So far this 12 months, the healthcare sector of the S&P 500 has carried out effectively, after being left behind final 12 months. Here’s how the 11 sectors of the S&P 500 have been performing, with dividends reinvested:

Any dialogue of “recent” returns actually must look again to the top of 2021, due to the seesaw sample of an 18% decline for the S&P 500

SPX

in 2022 and a 26% return in 2023.

On Wednesday, Joseph Andinolfi shared feedback from Jonathan Krinsky, the chief market technician at BTIG, who known as the healthcare sector his “highest conviction idea.”

When that article was revealed, the healthcare sector was one of the best performer of 2024 among the many sectors of the S&P 500. That modified Thursday when shares of Humana Inc.

HUM,

fell 8% after reporting disappointing outcomes from its Medicare Advantage enterprise, holding the sector again because the S&P 500 rose 1% for the day.

So a lot for in the future’s motion within the inventory market.

What may again Krinsky’s thought concerning the alternative within the healthcare sector is that it’s anticipated to point out the second-highest compound annual development price from 2023 by 2025, based mostly on weighted consensus estimates amongst analysts polled by FactSet:

| Sector or index | Two-year estimated EPS CAGR by 2025 | Two-year estimated gross sales CAGR by 2025 |

| Information Technology | 16.6% | 9.3% |

| Healthcare | 15.1% | 6.2% |

| Consumer Discretionary | 14.9% | 7.2% |

| Communication Services | 14.9% | 5.8% |

| Industrials | 12.8% | 5.3% |

| Financials | 10.8% | 5.7% |

| Materials | 8.2% | 2.2% |

| Utilities | 7.8% | 3.3% |

| Consumer Staples | 7.1% | 3.3% |

| Real Estate | 5.2% | 5.9% |

| Energy | 3.0% | -0.4% |

| S&P 500 | 12.4% | 5.3% |

| Source: FactSet | ||

The healthcare sector is predicted to point out the third-highest gross sales CAGR by 2025 among the many S&P 500 sectors. One easy technique to unfold your threat and put money into the whole sector is the healthcare Select Sector SPDR exchange-traded fund

XLV,

which holds all 64 shares within the sector, weighted by market capitalization.

Commodities-market news

New ETFs make it straightforward to wager on the worth of bitcoin. This might have an effect on gold’s standing as a automobile for hedging.

Getty Images

Myra P. Saefong explains how U.S. oil producers are reaching report output at the same time as the full variety of home rigs declines.

She additionally explains how the appearance of bitcoin

BTCUSD,

ETFs threatens the marketplace for gold

GC00,

More on commodities: ‘The squeeze is on.’ Uranium costs hit report and trade watchers see additional to go

Time is working out

Interest charges will transfer decrease, which implies savers who need the best charges ought to contemplate committing to longer-term CDs.

Getty Images

If you might be happy to be incomes greater than 4% in a financial savings account proper now, don’t get too snug: Those charges will plunge when the Federal Reserve reverses course and begins to decrease the goal vary for the federal-funds price, which is at present at 5.25% to five.50%, as a part of the central financial institution’s efforts to struggle inflation.

With inflation coming down, the Fed might start a coverage swap later this 12 months. And meaning savers had higher take into consideration locking in excessive CD charges. Beth Pinsker appears to be like at how savers can lock in one of the best rates of interest and overcome a typical reluctance to make a dedication.

More from Beth Pinsker: Your employer is now allowed to match your emergency financial savings

A beautiful pattern for long-term buyers

Jeremy Owens has good news: He has rolled out the primary episode of On Watch, a podcast from MarketWatch. He additionally wrote a companion piece that underlines a long-term pattern of working enchancment for U.S. corporations that’s anticipated to proceed.

Will synthetic intelligence make it tougher so that you can transfer on along with your profession?

Getty Images

For years, job candidates have tried to incorporate the appropriate key phrases of their résumés to assist them go by employers’ easy automated screens. But now synthetic intelligence is being put to higher use within the hiring course of. Weston Blasi describes the brand new position of AI in hiring, whereas busting frequent myths concerning the course of.

More on careers:

More on AI:

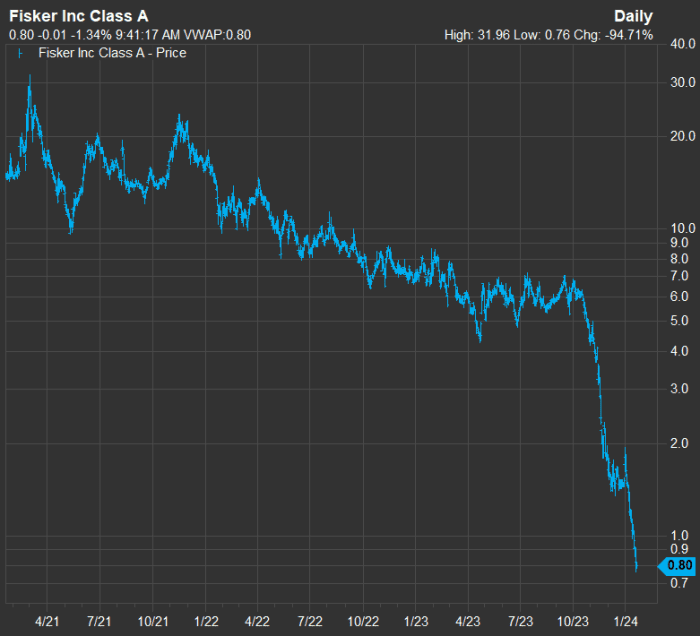

Fisker shorts had higher cowl

Fisker’s inventory has tanked, and brief sellers are being warned that it’s time to shut out their positions.

