Anniversary jitters anybody? Thursday marks 36 years since Black Monday KO’d world markets, with some sharing it-could-happen-again charts, as rising bond yields hold pulling the inventory market off stability.

A cautious day is organising, amid some additional crumbling of the Magnificent Seven fortress, with shares of Tesla down on Cybertruck expectations. That’s as shares of one other of the Seven — AI stalwart Nvidia

NVDA,

— has seen a little bit of a tough patch these days. A rally from Netflix might save the tech day.

Tesla may very well be an enormous determiner for a way shares carry out from right here, says Simon Ree, founding father of Tao of Trading, on X. “If we see aggressive dip-buying in TSLA Thursday, that would be a bullish tell. Conversely, if the market fades the pop in NFLX, that would signal overriding bearish sentiment.”

And get that third eye cranking as Chairman Jerome Powell gathers the Economic Club of New York for a fireplace chat on Thursday.

Watch MarketWatch’s stay protection of Powell’s speech

On that be aware and within the thick of earnings season, it’s value reflecting on what broadly adopted investor and hedge-fund supervisor Stanley Druckenmiller has stated about why central banks issue importantly in your investments. (h/t to quant researcher Wifey on X for the reminder).

“Earnings don’t move the overall market; it’s the Fed, focus on the central banks, and focus on the movement of liquidity, most people in the market are looking for earnings and conventional measures. It’s liquidity that moves markets,” Druckenmiller stated on the Lost Tree Club in 2015. Note, he’s expressed wariness on shares this 12 months, in addition to predicting a tough financial touchdown.

Our name of the day from Macro Tourist publication editor, Kevin Muir would are likely to agree, as he says Powell’s feedback have necessary bearing on markets for the following two months.

Muir believes some buyers means too caught up in current information that exhibits a robust financial system. “I will not disagree with the analysis that the U.S. economy appears to be running at full steam with no signs of slowing,” Muir writes in his newest weblog.

“However, I think they are mistakenly looking solely at the economic data and not considering financial conditions,” and given post-FOMC assembly strikes in asset costs, it’s straightforward to see that the Fed sees the market doing its tightening work for it, he says.

What buyers are likely to overlook, crucially, is that the Fed is a “supertanker that takes a long time to start and stop,” says Muir. And it doesn’t shift route attributable to a few information factors, however reasonably seems to be on the entire enchilada and figures out “gradual starts and stops.”

The large debate proper now? As financial information has been a little bit too sizzling, the bond market thinks the Fed will depart probabilities of a December hike on the desk. Muir says nope, the Fed has paused and it’ll take some severely robust financial information to get that climbing marketing campaign restarted.

On Thursday, Muir expects Powell shall be extra dovish than many buyers anticipate, and make sure what different members have been saying over the previous week, suggesting he’ll echo what Fed Vice Chair Philip Jefferson stated not too long ago.

Jefferson: “I will remain cognizant of the tightening in financial conditions through higher bond yields and will keep that in mind as I assess the future path of policy. I will be taking financial market developments into account along with the totality of incoming data in assessing the economic outlook and the risks surrounding the outlook and in judging the appropriate future course of policy.”

A extra dovish Fed is probably not a inexperienced gentle to purchase shares, stated Muir, although he’s contemplating shopping for some inflation protected bonds and gold and promoting the greenback, and he’s additionally undecided how bond yields will react attributable to so many variables. “However, I don’t think betting on a hawkish Powell is the correct play.”

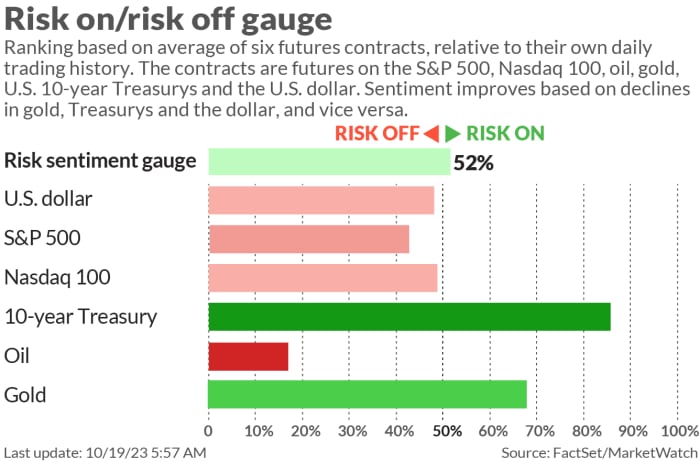

The markets

Stock futures

ES00,

NQ00,

are struggling as bond yields

BX:TMUBMUSD10Y

BX:TMUBMUSD02Y

climb. Gold

GC00,

and the greenback

DXY

are slipping and oil

CL.1,

BRN00,

can be falling after the U.S. relaxed Venezuela sanctions. The Israeli shekel

ILSUSD,

hit contemporary lows on fears of a protracted conflict.

For extra market updates plus actionable commerce concepts for shares, choices and crypto, subscribe to MarketDiem by Investor’s Business Daily.

The buzz

Weekly jobless claims fell to a nine-month low of 198,000, whereas a Philly Fed manufacturing survey confirmed a modest October restoration. Still to come back are present house gross sales and main financial indicators. Fed Chair Powell will converse at midday, with Chicago Fed President Austan Goolsbee at 1:20 p.m., Fed Vice Chair for Supervision Michael Barr at 1:30 p.m., Atlanta Fed President Raphael Bostic at 4 p.m. and Dallas Fed President Lorie Logan at 6:40 p.m.

