August was a sizzling month and it wasn’t simply in regards to the climate. Financial markets at the moment are bracing for what’s prone to be a rebound in headline U.S. inflation subsequent week, fueled by larger vitality costs.

Barclays

BARC,

and BofA Securities

BAC,

anticipate August’s client worth index to replicate a 0.6% month-to-month rise, up from the 0.2% month-to-month readings seen in July and in June. In addition, they put annual CPI inflation fee at 3.6% or 3.7% for final month, which compares with the three.2% and three% figures reported respectively for the prior two months.

While Federal Reserve coverage makers and analysts are loath to learn an excessive amount of into one report, August’s CPI has the potential to disrupt expectations that getting again to the central financial institution’s 2% goal will probably be straightforward. Inflation has as a substitute been nudging again up since June, with the probably rebound in August being considered primarily pushed by the vitality sector. What now stays to be seen is how for much longer vitality costs will stay elevated and whether or not they’ll start to feed into narrower measures of inflation that matter most to the Fed.

Read: Stock-market traders simply obtained reminded that the inflation struggle isn’t over

“We’re going to see a spike in gas prices and other commodity prices driven by supply cuts, which means headline CPI goes back up,” mentioned Alex Pelle, a U.S. economist for Mizuho Securities in New York.

Via telephone on Friday, Pelle mentioned that prospects for a warmer August CPI report have already been factored in by monetary markets, with all three main U.S. inventory indexes heading for weekly losses.

How traders react to subsequent Wednesday’s information will probably come down as to if the rebound in headline figures is seen as “a one-off” or one thing that will get repeated, and “what that means for the bottoming off of inflation,” Pelle mentioned. “The equity market is going to have some trouble in the fourth quarter after a pretty impressive first half. Earnings expectations are still pretty high, but the macro-driven backdrop is challenging.”

Rising vitality costs in August have already spilled into the month of September, with gasoline reaching the highest seasonal degree in additional than a decade this week. Voluntary manufacturing cuts by Saudi Arabia and Russia are a significant contributing issue curbing the provision of crude oil into year-end, and Goldman Sachs has warned that oil may climb above $100 a barrel.

In monetary markets, there’s one group of merchants which is telegraphing that the ultimate mile of the highway towards 2% inflation received’t be easy.

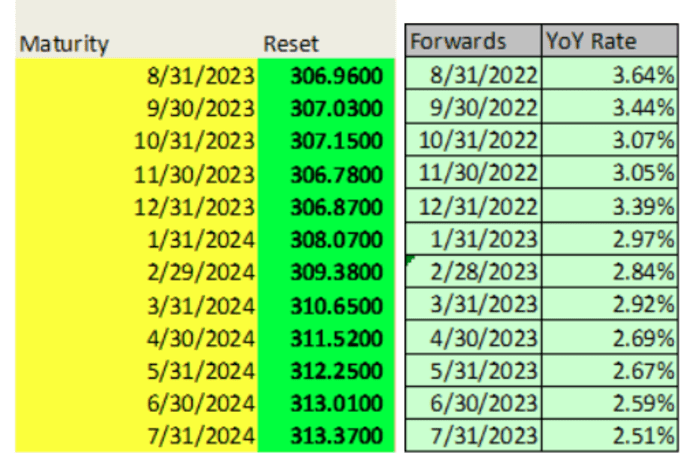

Traders of derivatives-like devices referred to as fixings anticipate that the following 5 CPI reviews, together with August’s, will produce annual headline inflation charges above 3%. Though coverage makers care extra about core readings that strip out unstable meals and vitality costs, they’re conscious of how a lot headline figures can impression the general public’s expectations.

Source: Bloomberg. The maturity column displays the month and 12 months of upcoming CPI reviews. The forwards column displays the year-ago interval from which the year-over-year fee is predicated.

At BofA Securities, U.S. economist Stephen Juneau mentioned August’s CPI received’t essentially change his agency’s view that inflation is prone to transfer decrease subsequent 12 months and fall again to the Fed’s goal with out the necessity for a recession. BofA Securities expects only one extra Fed fee hike in November and can keep that view if August’s CPI report is available in as he expects, Juneau mentioned through telephone.

After stripping out unstable meals and vitality objects, BofA Securities, together with Barclays, expects August’s core CPI readings to return in at 0.2% month-over-month — matching June and July’s ranges — and to fall to 4.3% on an annual foundation.

Based on core measures, August’s report wouldn’t “change the narrative all that much: Everything points to a moderation in price growth,” Pelle mentioned. “There’s a reason why food and energy are typically excluded,” and “we don’t want to put too much stock into one month.”

As of Friday afternoon, all three main U.S. inventory indexes have been headed larger, with the S&P 500 making an attempt to snap a three-day dropping streak. Dow industrials

DJIA,

the S&P 500

SPX

and Nasdaq Composite

COMP

have been respectively on observe for weekly losses of 0.8%, 1.2%, and 1.8%. They’re nonetheless up for the 12 months by greater than 4%, 16% and 31%.

Meanwhile, Treasury yields turned blended on Friday as fed funds futures merchants priced in a 93% likelihood of no motion by the Fed at its subsequent coverage assembly in lower than two weeks, and a more-than-50% probability of the identical for November and December — which would go away the Fed’s important coverage fee goal between 5.25%-5.5%.

“There is a risk that investors are too complacent about the inflation report,” mentioned Brian Jacobsen, chief economist at Annex Wealth Management in Elm Grove, Wis. “We might not get to 2% inflation as quickly as many hope.”

Source web site: www.marketwatch.com