Investors are in love with Goldilocks, however ought to as a substitute stay on the outlook for Disco Duck, in keeping with a workforce of Wall Street quantitative strategists.

“Going back to the question of market macro regime, we believe that there is a risk of the narrative turning back from goldilocks towards something like 1970s stagflation, with significant implications for asset allocation,” wrote a workforce of J.P. Morgan analysts, led by carefully adopted strategist Marko Kolanovic, in a Wednesday notice.

That Seventies state of affairs was a subject of dialogue within the second half of final yr, however was discarded in favor of “Goldilocks-type” or “just-right” outcomes extra just lately, they stated.

Archive: Why it’s flawed to check right now’s inflation surge to Seventies-style ‘stagflation’ (Oct. 26, 2021)

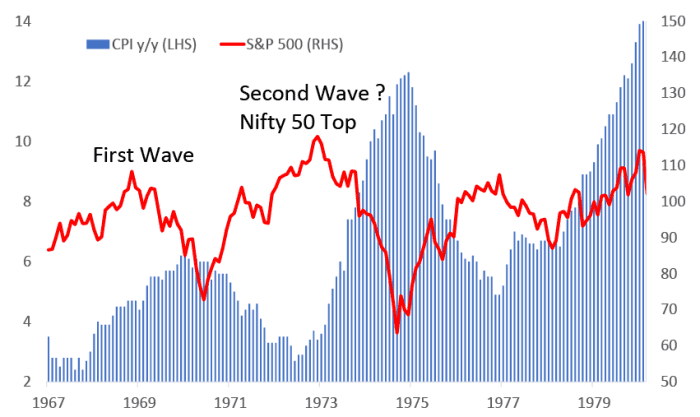

So what have been the Seventies all about? Foremost was excessive inflation that got here in three separate waves, with every timed indirectly to geopolitical developments, the strategists noticed.

Those included the Vietnam War, in addition to wars and revolutions within the Middle East. The latter have been accompanied by oil embargoes that resulted in vitality crises and transport disruptions. The stage was additionally set for rising authorities finances deficits.

That ought to all sound considerably acquainted to traders right now, they stated, noting that fairness markets have been basically flat from 1967 to 1980 in nominal phrases, whereas bonds and credit score outperformed considerably (see chart under).

J.P. Morgan, Bloomberg Finance

“There are many similarities to the current times. We already had one wave of inflation, and questions started to appear whether a second wave can be avoided if policies and geopolitical developments stay on this course,” they wrote.

Also see: Seventies-style stagflation could also be liable to repeating itself, Deutsche Bank warns

The strategists see parallels between now and the Seventies geopolitical backdrop, noting three battle zones: Eastern Europe, the Middle East and the South China Sea.

Related to these conflicts, traders have already witnessed one wave of an vitality disaster and the world is enduring a present spherical of transport disruptions within the Red Sea.

The greatest threat by far revolves round tensions or a commerce battle with China that would have a a lot larger influence on the worldwide financial system and would set off a second wave of inflation and a market selloff, they stated.

Meanwhile, fiscal deficits aren’t on a sustainable path.

It might all be establishing a reversion of the dynamic that prevailed from the late Nineteen Eighties to the 2000s, through which a “peace dividend” from the top of the Cold War will get undone, turning right into a macro backdrop characterised by a “conflict tax” or “conflict inflation,” they stated.

What would that imply for property?

“If such a negative feedback loop were to take hold (as it did in the 1970s), investors would move out of equities and into fixed-income assets — i.e. seek to receive elevated yields that companies and governments need to pay to fund, rather than more elusive equity growth in a stagflationary regime,” wrote Kolanovic and firm.

While shares have been flat from 1967 to 1980, bonds considerably outperformed with yields averaging above 7%, they famous — which meant that any yield pickup, equivalent to that offered by non-public credit score, would make an enormous distinction to long-term portfolio efficiency.

Investors don’t seem within the temper up to now to revisit the Seventies. Stocks have rallied into 2024, with the S&P 500

SPX

passing the 5,000-point milestone whereas the Dow Jones Industrial Average

DJIA

has additionally scored a string of data.

Stocks have been modestly decrease Wednesday afternoon, sustaining losses as traders weighed the minutes of the Federal Reserve’s January coverage assembly.

Stock Market Today: Dow Jones stays decrease as traders weigh Fed minutes, await Nvidia outcomes

Source web site: www.marketwatch.com