The S&P 500’s whole return index is at a document excessive, because the price-only S&P 500

SPX

sits solely 2% beneath its all-time peak. The meteoric year-end rally has left many Wall Street forecasts wanting stale — not only for this 12 months, however really subsequent 12 months’s as nicely.

One sector that’s been left behind are the banks. The SPDR S&P Bank ETF

KBE

has eked out a achieve of simply 4% this 12 months, and even with a latest rally the regional financial institution ETF

KRE

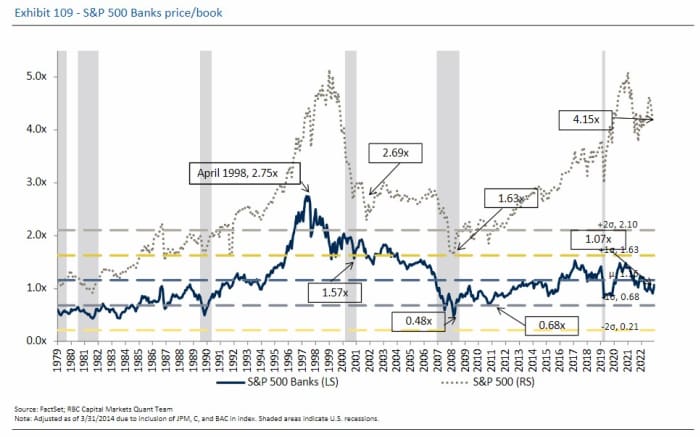

continues to be within the pink, down 8%. Earnings as an entire have held up — in response to Citigroup knowledge, earnings per share for 2023 within the sector are estimated to develop 16.8% this 12 months — but banks commerce on a dismal 9.3 occasions this 12 months’s earnings, and solely 9.7 occasions subsequent 12 months’s income.

Analysts at RBC Capital Market say banks might thrive subsequent 12 months if we see a replay of 1995. That 12 months was a terrific one for banks, which soared 54%, outperforming the broader S&P 500 by about 20 share factors. The parallel between now, probably, after which, is that the Fed charge hike cycle got here to an finish and the financial system had a smooth touchdown.

Granted, there’s the prospect of the ultimate Basel III Endgame capital guidelines, which financial institution CEOs not too long ago took to Capitol Hill to protest. But RBC analysts led by Gerard Cassidy say the important thing situation will likely be credit score high quality.

“We do not foresee this cycle being anything similar to 1990 or 2008-2009 due to a de-risking of the industry following the 2008-2009 financial crisis,” they are saying. Furthermore, the imposition of the Current Expected Credit Losses, or CECL, accounting commonplace means banks have larger ranges of loan-loss reserves to attract upon than in previous recessions.

And banks are low-cost, the RBC analysts say, even when contemplating the losses of their bond portfolios that they don’t should mark to market (and which is able to get smaller as rates of interest decline).

RBC says the banks to personal are Bank of America

BAC,

Fifth Third

FITB,

Huntington Bancshares

HBAN,

KeyCorp

KEY,

M&T

MTB,

PNC Financial Services Group

PNC,

Truist Financial

TFC,

Valley National

VLY,

Western Alliance Bancorp

WAL,

Webster Financial

WBS,

and Wintrust Financial

WTFC,

Michael Marone, co-founder and co-chief funding officer at Crescent Rock Capital, isn’t so positive. In an interview printed by Columbia Business School, he mentioned his fund was much less quick on regional banks in November than it was heading into the 12 months, however it might must see a tough touchdown earlier than getting concerned.

“Banks and financials generally are good investments to consider after turmoil. March [when banks including SVB collapsed] was not enough turmoil, not with financial conditions still needing to tighten,” he mentioned. He’s additionally involved that even a recession is not going to dampen inflation completely, normalizing at a better degree than earlier than COVID.

And he famous the regulatory response after March. “We’ll just have to see how cheap the banks get.”

