The ARK Innovation ETF is a poor guess for efficiency when the market’s subsequent main leg up begins.

I level this out not as a result of I’m predicting that such a rally is about to start, although, after all, it may at any time—even maybe on Thursday of this week, when the Dow Industrials

DJIA,

exhibited spectacular intraday power and closed up greater than 300 factors. I point out the ETF’s poor odds as a substitute to warning buyers who’re taking a look at latest efficiency as a information to the place to put their bets when a brand new bull market does lastly take off.

The ARK Innovation ETF

ARKK,

definitely has attracted consideration. Year thus far via March 1 it gained 23.9%—in distinction to a 3.2% acquire for the SPDR S&P 500 Trust

SPY,

which is benchmarked to the S&P 500, and a 9.4% acquire for the Invesco QQQ Trust

QQQ,

which is benchmarked to the Nasdaq 100 Index

NDX,

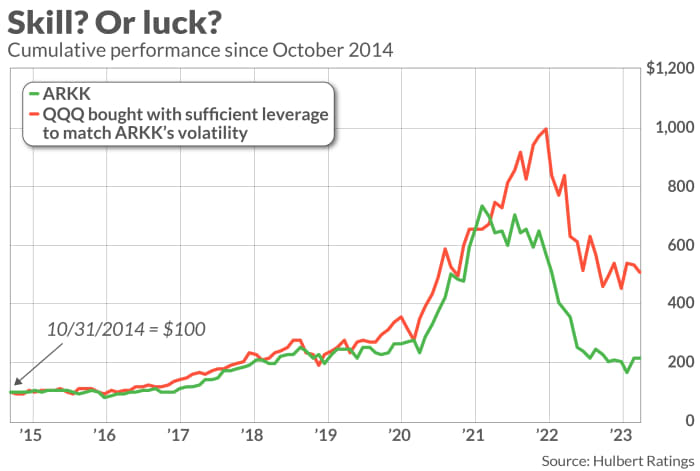

There is much less right here than meets the attention, nevertheless. ARKK’s outperformance seems to be due in very giant half to its willingness to incur well-above-average ranges of danger and volatility. Investors through the years have acquired comparatively little in return for incurring that danger. In reality, when you had been prepared to abdomen the ETF’s excessive danger, you might have carried out considerably higher just by investing within the Nasdaq 100 index with ample leverage to match ARKK’s volatility.

When outperformance throughout bull markets is attributable to danger, odds are overwhelming that the technique will likely be an enormous casualty when the market declines. And that’s precisely what occurred to ARKK during the last couple of years.

It’s not simply Monday-morning-quarterbacking for me to say this.

Two years in the past on this house, when ARKK was driving excessive, I argued that “ARK Innovation’s red-hot returns aren’t as impressive as they seem.” Since then, ARKK’s return has been minus 44.4% annualized, in distinction to minus 3.8% annualized for the QQQ.

An e mail to ARK Investment Management requesting remark was not instantly answered.

The accompanying chart updates the evaluation I carried out two years in the past. It compares ARKK’s efficiency since its October 2014 inception to a hypothetical portfolio that invested within the QQQ with simply sufficient margin (79%, to be actual) to make its volatility the identical as ARKK’s. In calculating this hypothetical portfolio’s efficiency, I deducted the curiosity value of this margin.

As you possibly can see, the leveraged-QQQ portfolio stayed neck and neck with ARKK up till the highest of the meme-stock bubble in early 2021—which is after I wrote my two-years-ago column. Since then, this leveraged portfolio has pulled manner forward. I calculate that over the whole interval since October 2014 the leveraged-QQQ portfolio beat ARKK by 12.0 annualized proportion factors.

The funding implication of this discovering: If you’re tempted to put money into ARKK within the subsequent bull market, take into account investing as a substitute within the QQQ on margin. If historical past is any information, you received’t incur any larger danger however will carry out lots higher.

Mark Hulbert is an everyday contributor to MarketWatch. His Hulbert Ratings tracks funding newsletters that pay a flat charge to be audited. He may be reached at mark@hulbertratings.com.

Source web site: www.marketwatch.com