Stock traders are exhibiting some hesitancy for Tuesday, with massive alerts on the economic system coming this week through client costs and retail gross sales. Ahead of that, Apple is predicted to tempt customers with one more new iPhone on Tuesday.

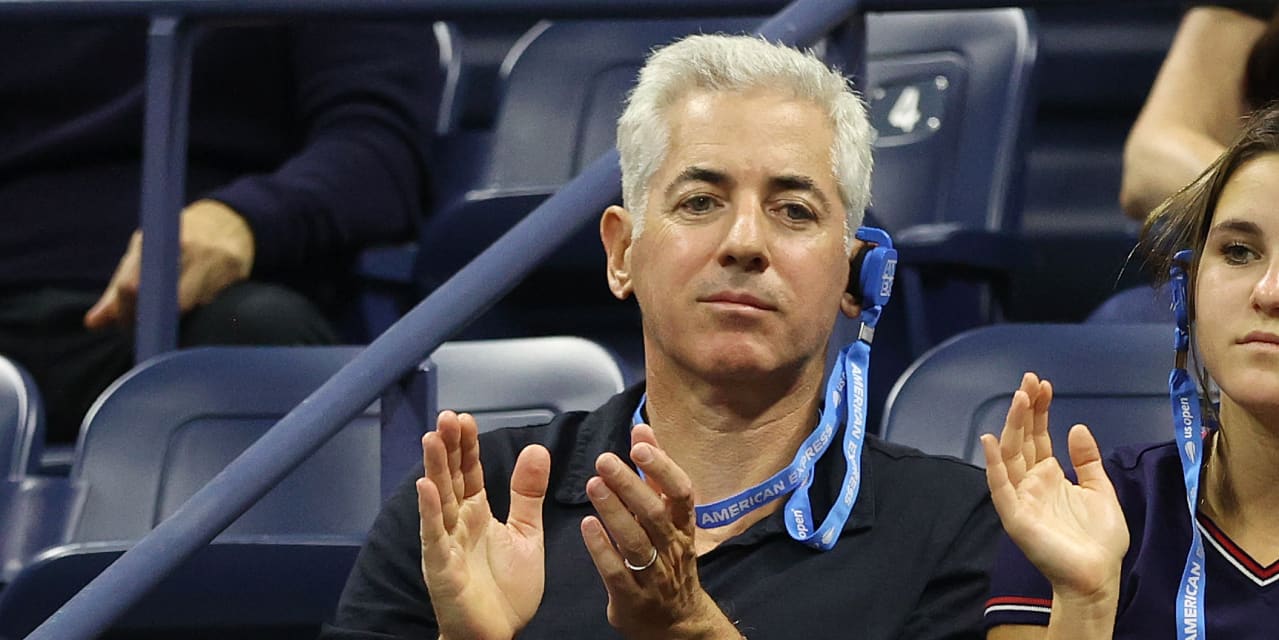

How a lot ought to traders be worrying proper now? Our name of the day from Pershing Square Capital Management supervisor Bill Ackman says that within the close to time period, we are able to loosen up somewhat, but it surely isn’t all roses.

He instructed the Julia La Roche Show in an interview the place he felt like he had a “crystal ball of what was going to happen,” beginning in January 2020 with the COVID-19 outbreak, and that carried on by rates of interest and the economic system. Indeed, the supervisor reportedly made practically $4 billion on a few pandemic-related bets.

“I would say the crystal ball has clouded a bit in the last period. I think these are unusual economic times and perhaps we always say that, but I don’t think this is a pattern that has been repeated…or it hasn’t been for more than 100 years,” he stated.

But he stays near-term upbeat. “For two years, people have been saying that recession’s around the corner and you know we’ve had a very different view, and continue to have this view that I think people are coming around to, that the economy is actually still quite strong,” he stated.

And whereas these on lower-income rungs have burned by a variety of COVID financial savings, he thinks the economic system has but to essentially see influence from the large fiscal stimulus seen lately.

Looking down the street although, Ackman has bought a stack of issues over the economic system. He sees a few third of federal debt on account of get repriced that means that over a comparatively quick time period, “interest expense will become a much bigger part of the deficit that is not going to be a contributor to the economy.”

And whereas greater rates of interest do assist savers, in the end that can be an enormous drag on the economic system, he stated, including that rising inflation, mortgage charges, automobile funds and bank card charges, are all set to gradual the economic system.

“We’re still in the midst of a war and there’s political uncertainty you know with an upcoming election,” he stated. That partly explains Pershing Square’s hedge through a brief place on the 30-year Treasury bond

BX:TMUBMUSD30Y

that he specified by a tweet in early August.

For roughly a 12 months, long-term Treasury yields have been buying and selling beneath short-dated ones, which is named an inverted yield curve, a phenomenon that’s usually seen as a precursor to recession.

“I don’t see inflation getting back to 2% so quickly, if at all, and if in fact we’re in a world of persistent 3% inflation, you know it doesn’t make sense to have a 4.3%, 4.25% Treasury yield,” he stated.

