The Social Security COLA for 2024 is more likely to be simply as excessive because it was in prior years.

It’s essential to level this out with a view to counter the alarmist narrative that’s taking maintain in some quarters that subsequent 12 months’s value of residing adjustment (COLA) can be a lot decrease than in prior years. Retirees and others residing on a hard and fast revenue are naturally upset.

To make certain, we gained’t know the precise COLA till October 12, which is when the September CPI degree can be reported. 2024’s COLA will equal the proportion distinction between September’s degree and the place the CPI stood in September 2022, 12 months prior.

Even although we will solely speculate at this level, quite a lot of written articles have appeared with scary headlines comparable to “The Social Security COLA for 2024 could be 2.7%, down from 8.7%.”

But these analyses and headlines give attention to the COLA’s absolute moderately than relative degree. And although 2024’s COLA nearly definitely can be decrease than 2023’s, in absolute phrases, inflation additionally can be lots decrease. And it’s the relation between these two that tells us whether or not retirees’ buying energy can be preserved or eroded.

Failure to give attention to that relation is an error that economists discuss with as “inflation illusion.” To illustrate, think about that the Social Security COLA in calendar 1980 was 14.3%. If you didn’t do not forget that inflation at the moment was operating within the double digits, you’d be envious of how good that 12 months’s Social Security recipients had it. In reality, these recipients most probably misplaced buying energy in 1980, because the Consumer Price index’s trailing 12-month inflation bought as excessive as 14.6% throughout that calendar 12 months.

Whether the 2024 COLA can be increased or decrease than subsequent 12 months’s precise inflation can be a perform of whether or not inflation is trending up or down later this 12 months and subsequent. When the CPI’s 12-month fee of change is trending upwards, then a given 12 months’s COLA can be decrease than precise inflation, since that adjustment would have been set the prior October when the speed was decrease.

In distinction, a given 12 months’s COLA will greater than compensate for inflation in a given 12 months if the CPI’s 12-month fee of change is trending down. And that seems to be the case at present. So there’s a very good likelihood that the CPI’s trailing 12-month fee of change this October can be increased than what inflation really seems to be in 2024.

Of course, we gained’t know till the top of subsequent 12 months whether or not the 2024 Social Security COLA can be increased or decrease than the 12 months’s precise inflation. But our greatest guess at this level is that 2024 can be a kind of years wherein the COLA can be barely increased than precise inflation. So, moderately than complaining, retirees ought to—tentatively—be hopeful.

I’ve obtained quite a few indignant emails in prior years after I’ve made comparable factors in regards to the significance of judging the Social Security COLA in relative moderately than absolute phrases. Many of you have got associated real hardships brought on by attempting to pay your payments with what you obtain from Social Security, arguing that these hardships show my evaluation is flawed.

But let me be clear: I’m not taking a place on whether or not Social Security advantages are in and of themselves enough. I’m solely specializing in whether or not Social Security’s inflation adjustment is enough. Those are two separate issues.

Consumer Price Index for the Elderly

While I’m on the topic, let me deal with a associated topic: Does the Social Security Administration (SSA) use the right measure of inflation when calculating its COLA? Many argue that it doesn’t, on the grounds that the aged’s value of residing rises quicker than it does for the remainder of us. In principle that argument makes quite a lot of sense.

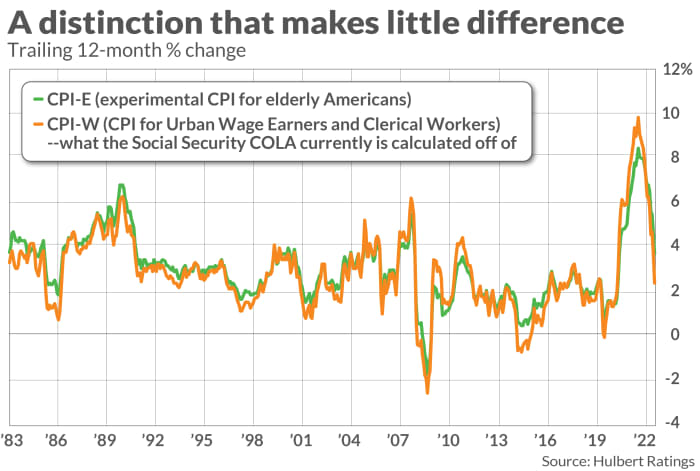

In follow, nonetheless, it makes little distinction. We know as a result of the SSA, since 1982, has calculated a separate “Consumer Price Index for The Elderly,” or CPI-E, which takes into consideration the distinct spending habits of the everyday aged individual. As you possibly can see from the accompanying chart, its 12-month fee of change is commonly just about indistinguishable from the “Consumer Price Index for All Urban Wage Earners and Clerical Workers,” or CPI-W—which is what the SSA makes use of to calculate its annual COLAs.

The backside line? In adjusting retirement advantages by inflation, the SSA shouldn’t be attempting to repair all inadequacies in how Social Security is run. It has a way more slender aim, which is to pretty modify these advantages by precise inflation. Its success or failure must be judged on that foundation alone.

Mark Hulbert is a daily contributor to MarketWatch. His Hulbert Ratings tracks funding newsletters that pay a flat price to be audited. He might be reached at mark@hulbertratings.com

Source web site: www.marketwatch.com