2023 will go down in historical past for the beginning of a brand new bull market, albeit a wierd one.

Despite some year-end catch-up by the remainder of the S&P 500 index, megacap know-how shares, characterised by the so-called Magnificent Seven, have dominated features for the large-cap benchmark

SPX,

which is up 23.8% for the yr via Friday’s shut.

That’s the results of “extreme speculation,” based on Richard Bernstein, CEO and chief funding officer of eponymously named Richard Bernstein Advisors. And it units the stage for traders to reap the benefits of “once-in-a-generation” funding alternatives, he argued, in a cellphone interview with MarketWatch.

MarketWatch’s Philip van Doorn final week famous that, weighting the Magnificent Seven — Apple Inc.

AAPL,

, Microsoft Corp.

MSFT,

Amazon.com Inc.

AMZN,

Nvidia Corp.

NVDA,

Alphabet Inc.

GOOG,

GOOGL,

Tesla Inc.

TSLA,

and Meta Platforms Inc.

META,

— by their market capitalizations on the finish of final yr, the group had contributed 58% of this yr’s roughly 26% whole return for the S&P 500, and that’s down from a wide ranging 67% on the finish of November.

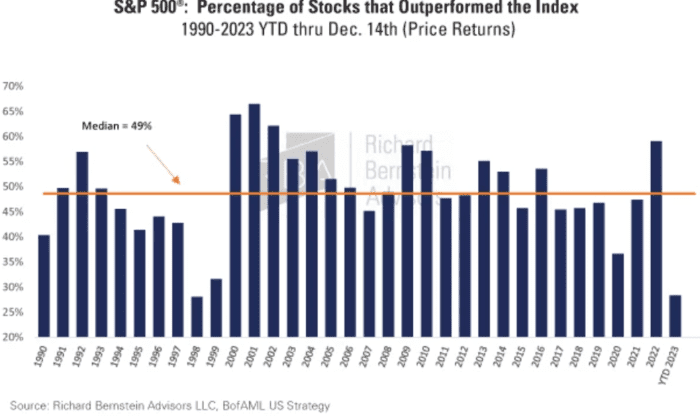

The chart beneath exhibits that the share of shares within the S&P 500 which have outperformed the index within the yr thus far stays nicely beneath the median of 49% stretching again to 1990:

Richard Bernstein Advisors

Meanwhile, the tech-heavy Nasdaq Composite

COMP

has soared greater than 40% this yr, whereas the extra cyclically weighted Dow Jones Industrial Average

DJIA,

which hit a string of data this month, is up 12.8%.

The narrowness of the rally gave some technical analysts pause over the course of the yr . They warned that that it was uncharacteristic of early bull markets, which generally see broader management amid rising confidence within the financial outlook.

Bernstein, beforehand chief funding strategist at Merrill Lynch, sees parallels with the late-Nineteen Nineties tech bubble, which holds classes for traders now.

The market efficiency signifies traders have satisfied themselves there are solely “seven growth stories,” he stated. It’s the kind of myopia that’s attribute of bubbles.

The penalties may be dire. In the Nineteen Nineties, traders targeted on the economy-changing potential of the Internet. And whereas these technological advances had been certainly economy-changing, an investor who purchased the tech-heavy Nasdaq on the peak of the bubble needed to wait 14 years to get again to break-even, Bernstein famous.

Today, traders are targeted on the economy-changing potential of synthetic intelligence, whereas trying previous different essential developments, together with reshoring of provide chains.

“I don’t think anyone is arguing AI won’t be an economy-changing technology,” he stated, “ the question is, what’s the investing opportunity.”

For his half, Bernstein argues that small-cap shares; cyclicals, or equities extra delicate to the financial cycle; industrials; and non-U.S. shares are all amongst property poised to play catch-up.

“I don’t think one has to be overly sexy on this one…it may not make a huge difference as to how you decide to execute and invest” in these areas, he stated. “There’s a bazillion different ways to play this.”

Those areas are exhibiting indicators of life in December. The Russell 2000

RUT,

the small-cap benchmark, has surged greater than 12% in December versus a 4.1% advance for the S&P 500. The Russell nonetheless lags behind by a large margin yr thus far, up 15.5%, or greater than 8 share factors behind the S&P 500.

Meanwhile, an equal-weighted model of the S&P 500

XX:SP500EW,

which includes the efficiency of every member inventory equally as a substitute of granting a heavier weight to extra invaluable firms, has additionally performed catchup, rising 6.2% in December. It’s now up 11% in 2023, nonetheless lagging behind the cap-weighted S&P 500 by greater than 8 share factors.

Bernstein sees early indicators of broadening out, however expects it to be an “iterative process.” What traders must be aiming for, he stated, is “maximum diversification,” in direct distinction to 2023’s traditionally slim market, which displays traders rejecting the advantages of diversification and taking extra concentrated positions in fewer shares.

To make sure, whereas the Magnificent Seven-dominated stock-market rally has attracted loads of consideration, it doesn’t imply these particular person shares have been the only real winners in 2023.

“I will say, ‘magnificent’ is in the eye of the beholder,” stated Kevin Gordon, senior funding strategist at Charles Schwab, in a cellphone interview.

The seven shares that account for such a big share of the S&P 500’s features achieve this principally as a result of their extraordinarily “mega” market caps moderately than outsize value features. And that’s simply, by definition, how market-cap-weighted indexes work, analysts notice.

That doesn’t imply the megacap shares are essentially the perfect performers over 2023. While Nvidia, up 243%, and Meta, up 194%, prime the checklist of year-to-date value gainers within the S&P 500, Apple Inc.

AAPL,

is just the 59th greatest performing inventory, with a 49% acquire. Combine that with a $3 trillion market cap, nevertheless, and Apple proves one of many largest movers of the general index.

What was weird concerning the 2023 rally wasn’t a lot the megacap tech efficiency, Gordon stated, however the truth that the remainder of the market languished to such a level till just lately.

Clarity across the financial outlook and rates of interest assist clear the way in which for the remainder of the market to play catch-up, he stated. Fears of a tough financial touchdown have light, whereas the Federal Reserve has signaled its seemingly completed elevating charges and is on observe to ship price cuts in 2024.

For inventory pickers that didn’t latch on to the few winners, 2023 was brutal. Passive traders who simply purchased S&P 500-tracking ETFs ought to really feel good.

So why not simply chase the index? Bernstein argues that would spell hassle if the megacap names are as a result of falter. That might make for a mirror picture of this yr the place features for a wider array of particular person shares is offset by sluggish megacap efficiency.

Gordon, nevertheless, performed down the prospect of “binary outcomes” during which traders promote megacaps and purchase the remainder of the market.

If troubled segments of the economic system, such because the housing sector, recuperate in 2024, traders “could definitely see a scenario where the rest of the market catches up but it doesn’t have to be at the expense of highfliers,” he stated.

Source web site: www.marketwatch.com