Thanks to President Biden’s State of the Union speech, the talk over the way forward for Social Security has made it into the front-page headlines.

Perhaps now we will, as soon as and for all, dispense with the city myths about Social Security that up till now have coloured the talk. Regardless of how we predict Social Security’s challenges needs to be met, it’s important for this debate to be based mostly on chilly, onerous information.

That sadly is just not the case presently.

Where’s the ‘crisis’?

To start with, take the widely-repeated assertion that Social Security is going through a “crisis.” This merely is just not correct, at the least based on the usual dictionary definition of a disaster as “a sudden change” or a “turning point.” We’ve identified for many years that, because the child growth era retires, Social Security’s funds would should be augmented.

Read: 12 issues you have to learn about Social Security’s future, defined by this system’s chief number-cruncher

Consider what was generally known as way back as 1983, which is when the final main legislative modifications had been made to shore up Social Security’s funds. Actuaries on the Social Security Administration (SSA) at the moment appropriately projected that, in mild of these modifications, the Social Security belief fund would be capable to pay out all advantages till the 2030 to 2050 interval. Their projections have proved remarkably correct, because the SSA presently initiatives that the belief fund might be unable to pay out 100% of advantages beginning in 2034.

Read: Yes, Republicans need modifications to Social Security and Medicare entitlements—as a result of some modifications are wanted

So we’ve identified for 4 many years that fixes would should be made by 2030 or quickly thereafter. There’s no extra of a Social Security funding “crisis” now than at any level since 1983.

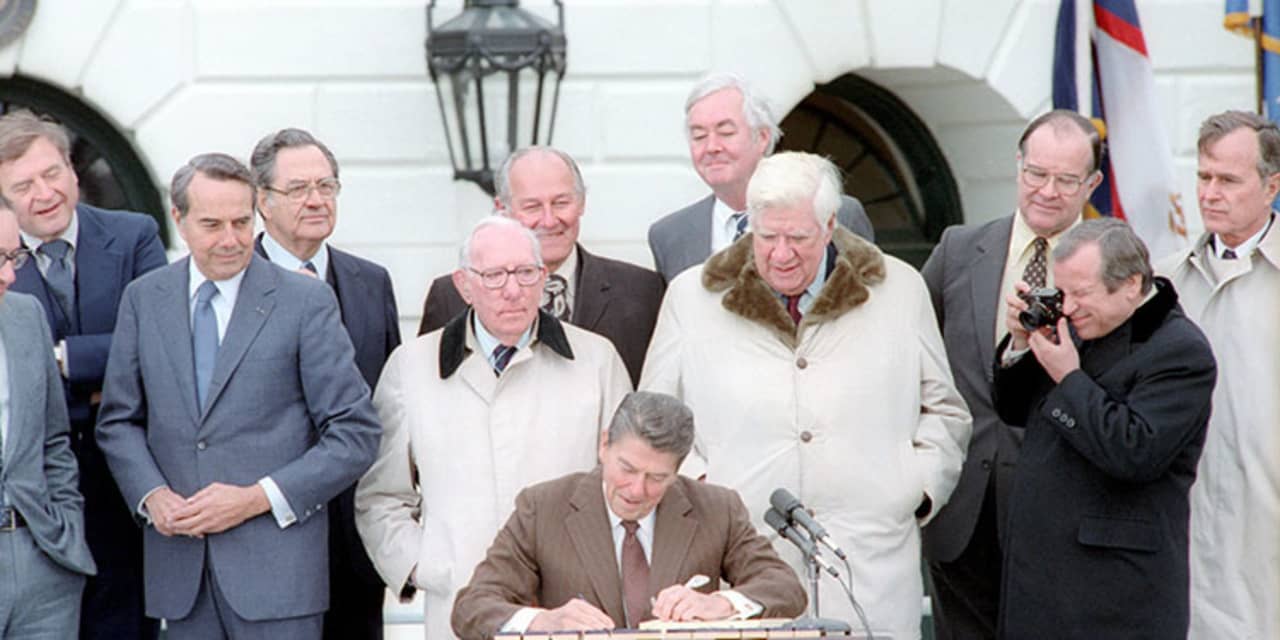

It’s additionally price recalling how lengthy it took our flesh pressers to enact the 1983 laws. SSA actuaries for a few years prior had projected that the belief fund could be unable to pay out 100% of advantages starting within the early Eighties, and as that insolvency date approached the deadline for motion was pinpointed as July 1983. Yet the Social Security Amendments of 1983 weren’t signed into regulation by then-President Reagan till April 20, 1983—with simply 10 weeks to spare.

It’s tough to think about how laws in coming years to shore up Social Security’s funds might be enacted with extra of a lead time than in 1983. But even when we match the lead time for that yr’s laws, we shouldn’t count on the following spherical of modifications to be enacted for at the least one other a decade.

It’s irrational to attend that lengthy, to make certain, because it turns into costlier to revive Social Security’s funds the longer it’s delayed. But kicking the can down the highway is what politicians do. Their conduct doesn’t represent a disaster.

The Social Security belief fund already is empty

Another falsehood about Social Security that’s extensively repeated is that the Social Security belief fund is already bankrupt, since there isn’t a cash left in it—it’s already been spent by the federal government. But that represents a basic misunderstanding of fundamental accounting.

By regulation, the SSA should make investments any surplus within the Social Security belief fund in U.S. Treasurys. In return, SSA carries these Treasurys on its steadiness sheet as an asset. To declare that the Social Security belief fund is broke is subsequently equal to claiming that each company that owns Treasurys must wipe these property off its books too.

Apple

AAPL,

for instance, has over $30 billion in U.S. authorities securities on its steadiness sheet, based on its newest annual report. Surely nobody thinks these property are nugatory.

What if Congress by no means can agree on any modifications?

Yet one other side of this debate that wants correcting is the concern amongst many eventual Social Security recipients that, if Congress can’t agree on making any modifications, they are going to obtain nothing after 2034. That’s not true, and to say that it’s the case is little greater than scaremongering. According to SSA, they might nonetheless obtain 77% of advantages. That’s not nice, by any means, however neither is it the tip of the world.

Martha Shedden, co-founder and president of the National Association of Registered Social Security Analysts, factors out that even when solely three quarters of scheduled advantages receives a commission, Social Security will nonetheless be the first supply of revenue for a lot of, if not most, retirees. So it’s not clear how your retirement planning would change even should you believed that our flesh pressers would let the Social Security belief fund change into unable to pay 100% of advantages.

The backside line? Everyone can agree that Social Security’s funds should be modified. But a “crisis” mentality is just not conducive to having a sober and earnest debate about the best way to make these modifications.

Mark Hulbert is an everyday contributor to MarketWatch. His Hulbert Ratings tracks funding newsletters that pay a flat price to be audited. He may be reached at mark@hulbertratings.com.

Source web site: www.marketwatch.com