It hasn’t been an excellent yr for traders to personal shares within the utilities sector – the worst-performing a part of the U.S. inventory market up to now in 2023 – however that could possibly be coming to an finish.

The S&P 500 Utilities Sector

XX:SP500.55

has stood its floor in September as a batch of blended financial knowledge and fears of upper rates of interest have rattled monetary markets, particularly expertise shares. The utilities sector has superior over 3% up to now in September and is by far the best-performing group within the S&P 500 after the vitality sector

XX:SP500.10,

in line with FactSet knowledge.

The utilities sector has additionally outperformed the knowledge expertise sector

XX:SP500.45,

which has fallen by 4.3% this month, by the widest margin since December 2022, in line with Dow Jones Market Data.

“Utilities are very oversold right now,” mentioned David Wagner, portfolio supervisor at Aptus Capital Advisors. “It seems that given this oversold nature that the rubber band is so stretched so far in one direction that one ought to always be on guard for some type of abrupt flip to the script.”

Utility shares obtained slammed earlier this yr when greater rates of interest made the sector much less engaging in comparison with Treasury payments and money-market funds.

Unlike fast-growing expertise shares, utilities shares are sometimes thought of dividend-income investments or defensive holdings, particularly throughout financial downturns or recessions. The corporations that present electrical energy, water and fuel utilities normally supply traders secure dividends, in addition to much less volatility in contrast with the general inventory market.

The utilities sector is anticipated to pay a dividend yield of three.3% this yr, greater than twice the 1.6% of the S&P 500

SPX,

however nicely beneath the 4.321% yield of the 10-year Treasury invoice

BX:TMUBMUSD10Y

and the 5.03% yield of the 2-year Treasury observe

BX:TMUBMUSD02Y,

in line with FactSet knowledge.

“It’s a normal connotation that when rates go higher, utility stocks tend to underperform, and obviously utilities tend to be a defensive, interest-rate sensitive sector,” Wagner instructed MarketWatch in a telephone interview. “During a risk-on rally [this year], utilities underperformed, so you’ve had a perfect storm for the underperformance of utilities year-to-date.”

That is why traders may benefit from the utilities sector that’s “already cheap” in comparison with expertise corporations that are normally thought of high-risk investments however at the moment are among the many most overvalued after a man-made intelligence-driven rally earlier this summer season, mentioned Irene Tunkel, chief U.S. fairness strategist at BCA Research.

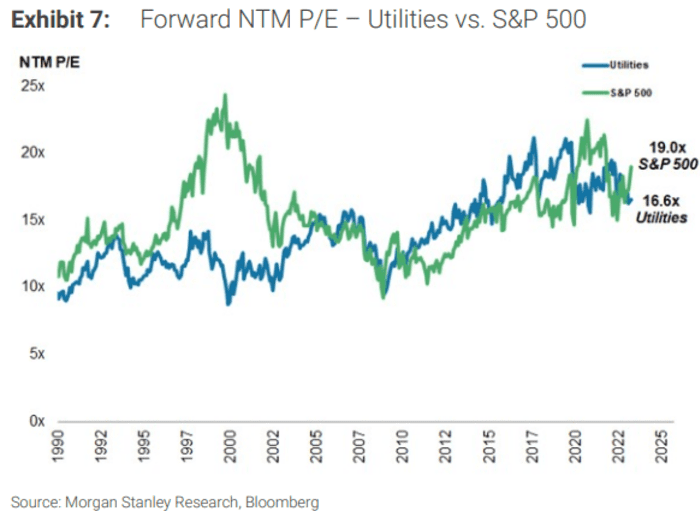

The S&P 500 Utilities Sector is buying and selling at 17.4 instances its estimated earnings for the next 12 months, whereas the broader S&P 500 is buying and selling at 19.4 instances its anticipated earnings and the S&P 500 Information Technology Sector is buying and selling at 27.8 instances its projected earnings for a similar interval, in line with FactSet knowledge.

See: Opinion: For higher good points in tech shares from right here, look past the ‘Magnificent Seven’

However, market analysts assume “an abrupt snap-back” in utility shares can also level to some “risk-off” trades or deeper anxiousness in regards to the U.S. economic system.

“The consensus view is that the yields will come down as they’ve already topped out,” Tunkel instructed MarketWatch through telephone on Friday. She mentioned the financial progress will decelerate within the absence of “surprises” which have been shifting the markets in 2023, and the “economic-surprise trade” will come to an finish.

“Many people are now looking at different sectors because they think that rates will come down because economic growth was too slow — they’re actually looking for defensives,” Tunkel mentioned.

Strategists at Morgan Stanley forecast the 10-year Treasury yield to retreat to three.35% by the second quarter of 2024 of their base case. They mentioned the market is susceptible each to a slowdown in progress and cooling of inflation amid wholesome progress — two outcomes that traders don’t appear ready for.

“This could be supportive of utility performance over the next several quarters given the correlation between utilities and the trend in rates,” mentioned David Arcaro, government director of fairness analysis at Morgan Stanley. “We also think utility valuations screen cheap relative to the S&P, relative to the last 10 years on an absolute basis, and inline with the long term relationship vs. bond yields so there could be valuation support over this timeframe.” (See chart beneath)

SOURCE: MORGAN STANLEY RESEARCH, BLOOMBERG

Key utilities catalysts into year-end

There are different catalysts that Morgan Stanley strategists anticipate to drive utility shares’ efficiency within the close to time period.

Several shares within the utilities sector “have meaningful regulatory decisions” coming this yr associated to mission approvals or settlement in electric-rate instances, mentioned Arcaro and his crew, in a Thursday observe.

For instance, the PPL Corporation’s

PPL,

plan to exchange 1,500 megawatt of getting older coal era with cleaner vitality combine in Kentucky by 2028, is looking for approval from the Kentucky Public Service Commission with a choice anticipated by November 6, the corporate mentioned on its second-quarter earnings name. Shares of PPL are up practically 3% in September.

“We see several opportunities where these regulatory processes have acted as overhangs on the stocks, and where we see a strong likelihood of success and positive rerating as the regulatory decisions are achieved,” Arcaro and his crew mentioned.

See: How a conservative group sees a climate-focused vitality transition that features fuel and nuclear

Other coverage assist contains U.S. Treasury steering on eligibility for the inexperienced hydrogen manufacturing tax credit score (PTC) within the September to October timeframe, Morgan Stanley strategists mentioned. Included in President Biden’s Inflation Reduction Act in 2022, which provides funding, packages, and incentives to companies and people within the largest U.S. effort on local weather change to this point, the PTC permits taxpayers to deduct a proportion of the price of renewable vitality programs from their federal taxes.

See: Climate winners and losers because the Inflation Reduction Act hits 1-year anniversary

Meanwhile, Arcaro and his crew see renewables demand accelerating for some utility shares comparable to NextEra Energy Inc.

NEE,

and AES Corporation

AES,

however they continue to be cautious on local weather tail-risk within the close to time period comparable to hearth and hurricanes.

U.S. shares completed decrease on Friday to cap a shedding week for the S&P 500 and the Nasdaq Composite

COMP.

The S&P 500 dropped 0.2% and the Nasdaq declined by 0.4% for the week, whereas the Dow Jones Industrial Average

DJIA

edged 0.1% greater, in line with FactSet knowledge.

Source web site: www.marketwatch.com