The U.S. inventory market doesn’t need to fall as a lot because it has due to increased rates of interest alone — and shortly traders will start to behave on this realization.

The conviction that inventory costs fall when rates of interest rise is so universally held that few cease to look at it. But unexamined and untested beliefs can all too simply lead us astray. As Humphrey Neill, the daddy of contrarian evaluation, continuously reminded his shoppers: “When everyone thinks alike, everyone is likely to be wrong.”

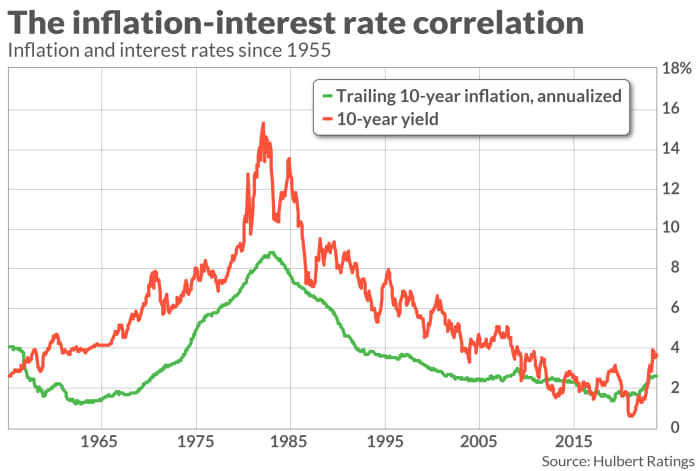

The first step in a re-examination is to remind ourselves that rates of interest and inflation are extremely correlated. This has been true traditionally, as you possibly can see from the accompanying chart.

This yr has been no exception: The 10-year Treasury yield

BX:TMUBMUSD10Y,

which many single out because the offender in why the bull market has stopped in its tracks, has risen sharply, to 4.81% from 3.79%, for the reason that begin of 2023 by means of Oct. 3. Over the identical interval, the 10-year breakeven inflation price — bond traders’ collective greatest judgment of anticipated inflation over the following decade — has risen barely to 2.33% fro.m 2.26%

The interest-rate/inflation correlation is essential, as a result of nominal company earnings develop sooner when inflation is increased. That doesn’t imply traders ought to welcome inflation, since increased inflation additionally signifies that future years’ earnings should be discounted at the next price.

But for a lot of behavioral causes, traders place better weight on the damaging influence of the better low cost price than on the upper nominal earnings-growth price that usually accompanies increased inflation.

Economists seek advice from this investor error as “inflation illusion.” Perhaps the seminal research documenting how this error impacts the inventory market was carried out by Jay Ritter of the University of Florida and Richard Warr of North Carolina State University. They discovered that traders systematically undervalue shares within the presence of excessive inflation.

Investors will make the identical error, in reverse, when inflation and rates of interest begin to come down. That’s why the inspiration of a serious purchase sign is presently being constructed.

Mark Hulbert is a daily contributor to MarketWatch. His Hulbert Ratings tracks funding newsletters that pay a flat payment to be audited. He will be reached at mark@hulbertratings.com

More: Stock market prone to right if 10-year Treasury yield reaches 5%, RBC says

Plus: How quickly rising Treasury yields are shaking up monetary markets — in 5 charts

Source web site: www.marketwatch.com