Drum roll, please.

For the previous three years, round this time, I’ve been telling you what the world’s prime fund managers personal and what investments they’re shunning. Each time, I’ve provided the rogue thought {that a} portfolio consisting solely of the latter—the stuff they hate—might be going to crush the market over the following 12 months.

And every time, it’s turned out proper. And then some.

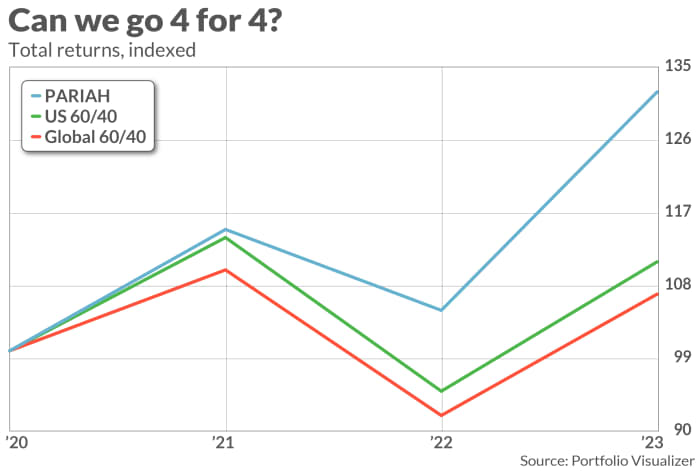

This portfolio of essentially the most hated belongings on Wall Street, which I name “Pariah Capital,” earned a surprising 26% return in 2023.

A “balanced” international portfolio, made up of 60% international shares

VT

and 40% international bonds

BNDW

? A full 10 factors much less, or 16%. (A U.S.-only equal of the “balanced” portfolio, consisting of 60% S&P 500

SPY

and 40% U.S. bonds

AGG,

earned 17%.)

Meanwhile, a portfolio consisting of these fund managers’ favourite investments? Just 5%. Dismal. More than 20 factors under Pariah Capital, and greater than 10 factors a balanced index.

This isn’t a one-off. This Pariah Capital technique beat the worldwide index by seven clear factors in 2022 and 5 in 2021 (after we first began reporting on it yearly).

Put one other manner, over the previous three years Pariah Capital has generated a complete return of 32%. That’s greater than 4 instances the 7% complete return earned by the worldwide balanced portfolio, and 3 times the 11% earned by its U.S.-only equal.

(Though I’ll give credit score the place credit score is due—within the 2022 bear market their prime picks did outperform each Pariah and the indexes, eking out a 5% achieve.)

There is a methodology to this insanity. Every month BofA Securities, previously Merrill Lynch, polls the world’s prime cash managers: Pension fund managers, mutual-fund managers, endowment managers and so forth. It normally speaks to greater than 200 massive cash honchos around the globe, dealing with in combination round $600 billion in belongings.

And it stories on what they assume, and what they personal of their funds.

The downside for these folks is twofold. First, as a result of all of them go to the identical enterprise colleges, get the identical coaching and certification, and since all of them have monumental profession incentives to go alongside to get alongside, they usually assume and act alike. And, second, if they’re already closely invested in a specific asset, they—and all the opposite cash managers who assume like them—have already pushed up the worth, which can mirror their bullish outlook.

Or, to place it one other manner: The belongings that these fund managers love are already in a vendor’s market (with costs to match). Meanwhile the belongings that they hate are in a purchaser’s market (ditto).

Pariah Capital pays no consideration by any means—none—to what these guys say concerning the markets or the worldwide economic system or the long run. It seems solely at what they personal.

Last 12 months, amongst different issues, these guys have been underinvested in expertise shares (Technology Select Sector SPDR ETF

XLK

then rose a staggering 56% throughout 2023), telecom providers (Fidelity MSCI Communication Services ETF

FCOM

rose 45%) and client discretionary shares (Consumer Discretionary Select Sector SPDR ETF

XLY

rose 40%). Among international markets, their least favourite was the usA., which then outperformed, the Vanguard Total Stock Market ETF

VTI

rising 26%.

Meanwhile amongst their favourite belongings the one one which carried out nicely was their guess on Europe—the SPDR euro Stoxx 50 ETF

FEZ

rose 27%.

So, what does the long run maintain for 2024?

Remember, first off, that it is a tongue-in-cheek train. Follow it at your individual threat. Also, after three straight years of success Pariah Capital should absolutely be due a 12 months of underperformance. Caveat emptor: Buyer beware.

Nevertheless, the primary BofA Securities’ Global Fund Manager survey of 2024 has simply dropped. It lists the big-money crowd’s prime picks and pans for the 12 months.

