Stock futures are pointing due south as warning grips buyers following Friday’s monster jobs beat.

While topic to revisions, that 517,000 surge in U.S. jobs might have shredded hopes amongst some that the Fed will probably be performed with charge hikes sooner moderately than later.

“Half a million jobs, climb down off the wall, call the recession off. This isn’t a soft-landing, the economy is still flying high,” says Chris Rupkey, chief economist at fwd: bonds, a analysis firm.

Add the roles numbers to a protracted record of issues that don’t make sense proper now, says Matt Maley, Miller Tabak + Co.’s chief market strategist. “After the action in the stock market this past week, you’d think that this earnings season has been great…and that the Fed has declared that they’re definitely going to cut rates soon…AND institute another QE program. However, none of these things took place. In the end, the fundamentals still matter, so be careful,” Maley informed purchasers.

In our name of the day, Maley highlights “some artificial factors” which were pushing shares greater, main some buyers to imagine that the markets are “looking beyond 2023.”

“Once those artificial factors peel away…the real/concrete developments will become much more prominent. When that happens, the stock market could/should reverse to the downside very quickly,” he mentioned.

Maley expressed stunned that the S&P 500 is buying and selling at a worth greater than 19 instances 2023 estimates, and given the very fact earnings season hasn’t gone that properly.

He additionally notes odd views making the rounds, akin to the concept the Fed pausing its rate-hiking program would be the identical as a pivot, although traditionally pausing has by no means been the catalyst for a brand new bull market.

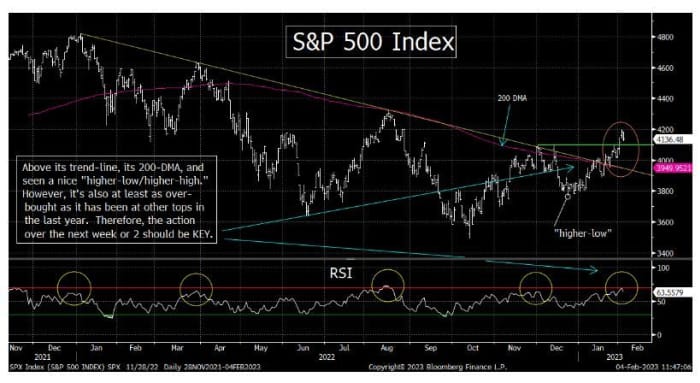

Maley takes a deeper have a look at the charts, the place sees some good news and dangerous. Firstly, if final week’s positive aspects that took the S&P 500

SPX,

the Nasdaq 100

NDX

and the Russell 2000

RUT

above key resistance ranges maintain, will probably be one of the best factor the bulls have going for them proper now.

But these markets have additionally grow to be overbought within the brief time period, he says.

Miller Tabak

With that in thoughts, he says watch the form of any pullback to return.

“It should last for a few days…and maybe even more than a week. If it’s a mild one…with low volume and the kind of breadth that is not extreme, it should mean that we’ll see even further material upside movement before we get through the month of February.”

“If however, the decline comes on high volume and rotten breadth…and is more than just a mild decline…it could signal that the recent rally was merely a great big sucker’s rally,” mentioned Maley.

The markets

Dow futures

YM00

are down over 200 factors, with S&P 500

SPX

and Nasdaq-100

NQ00

futures additionally round 1% decrease. Bond yields

BX:TMUBMUSD10Y

BX:TMUBMUSD02Y

have climbed. The greenback

DXY

is barely greater, together with oil

CL

and gold costs.

For extra market updates plus actionable commerce concepts for shares, choices and crypto, subscribe to MarketDiem by Investor’s Business Daily.

The buzz

Catalent inventory is up 21% in premarket buying and selling after a report that Danaher

DHR

is inquisitive about taking on the contract producer and pay a big premium.

Dell

DELL

is reportedly planning to chop 6,650 employees, in response to a report, and including to the 1000’s of tech layoffs introduced to this point.

