It felt like a little bit of a catch-up on Monday, with the Dow

DJIA

outperforming the S&P 500

SPX

which outperformed the Nasdaq Composite

COMP.

In any occasion, it broke a four-session dropping streak for the S&P 500, although the August gremlins is perhaps again out on Tuesday. More on that later.

But for the decision of the day we’ll go approach again in time to Friday — historical historical past — when the Labor Department reported 187,000 jobs had been created in July. Steve Englander, head of North America macro technique at Standard Chartered, has been one thing of a jobs-report skeptic, beforehand noting the divergence between the payrolls report and the quarterly census of employment and wages. (The most up-to-date knowledge, from December, exhibits the payrolls report with 2.2 million extra jobs than the extra authoritative, however much less well timed, QCEW report does.)

What Englander finds fault with within the July report is the birth-death mannequin. Each month the federal government surveys 122,000 companies and authorities businesses, protecting a couple of third of all employees, to give you the job numbers produced by what’s known as the institution survey. But new corporations pop up, in addition to fail, on a regular basis. Hence the birth-death mannequin fills within the hole with its estimate for job creation or destruction every month.

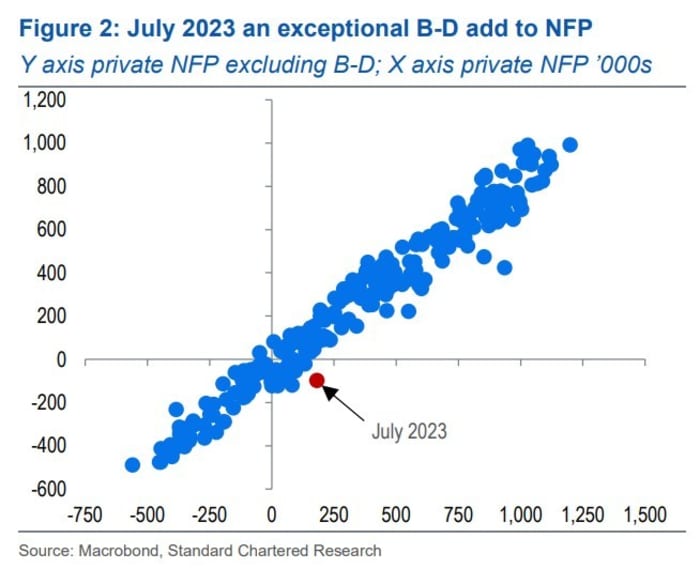

Englander for these functions is wanting on the non seasonally adjusted numbers, which confirmed 182,000 private-sector jobs created in July. The birth-death mannequin was chargeable for 280,000 of them, which suggests current corporations removed 98,000 positions.

“The behavioral question is whether it is plausible that optimism on economic prospects led to many jobs being created at newly established firms when ongoing businesses were contracting. The BLS’ business employment dynamics data, which is based on administrative data rather than a model, tells us this is very unlikely. As is intuitive, job creation from new and existing firms tends to move together. This is the basis of our suspicion of excess animal spirits at BLS,” he mentioned.

MarketWatch’s examination of the numbers does discover months that the private-sector job creation of latest corporations is constructive when current corporations are decreasing employees, but it surely isn’t regular — 5 out of the final 27 studies when January figures are excluded.

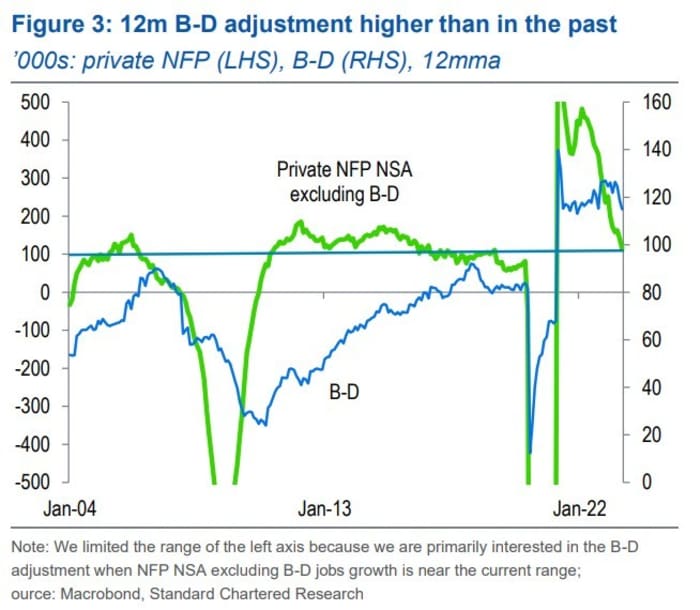

Englander says the figures could also be overstated by as a lot as 200,000 — and making use of seasonal adjustment would go away private-sector job creation down by practically 30,000. If he’s proper concerning the overstatement, this additionally implies job openings knowledge might be awry, since that report makes use of the headline payrolls knowledge for alignment. And he says when the typical of 12 months of personal payrolls excluding births and deaths are close to present ranges, the typical 12-month birth-death adjustment has been 35,000 to 60,000 jobs decrease than it’s now working.