Tesla shares

TSLA,

are down 6% as buyers shook off earnings disappointment, then received gloomy after CEO Elon Musk stated the Cybertruck would take 18 months to show right into a “cash-flow contributor.” Some analysts nonetheless see silver linings in these outcomes.

Opinion: Tesla’s Cybertruck has Elon Musk sounding unusually cautious

Netflix shares

NFLX,

are headed towards the largest acquire in practically three years after an enormous soar in subscribers and worth hikes. Disney

DIS,

supplied a peek at its ESPN financials, and analysts have been relieved by what they noticed.

American Airlines

AAL,

inventory is slipping as income fell quick, AT&%

T,

is up lifting its free cashflow outlook. Union Pacific inventory is up after stronger-than-forecast revenue.

Nokia shares

NOK,

are down after the telecom tools maker stated as much as 14,000 jobs would go as revenue dropped 69%.

Elsewhere, Las Vegas Sands shares

LVS,

are up after the on line casino group stated it could purchase again $2 billion in inventory. Equifax

EFX,

is sinking after the credit-score company lower its outlook.

Best of the net

Want to beat your return-to-office mandate? Try ‘coffee badging’ at your personal threat

How lots of of U.S. authorities workers grew to become gun trade gross sales reps

A U.S. State Department official resigned over what known as “blind support for one side,” within the Israel-Hamas conflict.

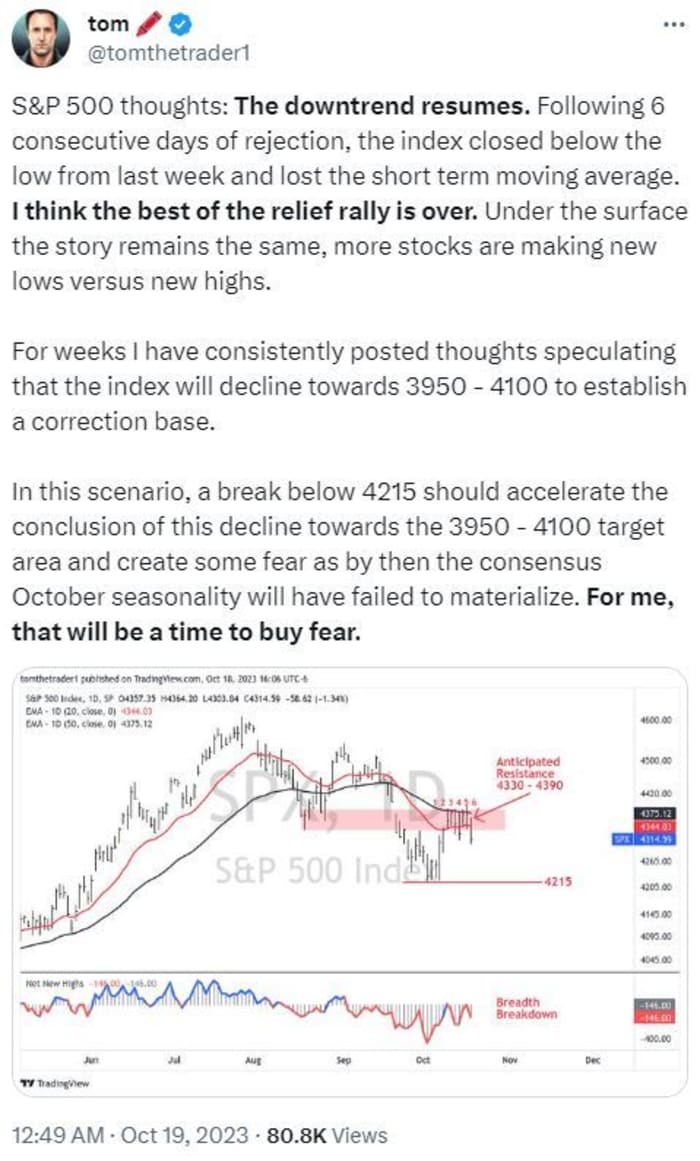

The chart

The better of the inventory reduction rally could also be over and it’s time to purchase worry, says dealer Tom, who writes the Lines On A Chart substack:

@tomthetrader1

The tickers

These have been the top-searched tickers on MarketWatch as of 6 a.m.:

| Ticker | Security title |

|

TSLA, |

Tesla |

|

NFLX, |

Netflix |

|

AMC, |

AMC Entertainment |

|

NVDA, |

Nvidia |

|

AAPL, |

Apple |

|

TSM, |

Taiwan Semiconductor Manufacturing |

|

GME, |

GameStop |

|

AMZN, |

Amazon.com |

|

NIO, |

Nio |

|

MSFT, |

Microsoft |

Random reads

Citadel’s Ken Griffin is constructing the most costly house on the planet.

Costco — which introduced a CEO change — has a discount $4,500, 157-piece Le Creuset set.

Need to Know begins early and is up to date till the opening bell, however join right here to get it delivered as soon as to your e mail field. The emailed model shall be despatched out at about 7:30 a.m. Eastern.

Listen to the Best New Ideas in Money podcast with MarketWatch monetary columnist James Rogers and economist Stephanie Kelton.

Source web site: www.marketwatch.com