market is already reeling from mortgage charges which might be the very best in 23 years at a mean of 6.72% for a 15-year mortgage and seven.65% for a 30-year fixed-rate mortgage.

Read now: Rising Treasury yields are upsetting monetary markets. Here’s why.

Homebuilder bonds, nonetheless, are holding up.

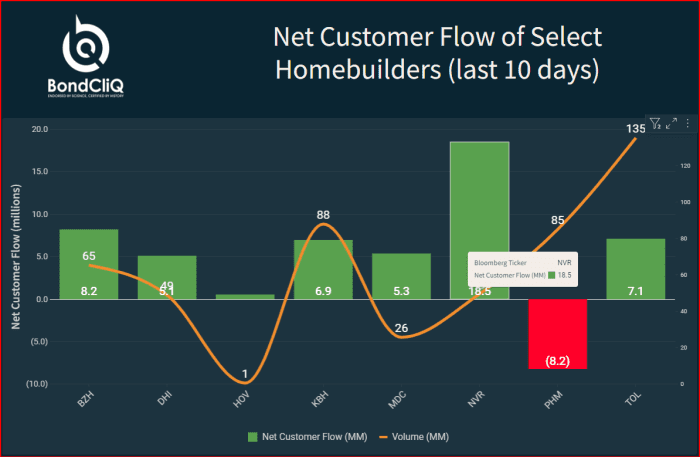

As the next charts from knowledge options supplier BondCliQ Media Services illustrate, there was better shopping for within the bonds of Beazer Homes USA Inc.

BZH,

D.R. Horton Inc.

DHI,

Hovnanian Enterprises Inc.

HOV,

KB Home

KBH,

M.D.C. Holdings Inc.

MDC,

NVR Inc.

NVR,

and Toll Brothers Inc.

TOL,

Only PulteGroup Inc.

PHM,

has seen better promoting.

Net buyer flows of choose homebuilders (final 10 days). Source: BondCliQ Media Services

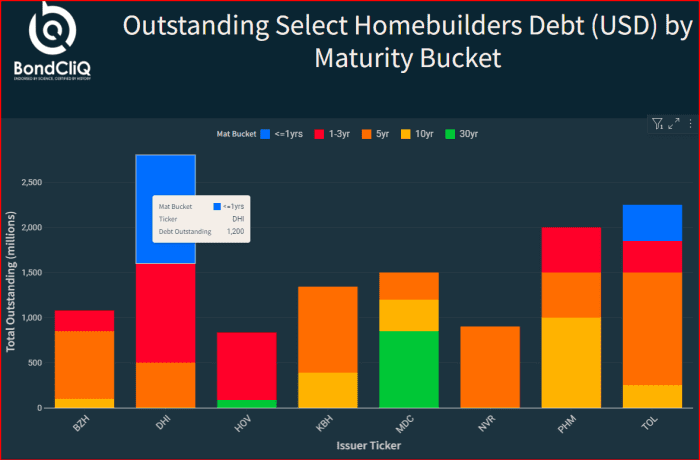

The following chart exhibits how a lot excellent debt every firm is dealing with and when it comes due, with D.R. Horton the clear chief with $1.2 billion of debt maturing in lower than a 12 months. That means it’s dealing with probably the most refinancing threat.

Outstanding choose homebuilder debt (USD) by maturity bucket. Source: BondCliQ Media Services

The housing sector has struggled because the Federal Reserve has moved quite larger. An improve in mortgage charges in August pushed pending residence gross sales all the way down to the bottom stage since April 2020. The median value of an present residence was $407,100.

See additionally: Home-buying demand falls as mortgage charges attain multi-decade highs

Beazer Homes’ inventory was the largest decliner on Tuesday, buying and selling down 6.5%. That was adopted by M.D.C., which was down 5.7% and KB Home, which was down 4.5%.

PulteGroup was down 3.8% and Toll Brothers was down 3.8%.

The S&P 500

SPX

was down 1.5%.

Source web site: www.marketwatch.com