The inventory market, as measured by the S&P 500 Index

SPX,

has fallen beneath the 4100 degree. That is critical as a result of there beforehand was triple resistance at that degree, and when SPX broke out above that degree in late January, it appeared as if the subsequent leg of the “new” bull market was underway.

Yet SPX has not solely fallen beneath that supposed assist degree, it’s confirmed the pullback by buying and selling all the way in which all the way down to 4000. It seems that breakout above 4100 was a false one. Those are harmful in bear markets (we final noticed one in January 2022).

So, now there’s resistance at 4200 (the early February highs), and whereas there could be some small assist ranges slightly below present ranges, the main assist is at 3900, after which 3760-3850. If SPX falls beneath 3760 (the December low) that might be a particularly adverse growth.

The McMillan Volatility Band (MVB) promote sign that was issued in early February stays in place. Its goal is the -4σ “modified Bollinger Band” which is at the moment at about 3920, however is falling.

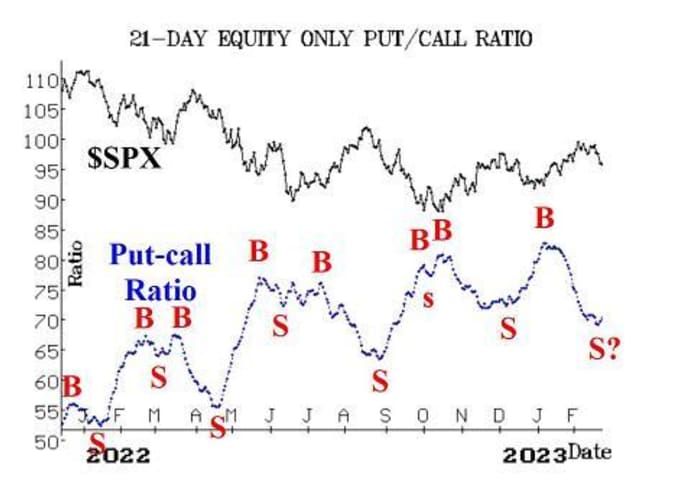

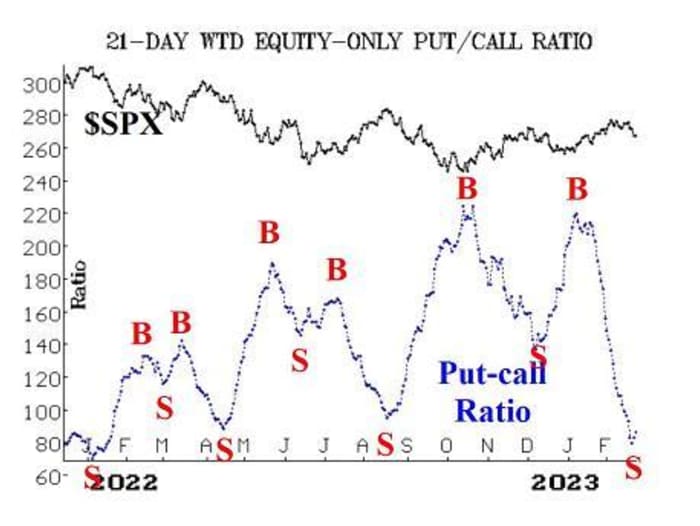

Equity-only put-call ratios are starting to weaken as properly. The weighted ratio is now on a promote sign, in line with our pc evaluation packages (in addition to the bare eye). This promote sign is emanating from a really low (i.e., overbought) degree, and the final two from this degree had been promote indicators in April and August of 2022 — each robust promote indicators.

Meanwhile, the usual ratio has additionally curled upward, however our pc evaluation packages will not be but “saying” that this can be a promote sign. This newest rise has a query mark on the accompanying chart.

