A strategist who anticipated the 2023 rally says he expects shares to go nowhere for the remainder of the 12 months, whereas probably struggling in 2024 as properly, as company earnings development fails to dwell as much as Wall Street’s overly optimistic expectations.

Barry Bannister, an fairness strategist at Stifel, stated in a report shared with MarketWatch late Wednesday that he believes this 12 months’s rally, spurred by aid {that a} U.S. recession wouldn’t arrive in 2023, has run its course.

He now expects the S&P 500

SPX

to commerce sideways for the remainder of the 12 months, finally ending at 4,400, roughly 68 factors decrease from the place the index closed on Wednesday, based on FactSet knowledge. However, traders can nonetheless discover alternatives as sectors which have lagged behind the market leaders.

Based on this view, Bannister sees alternatives in so-called “pair trades” like shorting Big Tech shares, whereas shopping for financials, supplies, industrials shares and different cyclical development shares which have underperformed.

He additionally expects the equal-weighted S&P 500 index

RSP

to beat the standard capitalization-weighted S&P 500 within the second half.

These trades would have already paid off over the previous month. Since the beginning of company earnings season in mid-July, the equal-weighted S&P 500 has risen 2.4%, based on FactSet knowledge, in contrast with 1.6% for the standard S&P 500.

Over the identical interval, a number of members of the “Magnificent Seven” group of megacap know-how shares that Bannister is recommending as shorts have began to retreat.

Apple Inc.

AAPL,

is down 6.6% at $178.19 per share, and Tesla Inc. is down 11.8% at $242 per share. Meanwhile, Nvidia Corp.

NVDA,

the inventory that has benefited maybe greater than some other from the artificial-intelligence increase, has barely budged.

Investors have purpose to hear, since Bannister belongs to a choose group of analysts who referred to as this 12 months’s rebound.

At the time Bannister made his bullish name early this 12 months, the consensus view on Wall Street, shared by analysts at JPMorgan Chase & Co.

JPM,

Morgan Stanley

MS,

Goldman Sachs Group

GS,

and others, was that shares would sink to new lows throughout the first half of 2023 earlier than rebounding later within the 12 months. Bannister opted to show that decision on its head, based mostly on the expectation that U.S. inflation would retreat.

That view ended up being right. Consumer costs rose by simply 0.2% in June, based on CPI knowledge, exhibiting inflation ebbed to the slowest tempo in two years and slowed extra shortly than economists had anticipated. Investors will obtain one other replace on the state of U.S. inflation Thursday morning.

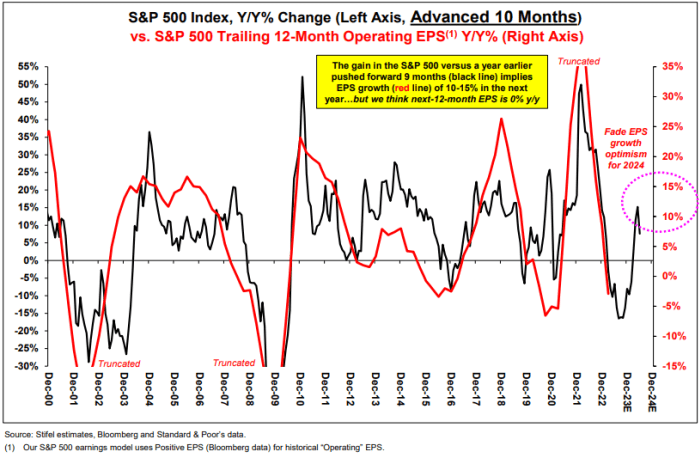

Bannister now believes the slowdown in inflation is reaching its restrict. But maybe extra essential, he expects shares may battle in 2024 as properly, as Wall Street’s lofty expectations for company earnings development are finally disillusioned.

For 2024, Bannister and Stifel anticipate S&P 500 combination earnings per share to come back in at $209, little-changed from the place analysts anticipate them to be in 2023, that’s in contrast with Wall Street’s consensus for $226.

STIFEL

“…[I]f our flattish EPS view is right the S&P 500 may be flat,” he stated in a notice to shoppers.

Bannister expects earnings may battle as a gentle recession will arrive throughout the first quarter of 2024, whereas rising oil costs create a mini-price shock, serving to to rework 3% inflation into a brand new flooring, making it harder for the Federal Reserve to justify interest-rate cuts.

Sluggish financial development additionally will damage company income, he stated. Making issues worse, COVID-19 stimulus drove a surge in earnings development in 2021 that can end in years of inauspicious year-over-year comparisons for corporations, Bannister stated.

U.S. shares completed decrease on Wednesday, extending an early-August hunch. The S&P 500 misplaced 31.67 factors, or 0.7%, to 4,467.71, whereas the Nasdaq Composite

COMP

shed 162.31 factors, or 1.2%, to 13,722.02. The Dow Jones Industrial Average

DJIA

fell by 191.13 factors, or 0.5%, to 35,123.36.

Source web site: www.marketwatch.com