The U.S. inventory market, as measured by the S&P 500 index

SPX,

continues in its blissfully robust bullish development. Once once more, the S&P 500, the NASDAQ-100 Index

QQQ

and the Dow Jones Industrial Average

DJIA

are all hitting report highs, although many shares are lagging behind. The Russell 2000

IWM,

for instance, is much beneath its all-time highs. But for those who personal the S&P 500 or index-tied choices, then the chart is bullish, and a core bullish place remains to be warranted. Some warning indicators are starting to seem (worsening market breadth, for instance), however they haven’t generated confirmed promote indicators but, for essentially the most half.

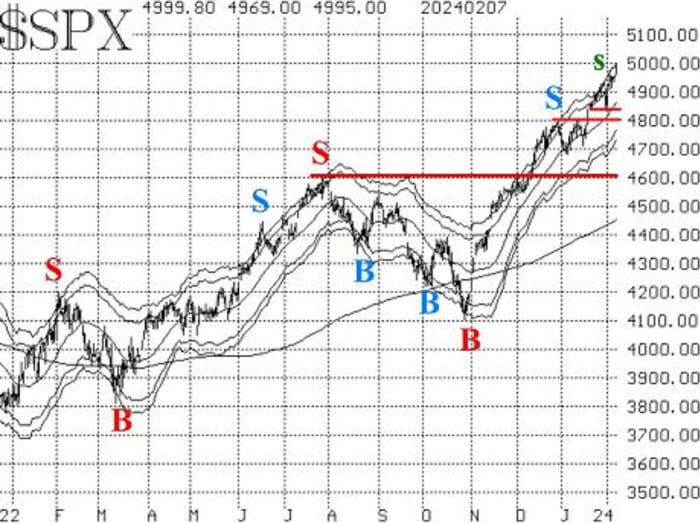

The S&P 500 chart has help at 4,850 (final week’s lows) and stronger help at 4,800. There is main help at 4,600, though a pullback to that stage can be some trigger for concern, merely as a result of it’s greater than 300 factors decrease than present ranges.

There is not any conventional resistance, for the reason that S&P 500 is buying and selling at all-time highs. In reality, the index nearly touched its +4σ “modified Bollinger Band” once more yesterday. A detailed above that band would cease out the “classic” mBB promote sign (small inexperienced “s” on the accompanying SPX chart). We don’t commerce these “classic” indicators, preferring to attend for a extra full setup of the McMillan Volatility Band promote sign, which has not occurred. If the S&P 500 closes above that +4σ Band, that might reset the entire course of and the era of a brand new promote sign must start once more.

