Siegel argues that bonds, which have been giving shares the shove, have confirmed to be a horrible inflation hedge, however traders have forgotten that given it’s 40 years for the reason that final massive value shock. “Stocks are excellent long-term hedges, stocks do beautifully against inflation, bonds do not,” he advised CNBC on Tuesday.

Don’t miss: ‘Bond math’ reveals merchants daring sufficient to guess on Treasurys may reap dazzling returns with little danger

Other inventory cheerleaders on the market are relying on a fourth-quarter rally, which, based on LPL Financial, delivers on common a 4.2% achieve as portfolio managers snap up inventory winners to spiff up performances.

Our name of the day from Evercore ISI’s head of technical technique, Rich Ross, is within the bull camp as he declares the “high for equities is not in,” and suggests some shares that can set traders up properly for that.

Ross notes November is the most effective month for the S&P 500

SPX,

Russell 2000

RUT

and semiconductors

SOX,

whereas the November to January interval has seen a 6% achieve on common for the Nasdaq Composite

COMP.

He says if the S&P can get away above 4,430, the following cease will probably be 4,630 inside 2023, placing him on the bullish finish of Wall Street forecasts.

In addition, even with 10-year Treasury yields again at their highs, the S&P 500 remains to be forward this week and that’s a “great start” to any rally, he provides.

Evercore/Bloomberg

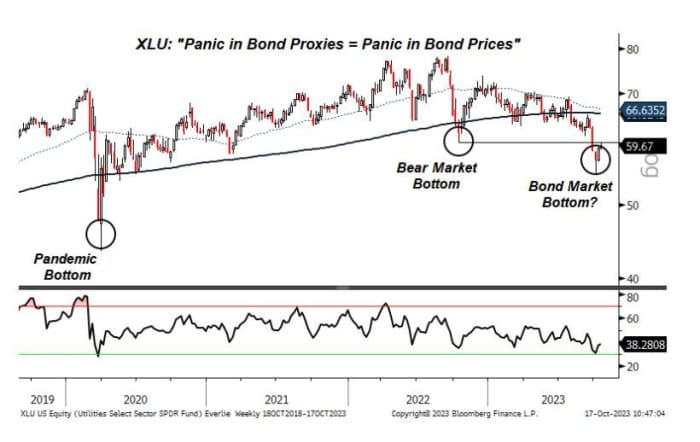

What else? He says “panic bottoms” seen in bond proxies, similar to utilities through the Utilities Select Sector SPD exchange-traded fund ETF

XLU,

real-estate funding trusts and staples, are “consistent with a bottom in bond prices,” which is nearer than it seems if these proxies have certainly bottomed.

Evercore/Bloomberg

Among the opposite inexperienced shoots, Ross sees banks bottoming following Bank of America

BAC,

earnings “just as they did in March of ’20 after a similar 52% decline which culminated in a year-end rally which commenced in Q4.”

He sees increasing breadth for shares — extra shares rising than falling — including that that’s a purchase sign for the Russell 2000, retail through the SPDR S&P Retail ETF

XRT

and regional banks through the SPDR S&P Regional Banking

KRE.

The technical strategist additionally says it’s time to purchase transports

DJT,

with airways “at bear market lows and deeply oversold,” whereas railroads are additionally bottoming and truckers proceed to rise.

As for tech, he’s a purchaser of semiconductors noting they have an inclination to realize 7% on common in November, and Nvidia

NVDA,

has been underneath strain as of late. He additionally likes software program similar to Microsoft

MSFT,

Zscaler

ZS,

MongoDB

MDB,

Intuit

INTU,

Oracle

ORCL,

Adobe

ADBE,

CrowdStrike

CRWD,

and Palo Alto Networks

PANW,

Evercore/Bloomberg

“The strong tech will stay strong and the weak will get strong,” says Ross.

The markets

Stock futures

ES00,

YM00,

are dropping, with bond yields

BX:TMUBMUSD10Y

BX:TMUBMUSD02Y

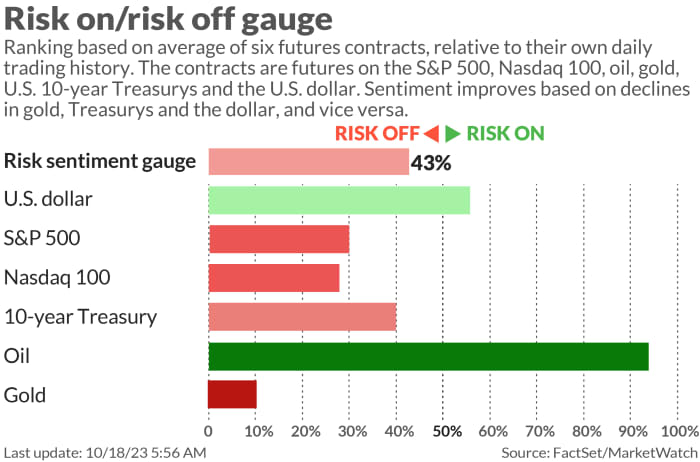

largely decrease. Oil costs

CL.1,

BRN00,

are rallying almost 3% after the lethal hospital explosion in Gaza City, with Iran reportedly calling for an oil embargo towards Israel. Gold

GC00,

has shot up $20.

For extra market updates plus actionable commerce concepts for shares, choices and crypto, subscribe to MarketDiem by Investor’s Business Daily.

The buzz

Morgan Stanley

MS,

State Street

STT,

U.S. Bancorp

USB,

Citizens Financial

CFG,

will all report this morning. Procter & Gamble

PG,

is up after an earnings beat. Tesla

TSLA,

(preview right here) and Netflix

NFLX,

(preview right here) will report after the shut.

Read: Ford CEO says Tesla, rival automakers loving the strike. He could also be flawed

United Airlines shares

UAL,

are down 5% after the airline lowered steering because of the Israel/Gaza conflict.

Housing begins are due at 8:30 a.m., with the Fed’s Beige Book of financial situations coming at 2 p.m. Also, Fed Gov. Chris Waller will converse at midday, adopted by New York Fed Pres. John Williams at 12:30 p.m. and Fed Gov. Lisa Cook at 6:55 p.m.

China’s third-quarter GDP rose 4.9%, slowing from 6.3% within the earlier quarter, however beating expectations.

Middle East tensions are ratcheting up with protests spreading throughout the area after a large lethal blast at a Gaza City hospital. President Biden advised Israeli Prime Minister Benjamin Netanyahu that “it appears as though it was done by the other team.”

Best of the net

Why the FDA must halt Cassava Sciences’ Alzheimer’s medical trials

Hail, warmth, rot in Italy push France to prime world winemaking spot

The tickers

These had been the top-searched tickers on MarketWatch as of 6 a.m.:

| Ticker | Security title |

|

TSLA, |

Tesla |

|

AMC, |

AMC Entertainment |

|

AAPL, |

Apple |

|

GME, |

GameStop |

|

NIO, |

Nio |

|

AMZN, |

Amazon |

|

PLTR, |

Palantir |

|

MULN, |

Mullen Automotive |

|

TPST, |

Tempest Therapeutics |

|

TTOO, |

T2 Biosystems |

Random reads

Loudest purr on the earth. Congrats Bella the cat.

Asteroid pattern provides window to historical photo voltaic system

Need to Know begins early and is up to date till the opening bell, however join right here to get it delivered as soon as to your e-mail field. The emailed model will probably be despatched out at about 7:30 a.m. Eastern.

Listen to the Best New Ideas in Money podcast with MarketWatch monetary columnist James Rogers and economist Stephanie Kelton.

Source web site: www.marketwatch.com