Wall Street’s pleasure over a attainable rebound within the IPO market tells us extra about analysts’ exuberance than what’s truly occurring.

That’s as a result of exercise within the IPO market up to now this 12 months is indistinguishable from the comparable interval of early 2022 and 2023, and people years have been the slowest for IPOs because the 2008 Global Financial Crisis. There have been simply 4 IPOs up to now this 12 months by January 23, in response to Renaissance Technologies, which is identical as what number of got here to market throughout the identical interval in January of a 12 months in the past.

Nor does the IPO pipeline look like materially extra crowded. Thirteen IPOs have filed their paperwork up to now this 12 months, in response to Renaissance Technologies, 13.3% beneath the quantity in the course of the comparable interval of a 12 months in the past.

The 12 months is simply starting, in fact, and it’s fully attainable that the IPO market will expertise a major rebound in coming months. But analysts are getting forward of themselves in declaring that the IPO market is experiencing a “revival” — which is the phrase I’ve seen a number of occasions in news tales concerning the IPO market.

Furthermore, since IPO quantity is closely depending on whether or not the foremost pattern of the inventory market is up, Wall Street’s pleasure a few sturdy IPO pattern actually boils right down to optimism that the bull market will proceed by 2024. This optimism might turn into well-founded, however market timing judgments are a dime a dozen and infrequently the event for particular celebration.

Apart from regular cyclical components impacting IPO quantity, there are a number of longer-term secular tendencies value noting, in response to Jay Ritter, a finance professor on the University of Florida and considered one of academia’s main specialists on the brand new subject market. He talked about three particularly:

1. Startups are ready longer to go public: This pattern began quite a lot of years in the past when startups started having little hassle accessing personal capital. Ritter says he doesn’t see this pattern reversing itself anytime quickly, because the quantity of enterprise capital funds raised elevated from $22-25 billion per 12 months within the 2011-2013 interval to $155-163 billion per 12 months in 2021-2022 interval, in response to the 2023 Pitchbook/NVCA annual yearbook. Furthermore, there may be at present a report degree of so-called “dry powder” amongst enterprise capital and personal fairness funds — unspent money that these funds are keen to speculate.

2. Going public just isn’t the one exit technique: It was once that the usual exit technique for a startup was to go public. But because the tech bubble bust in 2000, Ritter mentioned, greater than 80% of profitable exits have been through acquisitions. He added that he additionally doesn’t see this pattern reversing itself anytime quickly.

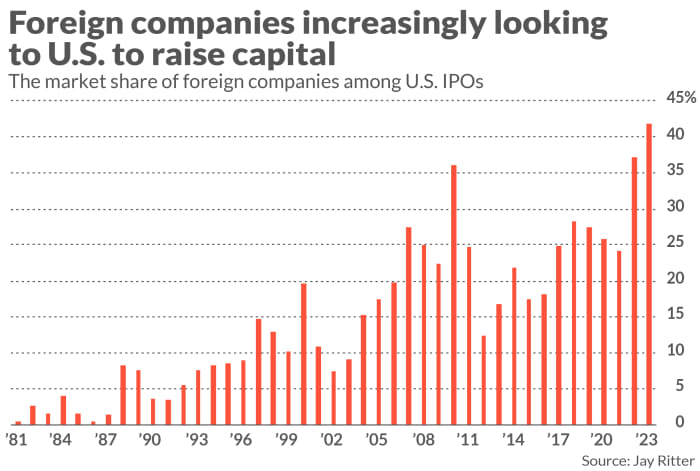

3. An growing share of U.S. IPOs are coming from international corporations: One vibrant spot is the growing share of U.S. IPOs from international corporations, as illustrated within the chart above (courtesy of knowledge from Ritter). This is an encouraging signal, since some in recent times had predicted that extreme authorized and regulatory necessities would discourage international corporations from utilizing the U.S. markets to boost capital. That doesn’t look like the case.

Mark Hulbert is a daily contributor to MarketWatch. His Hulbert Ratings tracks funding newsletters that pay a flat payment to be audited. He will be reached at mark@hulbertratings.com

Also learn: IPO market continues its revival with buyers seeking to Amer Sports, BrightSpring — and Reddit

More: The IPO market seems able to rebound, says Nasdaq CEO

Source web site: www.marketwatch.com