Tyson Foods

TSN

shares are tumbling after an earnings and income miss. Take-Two Interactive

TTWO

and Activision Blizzard

ATVI,

amongst others, will report after the market shut.

Monday’s knowledge and Fed calender is quiet, however Chair Jerome Powell will communicate on the Economic Club of Washington on Tuesday, so all eyes on that.

A 7.8 magnitude earthquake has left greater than 1,300 useless in southeast Turkey and Syria, with lots of feared trapped in crushed buildings throughout cities and villages on each side of the border. Turkey was hit by a second large quake hours later.

Tensions are rising over a Chinese balloon U.S. President Biden ordered shot down over the weekend. Hong Kong shares fell.

Best of the net

The world’s greatest passenger airways are heading again to the skies.

The large dangers on the desk as we enter 12 months two of Russia’s warfare in Ukraine.

Goldman Sach CEO David Solomon’s “hobby” as a preferred DJ is placing him and the financial institution in an uneasy highlight.

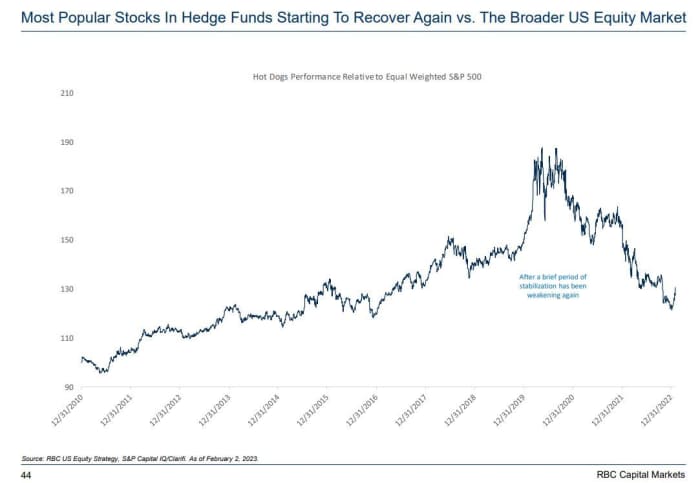

The chart

You need somewhat good news for shares? Check out the so-called scorching canine.

“The most popular stocks in hedge funds have been outperforming. This is good news for the market, as a shift in performance was seen in late 2018 right before the December bottom,” Lori Calvasina, head of U.S. fairness technique at RBC Capital Markets, tells purchasers in a brand new be aware.

She additionally says correlations throughout the S&P 500 and Russell 2000

RUT

are falling, notably for healthcare, client discretionary and comm companies. This is optimistic for inventory pickers as a result of excessive correlations inside equities makes it very powerful for these lively buyers to beat the market.

The tickers

These had been the top-searched tickers on MarketWatch as of 6 a.m.

| Ticker | Security title |

| TSLA | Tesla |

| AMC | AMC Entertainment |

| BBBY | Bed Bath & Beyond |

| APE | AMC Entertainment Holdings most well-liked shares |

| GME | GameStop |

| MULN | Mullen Automotive |

| AAPL | Apple |

| AMZN | Amazon.com |

| NIO | NIO |

| CVNA | Carvana |

Random reads

Grammy highlights: Beyoncé is now essentially the most awarded artist within the award’s historical past, and an Iranian singer dealing with jail obtained a particular Grammy for his protest anthem.

Under risk of being swallowed by a mine, a Swedish city is transferring itself one constructing at a time.

$1,850/month — what this 27-year previous pays to stay in an previous NYC laundromat

Need to Know begins early and is up to date till the opening bell, however join right here to get it delivered as soon as to your e-mail field. The emailed model will probably be despatched out at about 7:30 a.m. Eastern.

Listen to the Best New Ideas in Money podcast with MarketWatch reporter Charles Passy and economist Stephanie Kelton.

Source web site: www.marketwatch.com