There is room for a continued selloff in U.S. Treasurys which has already pushed 10- and 30-year yields to their highest ranges since 2007 and 2011, based on researchers at Barclays.

Though the current selloff took a breather on Friday, the regular drive increased in long-dated yields which unfolded this week left observers warning that the period of low charges could also be firmly behind the U.S. as a brand new regular seems to take form within the bond market. Long-term charges yields are simply starting to enter ranges which were traditionally in line with the place they traded through the early 2000s.

Read: Why Treasury yields preserve rising, inflicting ache for stock-market buyers and How higher-for-longer charges are enjoying out

Numerous elements are contributing to the altering dynamics — together with information displaying a resilient U.S. financial system; the minutes of the Federal Reserve’s final assembly, which revealed the opportunity of extra rate of interest hikes to return; and better actual or inflation-adjusted yields. The 10-

BX:TMUBMUSD10Y

and 30-year Treasury yields

BX:TMUBMUSD30Y

have respectively jumped by 29.6 foundation factors and 23.3 foundation factors over the six-day buying and selling interval that ended on Thursday. Meanwhile, year-to-date returns within the Treasury market turned detrimental this week.

“We have been cautioning against fading the bond market selloff, as, despite the sharp move higher, we thought yields were not yet stretched. We maintain that view,” Anshul Pradhan, head of U.S. charges analysis at Barclays

BARC,

and others wrote in a word on Thursday. In addition, “investors are getting worried about a large further selloff,” judging by what Barclays describes as “building stress” within the choices market.

It’s not simply the info that’s pointing to a U.S. financial system with appreciable momentum. As of this week, the Atlanta Fed’s GDPNow forecasting mannequin is projecting actual gross home product progress that would are available at a startling 5.8% for the third quarter. Even if one chooses to low cost that estimate, based on Barclays, the financial system is poised to develop at a strong tempo through the present interval.

“An economy growing above trend, potentially even accelerating, despite the tightening of policy, calls into question whether monetary policy is even tight,” Pradhan and others wrote. “Markets are reacting to this by adjusting real yields higher.”

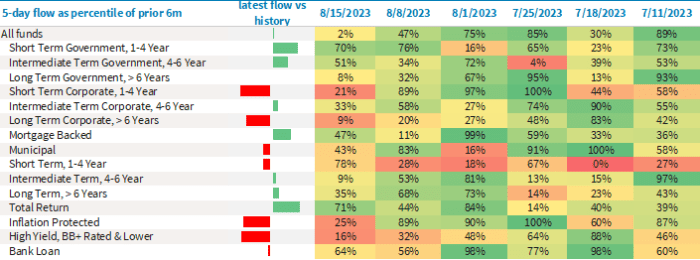

The Treasury market selloff that pushed long-dated yields to multiyear highs this week has began to negatively have an effect on broader demand for mounted earnings, notably in short- and long-term company bond funds, inflation-protected funds, and high-yield funds the place securities are rated at BB+ and decrease.

Source: EPFR, Barclays Research

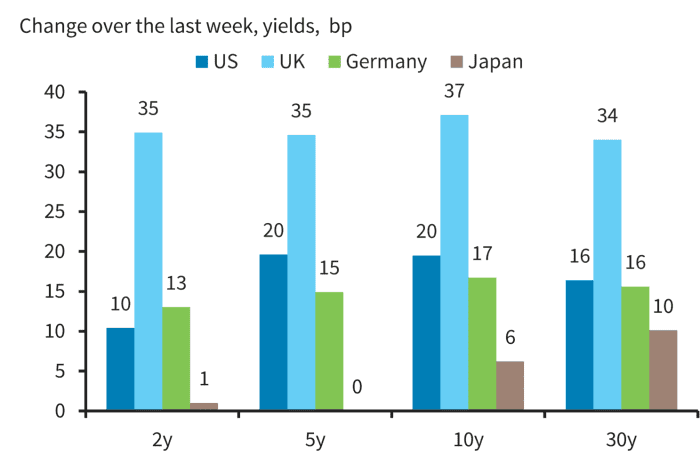

Currently, yields will not be simply rising within the U.S., however around the globe in locations like Japan, the U.Okay. and Germany because the higher-for-longer theme in charges takes maintain.

Source: Bloomberg, Barclays Research

This week’s Treasury-market selloff marks a turnabout in sentiment from earlier this 12 months, when fears that the U.S. would possibly fall right into a recession prevailed and the safe-haven enchantment of presidency debt put a cap on how excessive long-term yields may go.

Friday introduced one other day wherein dangerous property have been responding to readjustments within the bond market.

U.S. shares

DJIA

SPX

COMP

have been blended in New York’s afternoon buying and selling, with Dow industrials trying to keep away from the worst week since March. One-

BX:TMUBMUSD01Y

by 30-year Treasury yields have been down as patrons of U.S. authorities debt re-emerged. Ten- and 30-year yields traded at 4.23% and 4.37%, respectively, backing off from their highest ranges since 2007 and 2011.

Source web site: www.marketwatch.com