The bond market is entrance and middle for traders as of late, with JPMorgan warning of a “financial accident” if yields preserve going up, driving costs decrease.

“The damage in bonds has been more severe and more sustained than for equities, and you can’t help wondering where the real damage is. You can’t have this much value destruction in bonds without there being some stress somewhere. However, it’s near impossible to work out where exactly it might come to the surface and on the heels of the worst month for bonds of the year,” famous a group of Deutsche Bank strategists led by Jim Reid on Monday.

Our name of the day from Ed Yardeni, president of Yardeni Research, gives an concept on the subsequent market to fall. That’s as he raises the alarm over what he calls the “Wild Bunch,” or bond vigilantes, who’ve “seized control of the Treasury market.” His hope is that cooling inflation will calm issues down.

In a be aware to shoppers, Yardeni ticks off proof of these bond vigilantes in motion. For starters, the truth that the 10-year Treasury yield

BX:TMUBMUSD10Y

rose on latest weak information as a substitute of declining suggests a “shift in bond investors’ focused from what monetary policy makers may do to rising alarm about what fiscal policy makers are doing.”

“The worry is that the escalating federal budget deficit will create more supply of bonds than demand can meet, requiring higher yields to clear the market; that worry has been the bond vigilantes’ entrance cue,” he says.

Yardeni additionally sees the vigilantes in motion in the case of yield curve disinversion these days — an inverted yield curve happens when curiosity paid on short-term debt is greater than that of long run bonds.

“Perversely, now that the Fed seems to be on the verge of terminating its rate hiking, bond investors might have concluded that short-term rates aren’t high enough to cause a financial crisis, credit crunch, and a recession,” he mentioned.

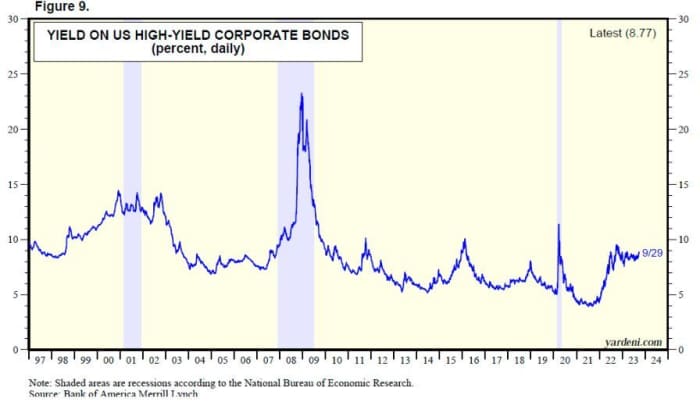

And right here’s the place he’s on guard for hassle, as he notes that the wild bunch have oddly left the high-yield company debt market — flat and steady –alone:

“Could it be that some of them view the government’s securities as riskier than high-yield corporates? The result of their rampage in the Treasury market suggests as much,” he mentioned, including that they’re on alert for indicators of rampage spreading to excessive yields.

And for positive, the wild bunch have DC coverage makers of their sights, after inflicting the Treasury market to completely reverse a drop within the 10-year yield from the worldwide monetary disaster by means of the pandemic over the previous three years, he notes.

Their message is obvious, says Yardeni: “Take meaningful actions to reduce the federal deficit now and in the future or we will push the bond yield up to whatever level it takes to get you to do so!”

Read: How Treasury market upheaval is rippling by means of world markets in 4 charts

The markets

Stock futures

ES00,

NQ00,

are pointing to opening losses, with the yield on the 10-year Treasury be aware

BX:TMUBMUSD10Y

up 4 foundation factors and that of the 30-year

BX:TMUBMUSD30Y

up 7 foundation factors. The greenback

DXY

is up, notably towards the Russian ruble

USDRUB,

whereas gold

GC00,

silver

SI00,

and oil

CL.1,

are beneath strain.