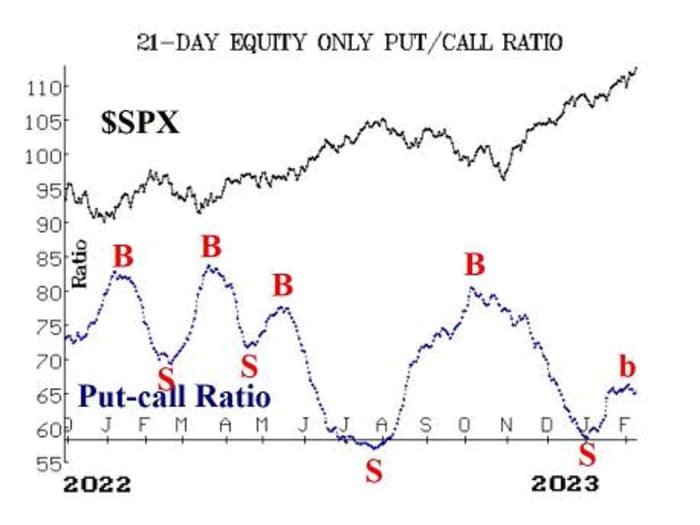

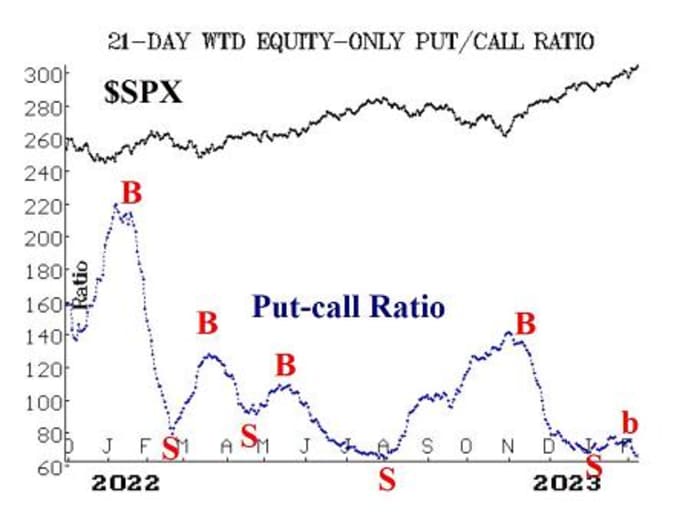

Equity-only put-call ratios have usually moved sideways over the previous few weeks and now have turned downward once more. They are very close to the decrease edges of their charts — i.e., in overbought territory. That is just not the perfect place for a purchase sign to happen, however so long as they’re trending decrease, that’s usually a bullish signal for shares. The newest downturn is marked with a small “b” on the accompanying charts, merely as a result of it’s coming from such a low stage on the chart. These ratios will solely be bearish if they start to development greater, and that has simply not been the case.

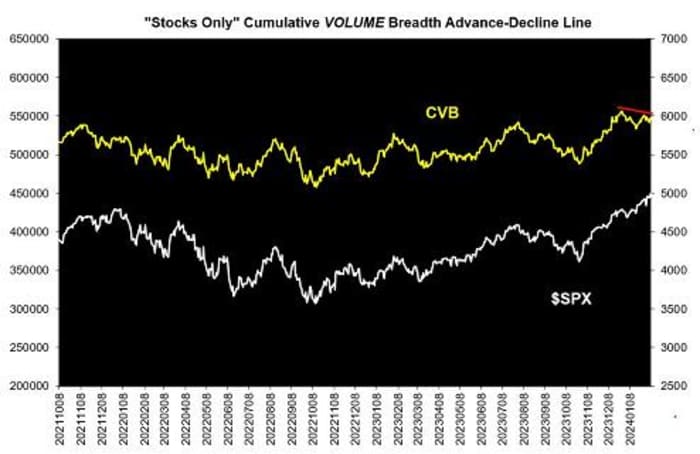

Market breadth has been poor, and the breadth oscillators are on promote indicators. This has been the case even with the S&P 500 at new all-time highs. A associated indicator, Cumulative Volume Breadth, can also be displaying a unfavorable divergence.

New highs on the New York Stock Exchange have continued to outnumber new lows, apart from in the future, so this indicator stays constructive. This purchase sign can be stopped out if, on the NYSE, new lows exceeded new highs for 2 consecutive days.

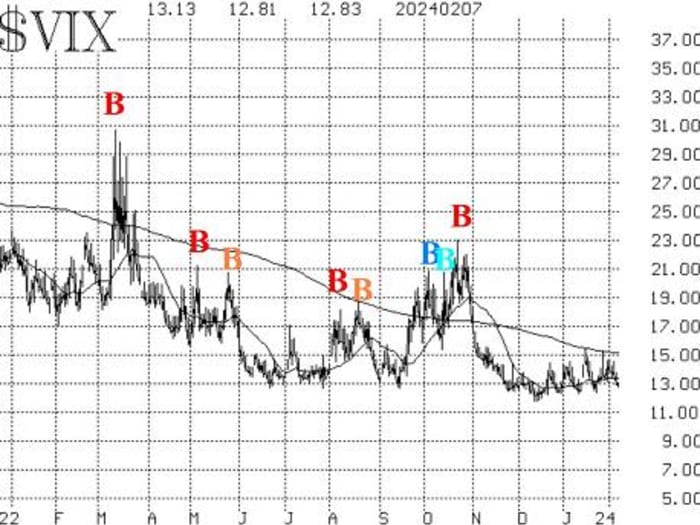

Volatility

VIX

has remained at low ranges, and so long as that’s the case, it doesn’t current an issue for the inventory market. The development of VIX purchase sign stays in place. The 200-day transferring common of VIX is at 15.20, and a detailed above there can be the primary signal of bother. So far, that hasn’t occurred.

The assemble of volatility derivatives continues to color a bullish image for the inventory market as properly. The time period constructions of the VIX futures and of the CBOE Volatility Indices

VX00,

proceed to slope upward, and that’s bullish for shares.

We proceed to take care of a core bullish place, and we are going to commerce different confirmed indicators round that core. Moreover, we’re rolling calls as much as greater strikes once they change into pretty deeply in-the-money.

Market perception: Important divergence

There is a creating divergence between cumulative quantity breadth and the S&P 500. That is, the index is making new all-time highs, however CVB is just not. CVB is merely the working day by day complete of “advancing volume minus declining volume.” There are two makes use of for CVB: one is when CVB makes a brand new all-time excessive earlier than the S&P 500 does. Then the index usually follows. We traded this constructive sign final fall.