Other dangers? Ackman stays frightened about regional banks following the spring disaster, as many have massive fixed-rate portfolios of property which have gotten much less and fewer useful as charges rise. “I would say the commercial real estate picture has not gotten better, if anything, you know, you’re going to start seeing real defaults, particularly with office assets,” he stated.

“Regional banks have the most exposure to construction loans so they are going to be a lot of construction loans that won’t be able to repaid. There will be a lot of restructurings, so either the investors groups are gonna have to put in a lot more equity or the banks are going to start taking some losses,” he stated.

Ackman says traders additionally face a presidential marketing campaign that would add some stress. The hedge-fund supervisor stated he’s stunned there haven’t been “more and better alternative candidates” for the 2024 marketing campaign over President Joe Biden and former President Donald Trump.

He’d wish to see JPMorgan Chase & Co. CEO Jamie Dimon toss his hat within the ring and believes Biden is “beatable,” by a robust candidate.

Ackman himself stated it’s “possible,” he himself might run sometime, however he’s extra centered on having a greater funding monitor file over Berkshire Hathaway Chairman and CEO Warren Buffett — and desires some 30 years to match the Oracle of Omaha.

Read: Here’s a straightforward option to make a extra concentrated play on the ‘Magnificent Seven’ shares

The markets

Stock futures

ES00,

NQ00,

are tilting south, led by tech, with Treasury yields

BX:TMUBMUSD02Y

BX:TMUBMUSD10Y

regular to a contact decrease and the greenback

DXY

recovering some floor.

Read: Watch this ‘canary in the coal mine’ for indicators of hassle in markets, Neuberger Berman CIO says

For extra market updates plus actionable commerce concepts for shares, choices and crypto, subscribe to MarketDiem by Investor’s Business Daily.

The buzz

Oracle shares

ORCL,

are down 10% in premarket buying and selling after disappointing steerage from the cloud database group.

Apple’s

AAPL,

massive occasion kicks off at 1 p.m. Eastern, with the launch of the pricier iPhone 15 anticipated to be on the agenda.

Hot ticket. Arm Holdings’ IPO is already 10 instances oversubscribed and bankers will cease taking orders by Tuesday afternoon, Bloomberg studies, citing sources.

Tech’s wild week: How Apple, Google, AI, Arm’s mega IPO might set the agenda for years

Upbeat outcomes are boosting shares of convenience-store operator Casey’s General Stores

CASY,

Packaging large WestRock

WRK,

and rival Smurfit Kappa

SK3,

have introduced a inventory and money tie up. WestRock shares are up 8% in premarket.

Read: U.S. price range deficit will double this 12 months to $2 trillion, excluding scholar loans

Best of the net

No higher than playing? Amateur traders are piling into 24-options.

China might ban garments that damage individuals’s emotions.

U.S. takes on tech large Google in landmark case.

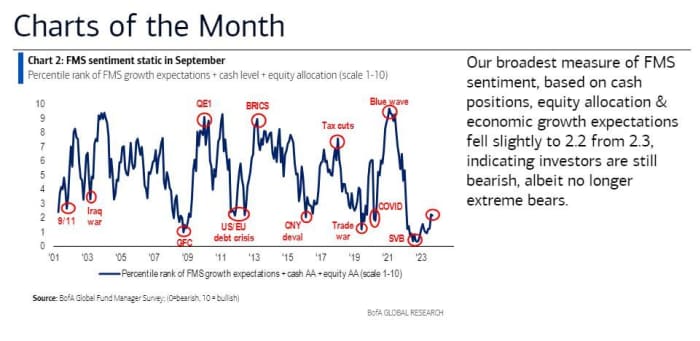

The chart

Bank of America’s international fund supervisor survey for September sees traders nonetheless bearish, however not on the intense aspect. Here’s the chart:

The tickers

These have been essentially the most energetic stock-market tickers on MarketWatch as of 6 a.m. Eastern:

| Ticker | Security identify |

|

TSLA, |

Tesla |

|

AMC, |

AMC Entertainment |

|

CGC, |

Canopy Growth |

|

NVDA, |

Nvidia |

|

GME, |

GameStop |

|

AAPL, |

Apple |

|

ACB, |

Aurora Cannabis |

|

NIO, |

Nio |

|

MULN, |

Mullen Automotive |

|

AMZN, |

Amazon |

Random reads

“Worst investment ever.” Brady Bunch fan buys authentic home for cut-price $3.2 million.

Millions of individuals “visit” this museum of 300 tanks yearly

Need to Know begins early and is up to date till the opening bell, however join right here to get it delivered as soon as to your e mail field. The emailed model can be despatched out at about 7:30 a.m. Eastern.

Listen to the Best New Ideas in Money podcast with MarketWatch monetary columnist James Rogers and economist Stephanie Kelton.

Source web site: www.marketwatch.com