“Market timing can appear to be a fool’s game. But that’s only half the story.”

The S&P 500

SPX

can be up greater than 30% this yr as of November 8, however for eight notably dangerous days for the U.S. market. That’s greater than double the benchmark index’s precise return of 14.1% over that point.

I level this out to supply extra perspective on a provocative report from DataTrek Research, which not too long ago reported that the S&P 500’s return via Nov. 8 was due primarily to the yr’s eight finest buying and selling days.

This is necessary as a result of for those who focus solely on what occurs while you miss the very best buying and selling days, market timing can look like a idiot’s sport. But that’s solely half the story. A defender of market timing might simply as simply give attention to the massive advantages that accrue to sidestepping the largest dropping days.

“What if you had equal success avoiding some of the best and some of the worst days? ”

In the true world, after all, nobody is ready to sidestep all the great or all of the dangerous days. But what if that had been potential? The desk beneath gives perception.

| 2023 return via 11/8 | Standard deviation of each day returns | |

| Buy-and-hold return | +14.1% | 0.85 |

| Sidestepping the 8 finest days | -1.5% | 0.78 |

| Sidestepping the 8 worst days | +30.5% | 0.79 |

| Sidestepping the 8 finest and the 8 worst days | +12.6% | 0.72 |

Notice that while you sidestep each the very best and the worst days, you come near matching the buy-and-hold return, however with measurably much less danger. As a end result, you beat the market on a risk-adjusted foundation.

“The most volatile sessions on Wall Street tend to be bunched together in clusters. ”

But do market timers have a sensible shot at avoiding the buying and selling periods with both the largest beneficial properties or the largest losses — essentially the most unstable buying and selling periods, in different phrases?

The shocking reply is “yes,” in accordance with a tutorial examine entitled “Volatility-Managed Portfolios.” It was performed by Alan Moreira of the University of Rochester and Tyler Muir of UCLA.

I wrote about this examine a number of months in the past, so will briefly summarize its findings right here. The professors discovered that essentially the most unstable periods on Wall Street are typically bunched collectively in clusters. By decreasing your fairness publicity when volatility spikes upward, and restoring that publicity when volatility recedes, you’ve good odds of sidestepping lots of the buying and selling periods with the largest beneficial properties or the largest losses.

As a end result, in accordance with the professors, you may beat the market on a risk-adjusted foundation.

This yr is an effective instance of how unstable periods are sometimes bunched collectively. Of the 16 buying and selling days this yr to date which might be amongst both the very best eight or worst eight, six occurred in a 14-trading-session stretch between March 3 and March 22.

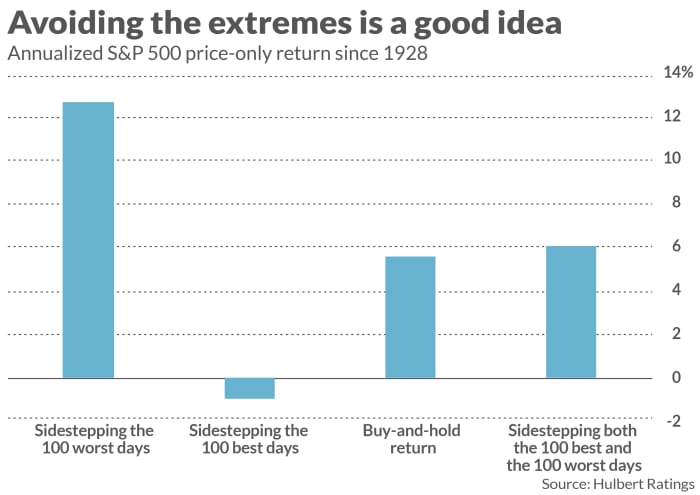

The professors doc their findings with numerous statistical exams. But one easy method of appreciating what they discovered is offered by the accompanying chart, which focuses on all S&P 500 buying and selling periods since 1928.

Notice that over this longer interval you truly beat a buy-and-hold technique in uncooked, unadjusted phrases when sidestepping each the best- and worst days. And while you consider the danger discount from avoiding essentially the most unstable days, you beat the market much more on a risk-adjusted foundation. That’s a successful mixture.

Mark Hulbert is a daily contributor to MarketWatch. His Hulbert Ratings tracks funding newsletters that pay a flat price to be audited. He could be reached at mark@hulbertratings.com

More: Stock-market timers beware: Just 8 days account for the entire S&P 500’s 14% achieve in 2023

Plus: Stock-market rally faces make-or-break second. How to play U.S. October inflation knowledge.

Source web site: www.marketwatch.com