How bullish is that the S&P 500

SPX,

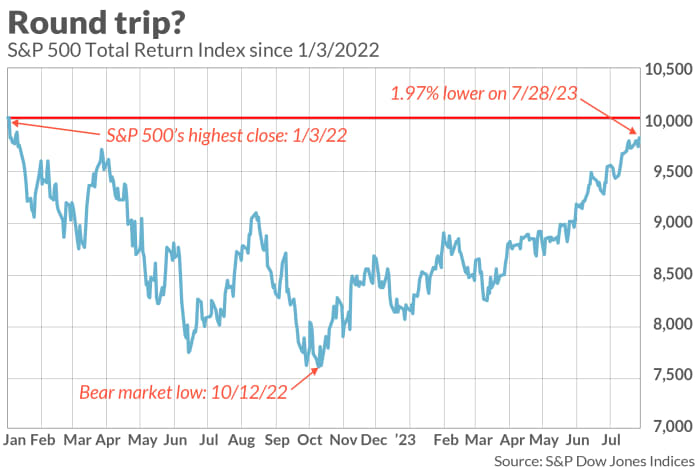

is near fully recovering from its 2022 bear market losses? The benchmark U.S. inventory index with dividends reinvested (whole return) is simply 2.0% beneath its January 2022 all-time excessive. Even a modestly good week within the inventory market might push this benchmark excessive.

If this does occur quickly, the restoration from the 2022 bear market could be one of many quickest in historical past. It’s been lower than 10 months for the reason that S&P 500’s bear market low final Oct. 12.

Unfortunately for the bulls, the market’s future can’t be judged on the pace of this restoration. Quick recoveries don’t essentially presage higher subsequent inventory market efficiency than longer recoveries.

To attain this conclusion, I analyzed all bear markets since 1900 within the calendar maintained by Ned Davis Research. In every case, I calculated how lengthy it took for the U.S. inventory market to rise above the extent at which it stood when that bear market started. I then measured the correlations between that restoration time and the inventory market’s efficiency over the one-, two- and three years subsequent to that restoration.

None glad conventional requirements of statistical significance. Sometimes, as was the case after the February-March 2020 bear market, a fast restoration time (simply 5 months in that case) was adopted by robust subsequent market efficiency. But the market additionally carried out extraordinarily properly subsequent to the four-year restoration from the 2007-2009 Global Financial Crisis.

This result’s what we must always anticipate, given the inventory market’s effectivity. One of the hallmarks of that effectivity is that the market is forward-looking. How it should carry out in coming months is a operate of whether or not the news will probably be higher or worse than presently anticipated — not how the inventory market carried out before now.

Imagine for a second if a fast restoration time did enhance the percentages of robust subsequent efficiency. In that case, merchants would rush in to purchase shares, and by doing that will bid up costs till the market’s anticipated future return is not any higher than common.

The backside line? We can all have a good time the inventory market’s latest energy. But celebration is just not an funding technique. Our job as traders will return to what it at all times is: analyzing whether or not the news is coming in higher or worse than anticipated.

Mark Hulbert is a daily contributor to MarketWatch. His Hulbert Ratings tracks funding newsletters that pay a flat payment to be audited. He will be reached at mark@hulbertratings.com

Source web site: www.marketwatch.com