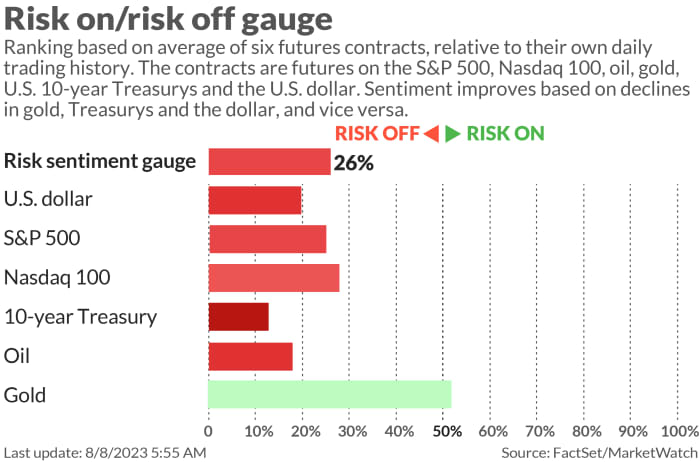

The markets

A risk-off tone appears to be the flavour for Tuesday. U.S. inventory futures

ES00,

NQ00,

had been decrease, oil futures

CL.1,

dropped, and the yield on the 10-year Treasury

BX:TMUBMUSD10Y

was again round 4%.

For extra market updates plus actionable commerce concepts for shares, choices and crypto, subscribe to MarketDiem by Investor’s Business Daily.

The buzz

A giant slate of earnings consists of outcomes from United Parcel Service, Eli Lilly

LLY,

and Warner Music

WMG,

with Rivian Automotive

RIVN,

and Upstart

UPST,

reporting after the shut. UPS inventory

UPS,

skidded on a decreased outlook whereas AMC Entertainment

AMC,

reported earnings and income forward of forecast.

Among Monday’s after-hours releases, Paramount Global

PARA,

produced outcomes forward of forecast and agreed to promote Simon & Schuster to KKR for $1.6 billion, Palantir Technologies

PLTR,

introduced a brand new $1 billion inventory buyback and Beyond Meat

BYND,

decreased its forecast.

Novo Nordisk

NVO,

Lilly’s rival for diabetes medication, mentioned its Wegovy remedy additionally reduces cardiovascular occasions, by some 20% in a examine.

Moody’s positioned the credit score scores of six banks on evaluation for downgrade and did lower the score of a number of others, wherein they blamed on interest-rate and asset and legal responsibility dangers.

June commerce knowledge is due for launch, after the superior report mentioned the deficit in items narrowed by 4.4%. In China, its commerce surplus of $80.6 billion for July was worse than the $70.6 billion that was anticipated.

Best of the net

Elon Musk calls the Cybertruck Tesla’s

TSLA,

finest product. Here comes the check.

Even Zoom

ZM,

is making workers return to the workplace.

Dish

DISH,

and EchoStar

SATS,

could also be merged, becoming a member of two corporations each managed by Charlie Ergen.

Top tickers

Here had been probably the most energetic stock-market tickers as of 6 a.m. Eastern.

| Ticker | Security title |

|

TSLA, |

Tesla |

|

PLTR, |

Palantir Technologies |

|

AMC, |

AMC Entertainment |

|

NIO, |

Nio |

|

AAPL, |

Apple |

|

TUP, |

Tupperware Brands |

|

TTOO, |

T2 Biosystems |

|

NVDA, |

Nvidia |

|

GME, |

GameStop |

|

AMZN, |

Amazon.com |

The chart

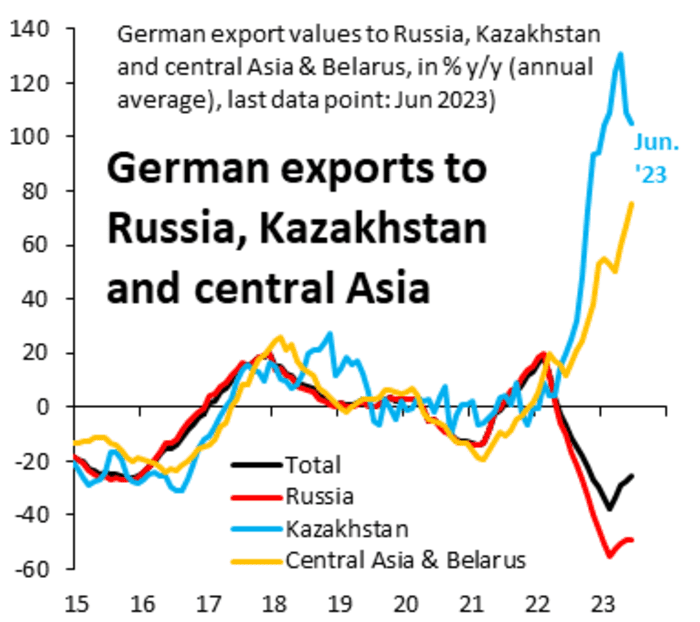

German exports to Kazakhstan, Central Asia and Belarus are surging, greater than doubling during the last yr. Now, the Kazakh financial system did develop at an almost 5% clip throughout June, however plainly a few of these exports could also be headed to Russia, in accordance with Robin Brooks, chief economist on the Institute of International Finance. He additionally factors out German and Polish exports to Kyrgzstan are surging, as are Swedish exports to Kazakhstan. European Union nations sanctions are supposed to forestall the export of cutting-edge know-how, sure sorts of equipment, aviation items and know-how, dual-use items and luxurious items to Russia, amongst different restrictions.

Random reads

The Baltimore Orioles took its lead play-by-play voice off the air after he precisely recalled the group’s dropping methods in earlier seasons.

A automotive crashed into the second ground of a home in Pennsylvania.

Hank the Tank, a bear (feminine it seems) that broke into 21 properties, has been captured.

Need to Know begins early and is up to date till the opening bell, however enroll right here to get it delivered as soon as to your e mail field. The emailed model will likely be despatched out at about 7:30 a.m. Eastern.

Listen to the Best New Ideas in Money podcast with MarketWatch monetary columnist James Rogers and economist Stephanie Kelton.

Source web site: www.marketwatch.com