“You will lag the long-term average if your investment horizon misses the market’s few stellar years.”

Financial planners are on shaky floor when extrapolating the previous into the longer term. Yet extrapolation underlies nearly all the things planners advise their purchasers to do. Stocks’ have crushed inflation by 6% annualized over the long run? Then construct purchasers’ retirement monetary plan on the belief that this shall be true for them too.

This is especially harmful recommendation at instances like now when shares are overvalued. It’s attainable it’s going to take many years for purchasers’ inventory efficiency to reside as much as the assumed development.

When I make this level to monetary advisers, many assume I’m referring to Japan’s inventory market, because it trades in the present day nicely beneath its all-time excessive in 1989, 34 years in the past. They dismiss Japan’s expertise as nothing greater than an exception that proves the rule.

These advisers are shocked to study that there have been even longer intervals the place the U.S. inventory market was a below-average performer. In truth, this has been the case over the previous 56 years, since September 1967. Though few are conscious of this multi-decade stretch of below-average efficiency, the numbers don’t lie.

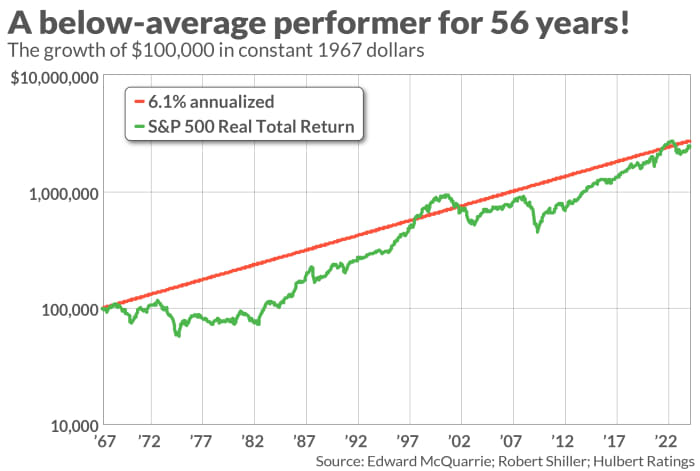

The inventory market’s common actual (inflation-adjusted) complete return (dividend-adjusted) since 1793 has been 6.1% annualized, in accordance with a database maintained by Edward McQuarrie, an emeritus professor at California’s Santa Clara University. This charge of return is represented by the pink line within the accompanying chart.

In distinction, the inexperienced line represents the S&P 500’s

SPX

actual complete return since September 1967. On an annualized foundation, its charge of return since September 1967 has been 5.7% annualized.

That might not appear an enormous distinction, but it surely provides up. A $100,000 funding in shares in September 1967 that grew at an annualized inflation-adjusted charge of 6.1% would in the present day be value $2.8 million in fixed {dollars}. Invested within the S&P 500, that very same $100,000 would as an alternative be value $2.3 million — a half million much less.

You will discover from the chart {that a} September 1967 funding within the U.S. inventory market rose above the 6.1% annualized trendline throughout the web bubble years of the late Nineties, after which once more (briefly) in 2022 earlier than the bear market started in January 2023. It speaks to equities’ overvaluation in 1967 that it takes bubble-like efficiency to carry its post-1967 efficiency as much as the long-term trendline — and solely for as long as the bubble doesn’t break.

You might imagine this illustration has little relevance to in the present day’s inventory market, for the reason that S&P 500’s actual complete return is eighteen% decrease than the place it was on the high of the bull market in January 2022. So even when bubble-like circumstances existed then, you may nonetheless argue that a lot of the recent air has been let loose of that bubble.

I’m not so positive this argument is persuasive. The S&P 500’s valuation in September 1967 was decrease than now, even making an allowance for in the present day’s inventory market being 18% decrease than it was nearly two years in the past. The S&P 500’s value/earnings ratio was 18.1 in September 1967, versus 18.9 in the present day. Its cyclically-adjusted value/earnings ratio in September 1967 stood at 22.2, versus 28.6 in the present day.

The takeaway, McQuarrie wrote in a current e-mail: “Stock market performance is lumpy and bunched, surging and languishing, for lengthy periods… [The stock market’s] “long term growth rate, even over two centuries, is biased upward by the few years in which the market soared.”

The funding implication: Even on the belief the longer term is just like the previous, you’ll lag the long-term common in case your funding horizon misses the market’s few stellar years.

Mark Hulbert is a daily contributor to MarketWatch. His Hulbert Ratings tracks funding newsletters that pay a flat payment to be audited. He will be reached at mark@hulbertratings.com

More: Don’t hand over on the 60/40 portfolio now — it has been a great insurance coverage coverage in an unpredictable inventory market

Plus: How to guard your self from shady retirement advisers

Source web site: www.marketwatch.com