However, there’s a unfavorable sign as properly. When the S&P 500 is making new all-time highs and CVB is lagging behind, that may be a warning signal for the inventory market. However, this unfavorable divergence can final for a very long time — it’s not a direct promote sign. There is a unfavorable divergence on the present time, because the accompanying chart exhibits.

On the right-hand facet, we will see that CVB final made a brand new all-time excessive in late December, and it has since fallen again whereas the S&P 500 has gone on to a collection of latest all-time highs.

The approach we often interpret that is: Do not ignore any promote indicators whereas this divergence is in place. For instance, available in the market commentary above, we famous that there’s now a breadth oscillator promote sign. Ordinarily we might be considerably cautious of the breadth oscillator indicators as a result of they’ve skilled a variety of whipsaws previously. However, given the very fact that there’s a unfavorable divergence with CVB, we’re going to act on that breadth oscillator promote sign.

Buy 1 SPY Mar (1st) at-the-money put: We will cease out of this commerce if the breadth oscillators achieve energy and transfer again to an overbought situation.

New suggestion: Potential MVB promote sign: This suggestion is repeated from final week. It seems extremely unlikely that it will likely be confirmed, however we are going to preserve it open, simply in case. A “classic” modified Bollinger Band promote sign has occurred. We don’t commerce these, however we are going to commerce a McMillan Volatility Band promote sign if that’s confirmed. Specifically, that might be confirmed if the S&P 500 had been to commerce at 4,824 or decrease. That value is mounted, so it stays there within the following days in addition to at the moment.

IF SPX trades at 4,824 or decrease, then purchase 1 SPY

SPY

March 15 at-the-money put and Sell 1 SPY March 15 put with a putting value 25 factors decrease.

If this commerce is established, it could have a goal of the decrease -4σ Band, and it could be stopped out if the S&P 500 had been to shut above the +4σ Band.

New suggestion: Potential VIX promote sign

This can also be a repeat suggestion from final week. If VIX closes above its 200-day transferring common, that might be a unfavorable sign that might possible be accompanied by different indicators as properly.

IF VIX closes above 15.30, then purchase 1 SPY March 15 at-the-money put and promote 1 SPY March 15 put with a putting value 25 factors decrease.

If this commerce is established, we are going to set a cease for it subsequent week.

Follow-up motion

All stops are psychological closing stops until in any other case famous.

We are utilizing a normal rolling process for our SPY spreads: In any vertical bull or bear unfold, if the underlying hits the brief strike, then roll the complete unfold. That can be roll up within the case of a name bull unfold or roll down within the case of a bear put unfold. Stay in the identical expiration and preserve the space between the strikes the identical until in any other case instructed.

Long 4 XLP

XLP

Feb. 16 72 calls: Raise the cease to 72.60.

Long 1 SPY Feb. 16 493 name: This place was initially a protracted straddle. It was rolled up, and the places had been bought. The calls had been rolled up a number of extra instances, together with most lately on Feb. 2, when SPY traded at 493. This is, in essence, our core bullish place. Roll the calls up each time they change into a minimum of eight factors in-the-money.

Long 0 UNM March 15 45 calls: These calls had been stopped out on Feb. 1, when Unum

UNM,

closed beneath 47.80.

Long 1 SPY Feb. 16 492 name: This was initially a protracted straddle. The name was rolled up, most lately on Feb. 2, and the put was bought. Roll up each time the decision is eight factors in-the-money. Meanwhile, increase the closing cease to 486.

Long 3 TLT

TLT

May 19 95 places: We will maintain so long as the put-call ratio promote sign is in place for T-Bonds.

Long 1 SPY Feb. 16 494 name: This name was purchased consistent with the brand new highs vs. new lows purchase sign. Stop out if NYSE new lows exceed new highs for 2 consecutive days. The name was rolled up on Feb. 2. Roll up each time the decision is eight factors in-the-money.

Send inquiries to: lmcmillan@optionstrategist.com.

Lawrence G. McMillan is president of McMillan Analysis, a registered funding and commodity buying and selling adviser. McMillan could maintain positions in securities really useful on this report, each personally and in shopper accounts. He is an skilled dealer and cash supervisor and is the creator of the best-selling e book “Options as a Strategic Investment.” www.optionstrategist.com

©McMillan Analysis Corporation is registered with the SEC as an funding adviser and with the CFTC as a commodity buying and selling adviser. The info on this e-newsletter has been fastidiously compiled from sources believed to be dependable, however accuracy and completeness are usually not assured. The officers or administrators of McMillan Analysis Corporation, or accounts managed by such individuals, could have positions within the securities really useful within the advisory.

Source web site: www.marketwatch.com