Market breadth, which had been a stalwart of the bullish indicator on the way in which up in December and January, has weakened significantly. Both breadth oscillators generated confirmed promote indicators as of February 17th. The decline since then has been swift, and breadth has been very adverse, together with one 90% down day. That implies that the breadth oscillators have already reached oversold standing. Still, the market can decline whereas these oscillators are oversold, so “oversold does not mean buy.” We want to attend for a confirmed purchase sign right here earlier than appearing.

Another indicator that has been bullish for fairly a while is “New 52-week Highs vs. New 52-week Lows.” This purchase sign is in jeopardy of being stopped out, though even when that occurs, a brand new promote sign isn’t essentially in place. On Feb. 22, for the primary time this 12 months, New Lows outnumbered New Highs on the NYSE. If that occurs once more, this indicator’s purchase sign can be stopped out, and the indicator would return to impartial standing. A promote sign requires that New Lows outnumber New Highs for 2 consecutive days, and that the variety of New Lows is larger than 100 on every of these two days.

The volatility complicated indicators are weakening however haven’t turned bearish but. First, VIX

VIX,

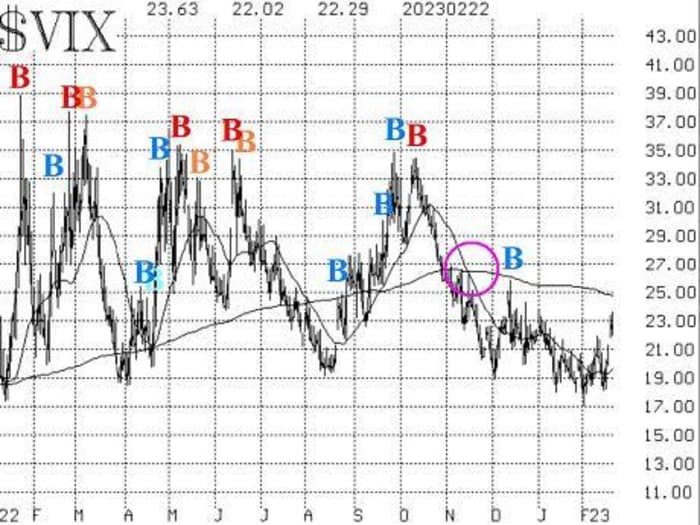

has returned to “spiking” mode — which means that it has risen greater than 3.0 factors over a three-day (or shorter) timeframe. That is an oversold situation, and SPX can drop sharply whereas VIX is in “spiking” mode.

Eventually, although, a VIX “spike peak” purchase sign will likely be generated. As one can see from the accompanying VIX chart, latest “spike peak” purchase indicators haven’t labored out all that properly – save for the robust purchase sign close to the October lows. A blue “B” on the chart is a dropping system commerce, whereas a purple “B” is a profitable one. Regardless, we’ll act on the brand new purchase sign when it seems.

The development of VIX remains bullish for shares so long as each VIX and its 20-day shifting common are beneath the 200-day MA. You can see that the 200-day MA is slightly below 25 and dropping. VIX remains to be properly beneath that time.

The assemble of volatility derivatives stays modestly bullish for shares, in that the time period constructions of the VIX futures and of the CBOE Volatility Indices proceed to slope upward. We are intently watching the connection between the 2 VIX futures entrance months — March and April. Should March VIX futures start to commerce at costs greater than April VIX futures, that might be extraordinarily adverse. So far, that hasn’t occurred, however the distinction between the 2 has narrowed.

In abstract, the breakdown this week, coupled with promote indicators from the equity-only put-call ratios implies that it’s best to once more set up a “core” bearish place. Then, indicators from different indicators might be traded alongside that.

New Recommendation: “Core” bearish place

As famous above, we need to set up and maintain a brand new “core” bearish place:

Buy 2 SPY

SPY,

April (21st) places with a placing worth 10 factors out-of-the-money

And Sell 1 SPY April (21st) places with a placing worth 30 factors decrease.

So, for instance, if SPY is buying and selling at 400, you’ll purchase the SPY April (21st) 390 places and promote the SPY April (21st) 360 places.