As ever, essentially the most fascinating half is what they’re shunning: What they don’t personal. The survey lists eight belongings the place the fund managers are, in complete, considerably “underweight in absolute terms.” By far the largest underweight is in U.Ok. equities. The others are utility shares, banks, insurance coverage shares, eurozone shares, power shares, actual property, and client discretionary shares.

This raises plenty of points.

First, it’s all equities—no money, no bonds. Yikes. That raises the dangers. Even for those who resolve to take of venture on this portfolio, modify in your personal temperament and circumstances. One main caveat is that whereas these fund managers are underweight these specific markets and sectors, they’re obese shares normally—which is motive sufficient to be nervous. Someone working one of these portfolio on the hedge-fund stage may mix it with a put choice on the worldwide inventory market. The remainder of us may simply mix it with money.

Second, a few of these investments want some finesse. For instance, to guess on the principle London inventory market index you’ll be able to put money into the low-cost Franklin Templeton FTSE United Kingdom ETF

FLGB.

It expenses simply 0.08% in charges and invests within the prime 100 or so shares. But the London inventory market is de facto bizarre. It is dominated by a small variety of large multinationals, like power behemoths Shell

SHEL,

and BP

BP,

medicine giants AstraZeneca

AZN,

and Glaxo

GSK,

and financial institution HSBC

HSBC,

And in order that’s principally what you get: The 10 largest firms make up almost half the portfolio. Problem is, that’s probably not a guess on the U.Ok. economic system or on shares which might be “British” in something however title. Rio Tinto is headquartered in London but it surely’s a world mining firm. And so on. So there’s a case for splitting a U.Ok. guess into two funds: Half in FLGB and half in iShares MSCI United Kingdom Small-Cap ETF

EWUS,

which is extra broadly unfold throughout about 250 midsize and smaller firms. The latter, alas, expenses 0.59% in charges.

Third, whereas fund managers are underweight each banks and insurance coverage, the ETF house for each is hard due to the sectors’ complexity. Some “insurance” ETFs don’t embrace Warren Buffett’s Berkshire Hathaway

BRK.B,

for instance. Some “bank” ETFs solely embrace regional banks, and exclude the giants on Wall Street. Many ETFs on this space cost hefty charges. There isn’t any excellent resolution. Fidelity MSCI Financials Index

FNCL

expenses simply 0.8%. It is 16% insurance coverage firms (principally Berkshire) and 84% every thing else.

But, with all these caveats, right here is Pariah Capital’s portfolio for 2024.

It consists of 12.5% or one-eighth every in Vanguard Utilities

VPU,

SPDR S&P Insurance ETF

KIE,

SPDR euro Stoxx 50 ETF

FEZ,

Energy Select Sector SPDR Fund

XLE,

Invesco KBW Bank ETF

KBWB,

Vanguard Real Estate

VNQ

) and Consumer Discretionary Select Sector SPDR Fund

XLY,

plus both 12.5% in FLGB or (my most popular choice right here) 6.25% every in FLGB and EWUS.

Meanwhile, the most recent survey reveals that cash managers are principally closely invested within the following eight belongings: The shares of healthcare, expertise, industrial and client staples firms, the U.S., Japanese and Emerging Markets indexes, and money. So a portfolio that adopted them—which, with a hat tip to Will Smith in “Men In Black,” we are able to name “The Best of The Best of the Best (With Honors!)” Portfolio—would maintain equal 12.5% quantities in healthcare Select Sector SPDR Fund

XLV,

Vanguard Information Technology ETF

VGT,

Industrial Select Sector SPDR Fund

XLI,

Consumer Staples Select Sector SPDR Fund

XLP,

Vanguard Total U.S. Stock Market

VTI,

Franklin FTSE Japan ETF

FLJP,

Vanguard FTSE Emerging Markets ETF

VWO,

and Goldman Sachs Access Treasury 0-1 Year ETF

GBIL.

Incidentally, for this train, for all of the sector ETFs I’ve intentionally chosen those that solely give attention to the U.S. market. Readers are inclined to closely desire specializing in the U.S., and in these instances the charges are decrease. But a purist would guess as a substitute on sector ETFs that invested globally: For instance iShares Global Energy

IXC

as a substitute of XLE. But that’s one other story.

Let the document present that the rising markets indexes are actually largely a guess on whether or not China goes to invade Taiwan: The two international locations’ equities make up 50% of the index. Russia used to dominate Eastern European index funds, with disastrous ends in 2022. If I needed to guess on rising markets broadly and keep away from this concern, I’d have a look at options. This, too, is one other story.

How will Pariah fare in 2024? Stay tuned. As I mentioned earlier, Pariah should be due a foul 12 months. Even I, cynic although I’m, can’t think about that betting in opposition to the big-money crowd goes to beat the pants off the indexes yearly. It can’t be that straightforward, absolutely?

Source web site: www.marketwatch.com