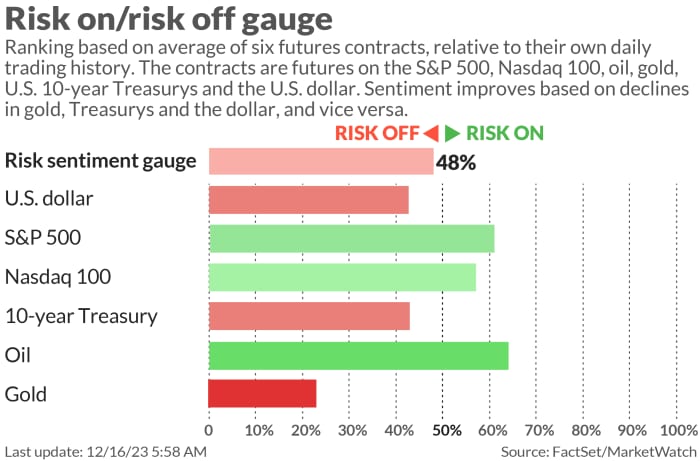

The market

Stock futures

ES00,

NQ00,

have been pointing larger. Gold

GC00,

was larger, and the yield on the 10-year Treasury

BX:TMUBMUSD10Y

remained beneath 4%. The Hang Seng

HK:HSI

rallied after a well-received central financial institution lending facility, although retail gross sales in China lagged economist estimates.

The buzz

Triple witching expiration of greater than $5 trillion value of choices contracts is forward, together with the rebalancing of the S&P 500 and Nasdaq-100.

Costco Wholesale

COST,

— which bought 2.9 million pumpkin pies over Thanksgiving — largely met expectations with its fiscal first-quarter outcomes, because it declared a particular money dividend.

Miami-based dwelling builder Lennar

LEN,

reported stronger-than-expected earnings on weaker-than-estimated income.

The Empire State manufacturing survey and industrial manufacturing knowledge are set for launch.

Jeff Bezos performed down AI risks in a prolonged podcast interview.

Best of the net

Mexico’s telecoms magnate Carlos Slim has joined the $100 billion-plus membership, helped partially by the surge within the peso.

Chinese spies allegedly recruited European politician — through crypto — in operation to divide the west.

The knowledge reveals folks don’t really wish to stay in dense, walkable cities.

Top tickers

Here have been the highest stock-market tickers on MarketWatch as of 6 a.m. Eastern.

| Ticker | Security identify |

|

TSLA, |

Tesla |

|

GME, |

GameStop |

|

NVDA, |

Nvidia |

|

NIO, |

Nio |

|

AMC, |

AMC Entertainment |

|

AAPL, |

Apple |

|

AMZN, |

Amazon.com |

|

MSFT, |

Microsoft |

|

BABA, |

Alibaba |

|

PLTR, |

Palantir Technologies |

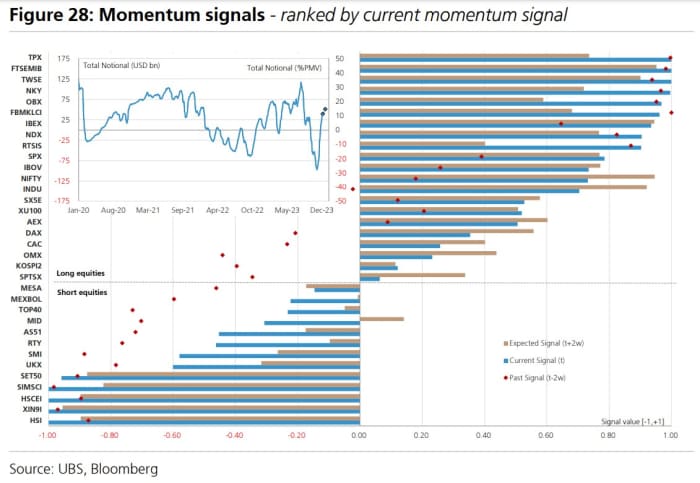

The chart

Momentum-driven commodity buying and selling advisers have stopped being quick on shares, however they nonetheless have loads of shopping for to do, in response to UBS strategists. “Overall positioning currently stands at 11% of their [assets under management] and we expect it to increase to 15% over the next two weeks,” say a group led by Nicolas Le Roux.

Random reads

That bull that was free at Newark’s Penn Station is now named Ricardo and will get to stay at an animal sanctuary.

Elon Musk’s ex Grime filed a trademark utility for the phrase Grok — to make use of for a toy — a month earlier than Musk’s firm behind the AI chatbot did.

Southwest Airlines

LUV,

has a coverage for plus-size passengers to get a free seat — however they advise them to get an additional ticket first and search reimbursement later.

Need to Know begins early and is up to date till the opening bell, however enroll right here to get it delivered as soon as to your e mail field. The emailed model will likely be despatched out at about 7:30 a.m. Eastern.

Source web site: www.marketwatch.com