Initially, we’ll set a cease to shut out this place if SPX closes above 4200.

New advice: Potential VIX “spike peak” purchase sign

As famous above, VIX has returned to “spiking” mode. The highest worth that it has reached whereas in “spiking” mode has been 23.63 (to date).

IF VIX closes no less than 3.0 factors beneath the best worth that it has reached from February 22nd going ahead, (at the moment 23.63),

THEN

Buy 1 SPY April (7th) at-the-money name

And Sell 1 SPY April (7th) name with a placing worth 15 factors greater.

Today, VIX is underneath 22, so it’s attainable that this purchase sign might be accomplished as quickly because the shut of buying and selling right now. (it must fall beneath 20.63 at right now’s shut).

Follow-up motion:

All stops are psychological closing stops except in any other case famous.

We are utilizing a “standard” rolling process for our SPY spreads: in any vertical bull or bear unfold, if the underlying hits the brief strike, then roll the whole unfold. That can be roll up within the case of a name bull unfold, or roll down within the case of a bear put unfold. Stay in the identical expiration, and preserve the space between the strikes the identical except in any other case instructed.

Long 0 SPY Feb (24th) 412 name and Short 0 SPY Feb (24th) 426 name: This unfold was purchased when the breakout over 3940 by SPX was confirmed, on the shut on January 12th. It was rolled up on February 1st, when SPY traded at 412. Then it was stopped out when $SPX closed beneath 4060 on Feb 21st.

Long 1 SPY Mar (17th) 410 name and Short 1 SPY Mar (17th) 425 name: This unfold was purchased according to the “New Highs vs. New Lows” purchase indicators. It was rolled up on January 26th, when SPY traded at 404, after which it was rolled up once more at expiration. Stop your self out of this place if New Lows on the NYSE exceed New Highs for 2 consecutive days.

Long 0 SPY Mar (17th) 415 name and Short 0 SPY Mar (17th) 431 name: This commerce was stopped out on February 21st, when $SPX closed beneath 4020.

Long 3 XM Mar (17th) 15 calls: Continue to carry XM

XM,

whereas takeover rumors play out.

Long 1 SPY Mar (17th) 410 put and Short 1 SPY Mar (17th) 385 put: This bear unfold was purchased according to the McMillan Volatility Band (MVB) promote sign. This commerce can be stopped out if SPX had been to shut again above the +4σ Band. We will preserve you up to date relating to the place of the MVB every week.

Long 2 CTLT Mar (17th) 70 calls: This takeover rumor remains to be “in play,” though CTLT

CTLT,

inventory has fallen barely. Continue to carry whereas these rumors play out.

Long 3 MANU

MANU,

Mar (17th) 25 calls: Hold and not using a cease whereas the takeover rumors play out.

Long 2 GRMN April (21st) 95 places: These had been purchased on February 21st, when GRMN

GRMN,

closed beneath 95. The subsequent day, the corporate reported better-than-expected earnings, and shares jumped greater. We will stay on this place so long as the GRMN weighted put-call ratio stays on a promote sign.

All stops are psychological closing stops except in any other case famous.

Send inquiries to: lmcmillan@optionstrategist.com.

Lawrence G. McMillan is president of McMillan Analysis, a registered funding and commodity buying and selling advisor. McMillan could maintain positions in securities advisable on this report, each personally and in shopper accounts. He is an skilled dealer and cash supervisor and is the creator of the best-selling e book, Options as a Strategic Investment. www.optionstrategist.com

©McMillan Analysis Corporation is registered with the SEC as an funding advisor and with the CFTC as a commodity buying and selling advisor. The info on this publication has been fastidiously compiled from sources believed to be dependable, however accuracy and completeness will not be assured. The officers or administrators of McMillan Analysis Corporation, or accounts managed by such individuals could have positions within the securities advisable within the advisory.

Source web site: www.marketwatch.com