The inventory market’s latest pullback could have purchased the market’s latest rally extra time.

That’s as a result of short-term market timers because the starting of February have on common considerably retreated from their prior bullishness. As I indicated two weeks in the past when anticipating a market pullback, “it would be a positive sign if the timers on balance quickly jump off the bullish bandwagon at the first sign of market weakness.” In that occasion, the pullback would doubtless be comparatively modest and the market’s rally may resume pretty shortly.

The first a part of this script has definitely come to go. Since the market’s early February excessive, the S&P 500

SPX,

has slipped simply 2.1%, and the Nasdaq Composite

COMP,

simply 2.8%. But these small declines have nonetheless been sufficient to trigger the typical short-term market timer to change into markedly much less optimistic.

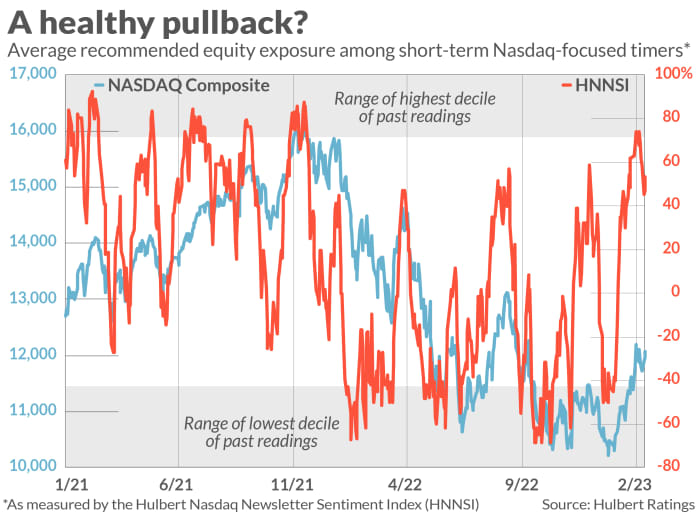

Consider first the typical really helpful fairness publicity stage amongst a subset of short-term market timers who give attention to the Nasdaq inventory market specifically. (This common is what’s tracked by the Hulbert Nasdaq Newsletter Sentiment Index, or HNNSI.) At the time of my two-weeks-ago column on market sentiment, the HNNSI stood on the 90.1 percentile of its historic distribution since 2000. It right now stands on the 69.2 percentile.

Even extra subdued are these market timers who give attention to the broad market relatively than the Nasdaq market specifically. The common of their present publicity ranges stands on the 50.8 percentile of its two-decade distribution.

It’s outstanding that the market timers aren’t extra upbeat. At its peak earlier this month, the Nasdaq Composite was up greater than 20% from its late-2022 low, thereby satisfying the semiofficial criterion for what constitutes a brand new bull market. It’s solely modestly beneath that threshold stage now. Yet the market timing group is in a meh temper, and that’s bullish — relative to what we’d usually anticipate within the wake of a rally as sturdy because the one just lately.

Note fastidiously that contrarian evaluation is at greatest a short-term software, offering perception over an horizon that doesn’t lengthen out way more than a month or two. So market timers’ latest habits sheds no mild on the place the inventory market could also be by the tip of this 12 months.

At a minimal, although, contrarians consider the outlook for the following a number of weeks is much more upbeat than it will have been had the market timers behaved as they usually would after a greater-than-20% rally and change into excessively bullish.

Mark Hulbert is a daily contributor to MarketWatch. His Hulbert Ratings tracks funding newsletters that pay a flat charge to be audited. He could be reached at mark@hulbertratings.com.

Source web site: www.marketwatch.com