Fisker Inc.

When an investor or dealer shorts a inventory, it means they borrow the shares, promote them instantly and hope the worth drops to allow them to purchase them again, return them to the lender and pocket the distinction.

If the share value falls because the dealer expects, the dealer must resolve when to “cover” the place, which implies to purchase again the shares. If the inventory value rises, the dealer is a paper loss, and if the worth rises above a sure stage, the dealer’s dealer would require collateral to be delivered to guard the dealer from a loss. A brief squeeze is when a big group of buyers races to cowl brief positions all of sudden, inflicting the share value to rise rapidly.

According to the latest obtainable knowledge from FactSet, greater than 47% of Fisker Inc.’s

FSR,

shares have been shorted. This signifies that if you wish to place a brand new brief wager in opposition to this inventory, you might have some issue doing so. You must pay the lender for the privilege of borrowing the shares.

Now take a look at this three-year chart for Fisker’s share value:

The time is ripe for Fisker shorts to cowl.

That is kind of a fall to a value beneath a greenback from a peak of slightly below $32 in March 2021.

Early Friday, shares of Fisker bounced a bit after CFRA analyst Garrett Nelson warned merchants with brief positions that it was time to cowl.

Other firm news

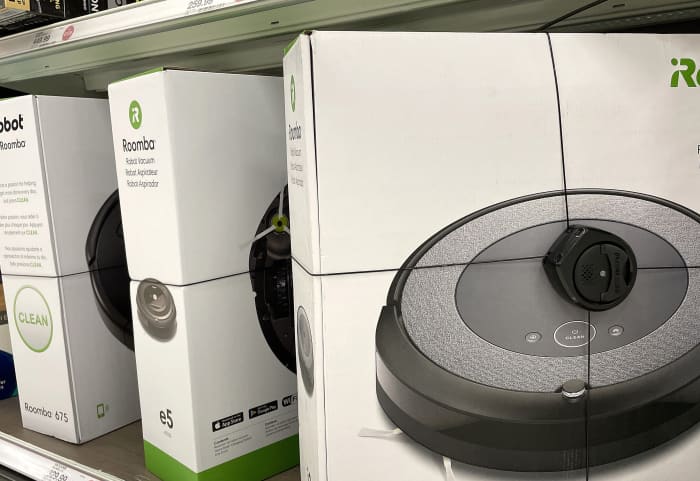

Regulators seem to imagine it will be dangerous to shoppers for Amazon to have a nook available on the market for vacuuming robots.

Getty Images

Shares of iRobot Corp.

IRBT,

sank 40% early Friday after the Wall Street Journal reported that European regulators had been more likely to block the corporate’s deal to be acquired by Amazon.com Inc.

AMZN,

On Thursday, the iShares Semiconductor ETF

SOXX

rose greater than 3%, pushed by stronger-than-expected gross sales steerage from Taiwan Semiconductor Manufacturing Co.

TSM,

whose American depositary receipts rose 10% that day.

Apple Inc.

AAPL,

made an uncommon transfer this week, with low cost pricing for iPhones in China.

After a federal choose blocked JetBlue Corp.’s

JBLU,

deliberate acquisition of Spirit Airlines Inc.

SAVE,

on Tuesday, Spirit’s shares fell 47% to shut at $7.92. Then it fell one other 22% on Wednesday to shut at $6.14, and one other 7% on Thursday to shut at $5.70.

J.P. Morgan analyst Jamie Baker wrote on Tuesday that the choose’s choice was truly a great final result for JetBlue.

Spirit might have issue discovering different suitors until it restructures its debt or comes up with a viable plan to enhance its operations.

Then once more, Spirit’s shares reversed path Friday morning, with a 24% achieve to $7.08, after the airline offered buyers with an replace on its monetary place.

Consider shopping for a smaller home

Aarthi Swaminathan writes the Big Move column. This week she helps a reader who is considering shopping for a home Florida. There are many elements to think about, particularly insurance coverage.

More from Aarthi Swaminathan: These Americans are struggling to pay their payments on time: ‘Financial stress appears to have risen,’ New York Fed says

A dose of sense for buyers and merchants

Mark Hulbert analyzes market knowledge to assist buyers take a logical method to monetary selections. Here are three of his most up-to-date articles:

The Moneyist navigates tough monetary waters

MarketWatch illustration

Quentin Fottrell — the Moneyist — tackles troublesome cash issues which are typically associated to disagreements inside households. Here are a few of his current responses to readers’ questions:

Good shares at good costs

Getty Images/iStockphoto

Mark Phillips, an fairness strategist at Ned Davis Research, revealed an inventory of 31 “wonderful European companies at a fair price” on Tuesday, based mostly on historic knowledge and present share costs. Here’s an extra pruning of his record to 10 corporations, based mostly on estimates by 2025.

Michael Brush: An enormous buying and selling alternative might be coming if the Biden administration reforms marijuana legal guidelines

Want extra from MarketWatch? Sign up for this and different newsletters to get the newest news and recommendation on private finance and investing.

Source web site: www.marketwatch.com