It has been three years for the reason that U.S. inventory market hit its COVID-19 backside as the worldwide financial system immediately shut down in the beginning of the pandemic in early 2020.

The S&P 500

SPX,

has risen almost 76% from its closing low of 2237.40 reached on March 23, 2020, whereas the Dow Jones Industrial Average

DJIA,

is up 72.3% from its low of 18591.93 hit on the identical day and the Nasdaq Composite

COMP,

has superior over 70%, in response to Dow Jones Market Data.

Infections attributable to COVID-19 started to unfold in early 2020, and panic triggered by the financial uncertainty led to a drop within the inventory market that began in late February. On Feb. 24, the Dow industrial common slumped greater than 1,000 factors, its third-worst day by day level drop in historical past.

The selloff accelerated in mid-March, with the Dow getting into bear-market territory on March 10, down greater than 20% from the document shut set within the earlier month. Meanwhile, the large-cap index S&P 500 dropped almost 34% in a couple of month, wiping out three years’ value of good points for the market, in response to Dow Jones Market Data.

However, an enormous quantity of help from the Federal Reserve, together with an emergency interest-rate reduce, in addition to the fast growth of COVID-19 vaccines, restricted an extra downturn in shares. The S&P 500 rose to an all-time excessive in August and reached a number of extra all-time highs within the following months, in response to Dow Jones Market Data.

In 2021, three main indexes all closed out the 12 months with strong good points as buyers dismissed a sequence of market-moving occasions that would have crashed shares. The robust efficiency got here in a 12 months outlined by, amongst different issues, the January 6 assault on the U.S. Capitol, supply-chain disruptions, excessive inflation, labor-market shortages and the omicron and delta COVID variants.

But because the calendar flipped to 2022, U.S. shares began to tumble after the Federal Reserve and central banks across the globe started elevating rates of interest aggressively to battle surging inflation, stoking fears of a world recession.

Russia’s invasion of Ukraine in February 2022 and China’s zero-COVID insurance policies, in place till the nation immediately scrapped the stringent measures in December 2022, additionally contributed to market volatility. The three inventory indexes all suffered their worst 12 months since 2008.

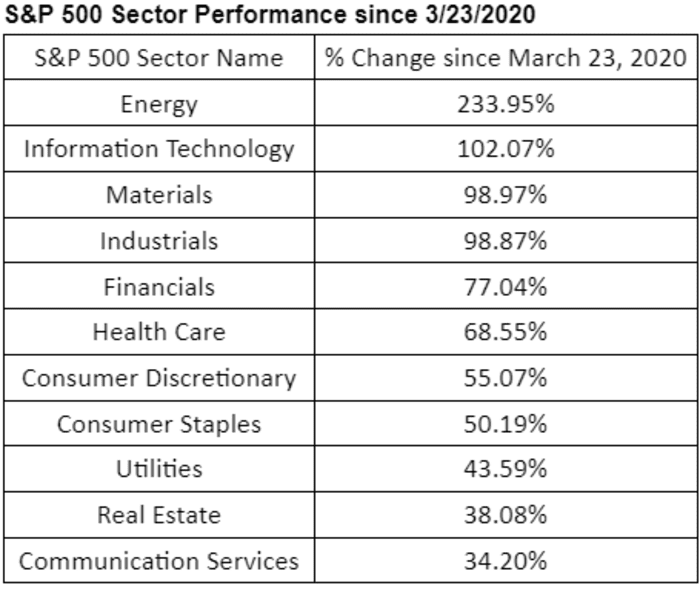

Among 11 S&P 500 sectors, vitality

SP500.10,

has been the best-performing sector over the previous three years. The sector was boosted by a spike in crude-oil and natural-gas costs within the aftermath of Russia’s invasion of Ukraine.

DOW JONES MARKET DATA

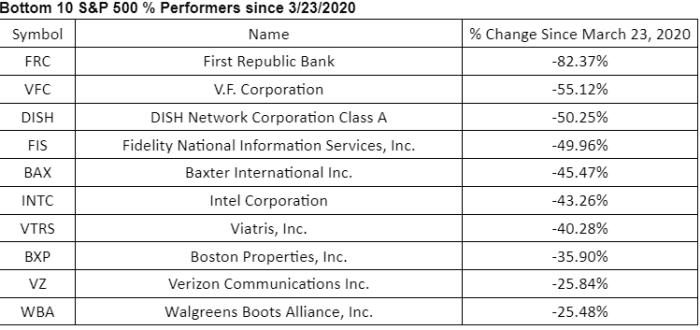

Among particular person shares, First Republic Bank has been the worst performer within the S&P 500 since March 2020, with the monetary establishment coming below stress following the collapse of two U.S. regional banks.

DOW JONES MARKET DATA

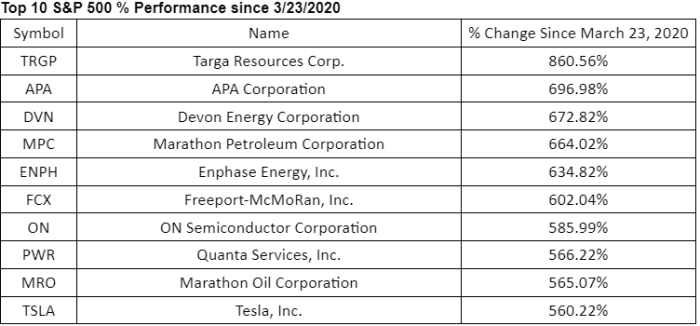

DOW JONES MARKET DATA

Also see: The Fed pivot is close to, and yield curve inversion has possible peaked. That’s normally unhealthy news for shares, this Fidelity strategist says.

U.S. shares rallied on Thursday after closing sharply decrease within the earlier session. The Federal Reserve raised rates of interest by one other 25 foundation factors on Wednesday whereas noting that coverage makers weren’t penciling in fee cuts this 12 months, regardless of latest stress within the banking business. Stocks additionally reacted after Treasury Secretary Janet Yellen stated she wasn’t contemplating steps to ensure all financial institution deposits.

The S&P 500 gained 0.3%, whereas the Dow superior 0.2% and the Nasdaq Composite was up 1%.

Source web site: www.marketwatch.com