How have you learnt if an economic system is headed right into a recession? You don’t, till it’s already in a single.

That’s the implication of a little-known indicator that keys off the distinction between two separate measures of client sentiment. Fed Chair Jerome Powell didn’t make any point out of this indicator in his news convention on Wednesday, however I wouldn’t be stunned if he and different Fed officers know it.

In truth, Powell appeared to at the least considerably backpedal on his earlier forecasts of a so-called “soft landing,” now saying that such an final result is “possible” —a nd that the Fed’s interest-rating setting committee doesn’t contemplate a smooth touchdown because the “baseline expectation.”

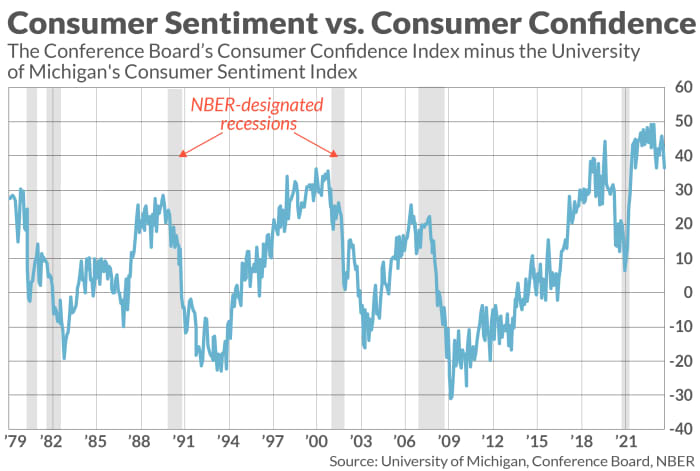

The indicator I’m referring to is constructed by subtracting the University of Michigan’s Index of Consumer Sentiment (UMICS) from the Conference Board’s Consumer Confidence Index (CCI). Since 1979, which is how far again month-to-month information prolong for each indexes, recessions have been imminent each time this unfold vastly widened after which started to slim.

These preconditions have been met, as you may see from the accompanying chart. After widening to a document final December of 49.3 share factors, the unfold presently stands at 36.6 share factors — a narrowing of 12.7 share factors. On common previous to the 5 recessions from 1979 as much as and together with the 2008 Global Financial Crisis, the unfold had declined 9.7 factors by the point the recession started. (I ignored the early 2020 COVID pandemic recession as a result of it was so distinctive.)

I wrote about this indicator final May, when it had already narrowed 11.3 share factors since its December 2022 studying. Skeptics level out that, however this narrowing that had already occurred, the U.S. economic system since then has remained robust. But I don’t put an excessive amount of weight on this objection, since there usually is an extended lag between when a recession begins and when the National Bureau of Economic Research publicizes that one has begun. (The NBER is the semi-official arbiter of when recessions start and finish.) Historically, in accordance with the NBER, this lag has been wherever between 4 and 21 months; within the case of the newest recession it was 15 months.

Why the indicator works

The indicator keys off the completely different features of shoppers’ temper that the CCI and the UMICS measure. According to James Stack of InvesTech Research, from whom I first heard about this indicator, the CCI extra closely displays shoppers’ attitudes in the direction of the general economic system, whereas the UMICS is extra closely weighted in the direction of their quick private circumstances.

The idea behind the indicator is that, when the economic system begins to weaken, shoppers initially change into involved about their very own private circumstances whereas remaining upbeat in regards to the economic system on the whole — inflicting the unfold between the 2 client measures to widen. A recession turns into imminent when this souring spreads from shoppers’ private conditions to worrying in regards to the economic system usually — which has the impact of narrowing that unfold.

Further empirical help for the indicator is its monitor document in forecasting the S&P 500’s

SPX

whole actual return. As you may see from the chart under, the U.S. inventory market has turned in losses, on common, within the wake of the ten% of months wherein the indicator was best. Its newest readings are solidly inside this prime decile.

| When the CCI degree minus the UMICS degree was… | S&P 500’s common whole actual return over subsequent 12 months | S&P 500’s common whole actual return over subsequent 5 years (annualized) |

| The 10% of months since 1979 when the unfold was best | -2.2% | -4.3% |

| The 10% of months since 1979 when the unfold was lowest | +14.1% | +14.8% |

Mark Hulbert is an everyday contributor to MarketWatch. His Hulbert Ratings tracks funding newsletters that pay a flat payment to be audited. He might be reached at mark@hulbertratings.com

More: This former Fed insider has 3 massive takeaways from Powell’s press convention

Plus: Fed predicts ‘soft landing’ for the economic system — low inflation and no recession

Source web site: www.marketwatch.com