The economic system grew at a way more fast tempo than anticipated within the closing three months of 2023, because the U.S. simply skirted a recession that many forecasters had thought was inevitable, the Commerce Department reported Thursday.

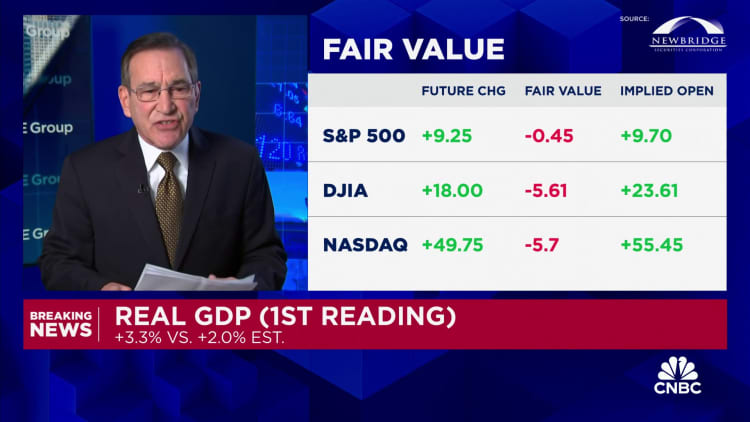

Gross home product, a measure of all the products and providers produced, elevated at a 3.3% annualized charge within the fourth quarter of 2023, in accordance with information adjusted seasonally and for inflation.

That in comparison with the Wall Street consensus estimate for a acquire of two% within the closing three months of the 12 months. The third quarter grew at a 4.9% tempo.

The U.S. economic system for all of 2023 accelerated at a 2.5% annualized tempo, effectively forward of the Wall Street outlook originally of the 12 months for few if any positive factors.

As had been the case by the 12 months, a robust tempo of shopper spending helped drive the growth. Personal consumption expenditures elevated 2.8% for the quarter, down simply barely from the earlier interval.

State and native authorities spending additionally contributed, up 3.7%, as did a 2.5% enhance in federal authorities expenditures. Gross non-public home funding rose 2.1%, one other vital issue for the sturdy quarter.

On the inflation entrance, the value index for private consumption expenditures rose 2.7% on an annual foundation, down from 5.9% a 12 months in the past, whereas the core determine excluding meals and vitality posted a 3.2% enhance yearly, in comparison with 5.1%.

However, the inflation charges each had been a lot decrease in a quarterly foundation. Core costs, which the Federal Reserve prefers as a longer-term inflation measure, rose 2% for the interval, whereas the headline charge was 1.7%.

Markets confirmed solely modest response to the report. Stock futures gained barely whereas Treasury yields moved decrease.

In different financial news Thursday, preliminary jobless claims totaled 214,000, a rise of 25,000 from the earlier week and forward of the estimate for 199,000.

The GDP report wraps up a 12 months wherein most economists had been nearly sure the U.S. would enter at the very least a shallow recession. Even the Fed had predicted a gentle contraction because of banking business stress final March.

However, a resilient shopper and a strong labor market helped propel the economic system by the 12 months, which additionally featured an ongoing pullback in manufacturing and a Fed that stored elevating rates of interest in its battle to convey down inflation.

As the calendar turns a web page to a brand new 12 months, hopes have shifted away from a recession as markets anticipate the Fed will begin chopping charges whereas inflation continues to float again to its 2% purpose.

Concerns stay, nonetheless, that the economic system faces extra challenges forward.

Some of the troubles middle across the lagged results of financial coverage, particularly the 11 rate of interest hikes totaling 5.25 proportion factors that the Fed accredited between March 2022 and July 2023. Conventional financial knowledge is that it could possibly take so long as two years for such coverage tightening to make its manner by the system, so that might contribute to slowness forward.

Other angst facilities round how lengthy shoppers can preserve spending as financial savings dwindle and high-interest debt masses accrue. Finally, there’s the character of what’s driving the growth past the patron: Government deficit spending has been a major contributor to development, with the overall federal IOU at $34 trillion and counting. The funds deficit has totaled greater than half a trillion {dollars} for the primary three months of fiscal 2024.

There are also political worries because the U.S. enters the guts of the presidential election marketing campaign, and geopolitical fears with violence within the Middle East and the persevering with bloody Ukraine conflict.

This is breaking news. Please verify again right here for updates.

Source web site: www.cnbc.com