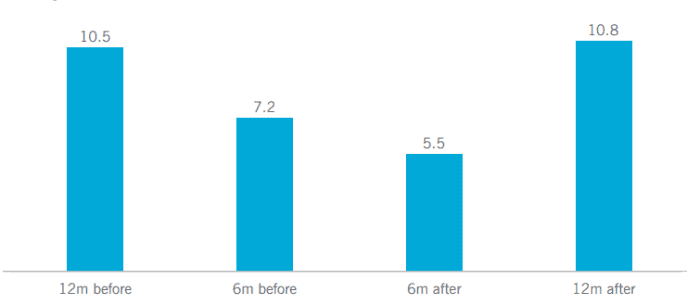

Here’s some good news for buyers fretting over what guarantees to be a extremely contentious 2024 U.S. presidential election: History exhibits shares are likely to rally within the yr earlier than Election Day.

But there’s a rub, famous Saira Malik, chief funding officer at Nuveen, which has $1.2 trillion in belongings underneath administration: While the S&P 500

SPX

has seen a mean whole return of round 10% in presidential election years primarily based on information going again to 1928, the large-cap benchmark had already rallied by greater than that between early November and the tip of final yr.

In different phrases, these pre-election features could have already occurred.

“That’s kind of an interesting statistic and one of the many reasons we’re a little bit more concerned about equities coming into the beginning of 2024,” Malik instructed MarketWatch in a cellphone interview.

Nuveen

Those different causes embrace a bent for markets to be extra risky in election years, in addition to issues that buyers are nonetheless pricing in additional rate of interest cuts than the Federal Reserve is more likely to ship, Malik stated. Also, shares are expensive, with the S&P 500 buying and selling at a few 20% premium to its common valuation since 2010, she famous.

Investors additionally know the 2024 election is more likely to be extremely contentious. Donald Trump heads into Tuesday’s Republican major because the clear front-runner for his occasion’s nomination as he seeks a November rematch with President Joe Biden.

Washington Watch: New Hampshire GOP major: Haley tries to show the tide, as Trump cruises towards the 2024 nomination

Trump is campaigning amid quite a few authorized woes. Trump faces fees in Washington, D.C., and Georgia’s Fulton County in election-interference instances and was indicted final yr in a hush-money case and a classified-documents case. He has denied wrongdoing and argued the prosecutions are politically motivated, whereas repeating false claims about his 2020 election loss.

Biden faces low approval scores, together with inside his personal occasion. An ABC News ballot this week discovered 57% of Democrats and Democrat-leaning independents can be happy with a Biden nomination, whereas 72% of Republican-aligned adults can be happy with having Trump as their occasion’s nominee.

Meanwhile, worries over U.S. political dysfunction are on the rise. Last yr’s federal debt-ceiling showdown and the following ouster of Kevin McCarthy from his put up as speaker of the House underlined issues amongst some buyers that confidence in U.S. establishments and governance was starting to erode.

See: What U.S. political dysfunction means for the inventory market and buyers

As the election attracts close to, an more and more contentious political backdrop might be a recipe for larger market volatility. A contested election outcome, might drive that volatility even larger, Malik stated.

Presidential election years additionally imply buyers ought to be ready for an avalanche of charts and tables analyzing historic market efficiency across the quadrennial occasion.

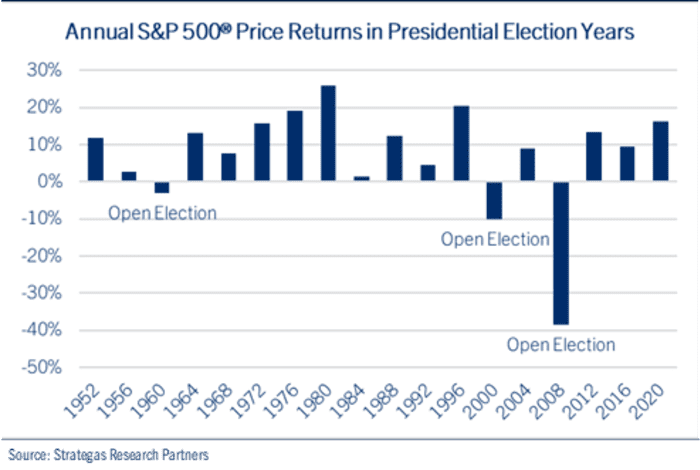

Acknowledging the “risk of a jinx,” John Lynch, chief funding officer at Comerica Wealth Management, highlighted the one under exhibiting that shares have by no means posted a yearly decline when an incumbent president — win or lose — ran for re-election. That consists of 2020, when shares suffered a February-March crash triggered by the onset of the COVID-19 pandemic, however quickly recovered to put up a yearly acquire.

Strategas Research Partners

Going again to 1952, the index has suffered a yearly fall in an election yr solely 3 times — 1960, 2000 and 2008. All three have been years have been “open” election years, with no incumbent operating for re-election, Lynch famous.

Still, the efficiency of the market, in so far as it displays the economic system, may additionally be telling a few candidate’s prospects. Lynch famous that each president who managed to keep away from recession within the two years earlier than their re-election went on to win a second time period, whereas each president that skilled recession in that stretch ended up dropping.

He famous that shares sometimes outperform in presidential election years when the incumbent wins. After all, a powerful economic system and market doubtless means voter sentiment is behind the sitting president.

The sample in years when incumbents lose, in the meantime, tends to contain a pair of selloffs, one throughout the peak of major season in early spring and one other following the occasion conventions in late summer time.

That’s left the inventory market with seemingly robust predictive energy, Lynch stated.

In 24 presidential elections since 1928, the path of the index has telegraphed the election end result, Lynch stated, citing information from Strategas. If the S&P 500 was constructive within the three months main as much as the election, the incumbent or the candidate of the incumbent’s occasion received. Of the 4 instances the indicator was incorrect, the index rose however the incumbent occasion’s candidate nonetheless misplaced.

U.S. shares noticed a powerful rally in 2023, consistent with the so-called presidential cycle that sometimes sees strong features within the third yr of a president’s time period. Equities consolidated to start the brand new yr, however completed final week on a powerful be aware, with the S&P 500 logging its first document shut in additional than two years.

See: After S&P 500’s new document excessive, right here’s what historical past says might occur subsequent

The Dow Jones Industrial Average

DJIA

additionally logged a document shut, rising 0.7% for the week, whereas the Nasdaq Composite

COMP

noticed a 2.3% weekly advance as tech shares reasserted their management.

The robust tech efficiency, in the meantime, could mirror issues concerning the endurance of the patron, stated Nuveen’s Malik. The agency contends the mix of cyclical danger and politically impressed volatility presents a case for taking part in protection.

That consists of specializing in shares of dividend growers — firms which have persistently raised their dividends over time — in addition to international infrastructure performs that stand to see additional advantages from developments favoring reshoring, nearshoring and different modifications to provide chains.

Dividend-growth and international infrastructure shares have traditionally weathered down markets comparatively effectively, Malik stated, emphasizing Nuveen’s issues concerning the potential for a drawdown following the “remarkably strong” fairness rally seen over the ultimate two months of 2023.

Source web site: www.marketwatch.com