The Nasdaq-100 crashed under its 50-day transferring common for the primary time since March this week, placing it on tempo for its worst stretch of losses since December.

What’s extra, the tech-heavy index is on observe to cap off a two-week pullback of 4%, as of Thursday’s shut. If these losses maintain, it might mark the worst such stretch since Dec. 23, when the index fell 5% over two weeks, in response to Dow Jones Market Data.

On Wednesday, the favored Nasdaq-100-tracking Invesco QQQ Trust Series 1

QQQ

trade traded-fund, closed under its 50-day transferring common for the primary time since March 10, FactSet information confirmed. It managed to recoup a few of these losses on Thursday, rising 0.2% to $368.59, however remained under the transferring common for a second day.

Given that probably the most invaluable tech shares are accountable for such a big proportion of the index’s worth, their efficiency since mid-July is prompting analysts to fret that this late-summer pullback would possibly morph into a much bigger, and probably broader, selloff.

Among the so-called “Magnificent Seven” shares credited with being the largest contributors to this 12 months’s rally, Apple Inc.

AAPL,

Nvidia Corp.

NVDA,

Microsoft Corp.

MSFT,

and Tesla Inc.

TSLA,

all closed under their 50-day averages this week.

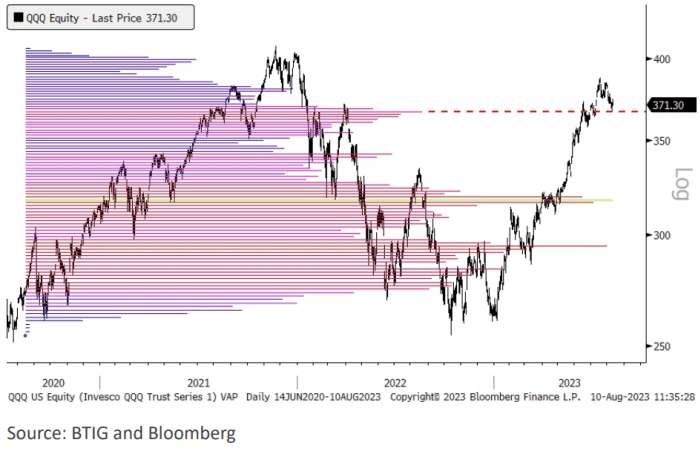

Analysts stated different discouraging indicators lurk below the hood. In a analysis observe shared with shoppers and the media on Thursday, Jonathan Krinsky, the highest technical analyst at BTIG, stated that QQQ and a number of other different widespread tech-heavy ETFs are nearing a “volume pocket” that would see them transfer even decrease, in a rush.

An evaluation of volume-at-price information over the previous three years reveals a sustained break under $368 for QQQ would go away it weak to a extra fast selloff primarily based on historic volume-at-price, a software utilized by inventory analysts to parse the place ranges of help and resistance would possibly emerge for a given safety.

Volume-at-price measures buying and selling quantity for a given safety at a spread of value factors over a given interval. Krinsky appeared again on the final three years in his evaluation.

“Support and resistance is based on prior price memory,” Krinsky stated throughout a cellphone interview with MarketWatch. “Within that range, there is not as much price memory from participants. That is when you can get the faster price moves,” he added.

BTIG

He famous that QQQ rallied by roughly 16% over six weeks from late April to mid-June, elevating the chance {that a} reversal may occur simply as swiftly, if not quicker. QQQ is up 38.4% 12 months thus far as of Thursday’s shut, in response to FactSet information.

Technology shares have fallen in latest weeks after their newest quarterly earnings didn’t impress the market.

Rising Treasury yields have helped to heap extra strain on shares, particularly the highflying expertise names which might be significantly delicate to rates of interest.

The huge query now could be whether or not an extra unraveling of Big Tech’s advance will take the broader market down with it, or whether or not different corners of the market will assist to select up the slack. Together, the largest tech shares are accountable for roughly 40% of the valuation of the Nasdaq-100 following final month’s particular rebalancing.

See: Here are 4 of the largest modifications to the Nasdaq 100 from Monday’s particular rebalancing

James St. Aubin, chief funding officer at Sierra Investment Management, stated it seems to be like merchants have been content material to rotate into different areas of the market that aren’t fairly as richly valued because the Big Tech names.

The leaders are fading, however the laggards are arising proper behind them,” St. Aubin stated throughout a cellphone interview with MarketWatch. “If money was flowing out across the board and going into cash and bonds, that would be a bit more concerning.”

U.S. shares eked out a acquire on Thursday after blowing most of their early features. The market initially rallied after the discharge of July inflation information that largely matched economists’ expectations. But San Francisco Fed President Mary Daly stated later that the Fed nonetheless has extra work to do to tame inflation, sending Treasury yields larger and upsetting a swift turnaround for equities.

The S&P 500

SPX

completed barely in optimistic territory at 4,468, whereas the Nasdaq Composite

COMP

gained 15.97 factors, or 0.1%, to 13,737.99 and the Dow Jones Industrial Average

DJIA

rose 52.79 factors, or 0.2%, to 35,176.15, FactSet information present. The blue-chip gauge had risen greater than 450 factors at its highs of the session. The 10-year Treasury yield

BX:TMUBMUSD10Y

jumped to 4.081%, its second highest degree of the 12 months, in response to Dow Jones Market Data.

Source web site: www.marketwatch.com