Read: Gold seems headed for a ‘death cross’ simply 5 months after teasing file highs

For extra market updates plus actionable commerce concepts for shares, choices and crypto, subscribe to MarketDiem by Investor’s Business Daily.

The buzz

POINT Biopharma

PNT,

inventory is up 84% after Eli Lilly introduced a $1.4 billion deal for the most cancers remedy firm, paying $12.50 a share.

SmileDirectClub shares

SDC,

are down one other 12% following a chapter submitting, as a purchaser for the tooth straightening group could possibly be onerous to seek out.

WeWork inventory

WE,

is down 5% after the workplace work area supplier mentioned it could miss curiosity funds to proceed talks with its lenders.

U.S.-listed Chinese shares are down after property builders (besides Evergrande, which rallied) pulled the Hang Seng

HK:HSI

2.6% decrease. Alibaba

BABA,

JD.com

JD,

XPeng

XPEV,

and Li Auto

LI,

are off 2% or extra.

Tesla

TSLA,

has launched a inexpensive, rear-wheel-drive model of its bestselling Model Y crossover SUV within the U.S.

Cleveland Fed President Loretta Mester mentioned late Monday that the central financial institution could must hike charges as soon as extra this yr after which preserve them excessive “for some time.”

Elsewhere a speech is due from Atlanta Fed President Raphael Bostic at 8 a.m., adopted by job openings at 10 a.m.

Best of the net

Why house insurance coverage costs within the U.S. went up 21% between 2022 and 2023.

Meta plans to cost $14 a month for ad-free Instagram or Facebook.

Burger King continues to be open in Russia regardless of a pledge to exit.

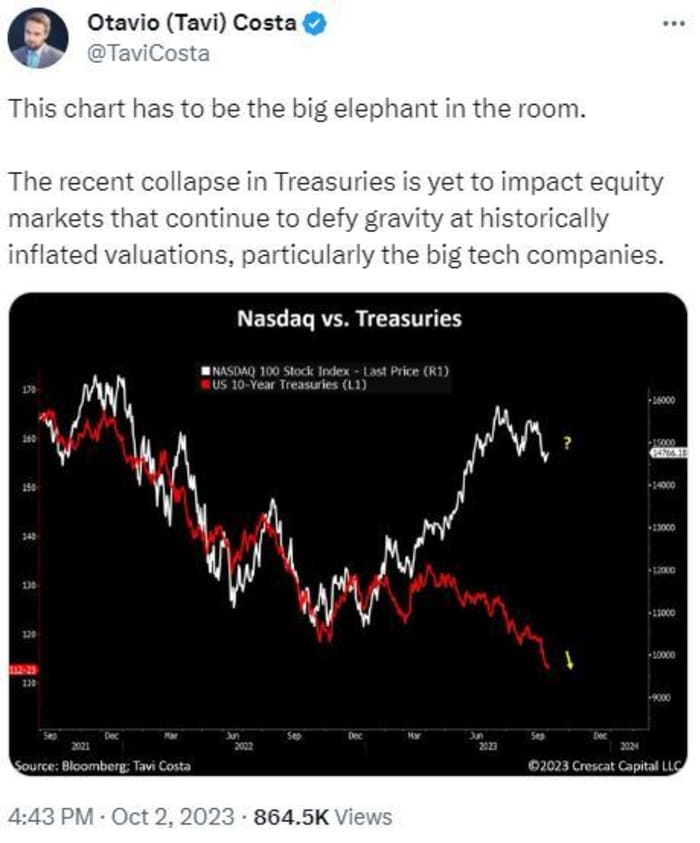

The chart

Here’s a chart from the portfolio supervisor of Crescat Capital, Otavio Costa, whose chart sums up attainable brewing hassle for tech corporations:

@TaviCosta

The tickers

These had been the top-searched tickers on MarketWatch as of 6 a.m.:

| Ticker | Security title |

|

TSLA, |

Tesla |

|

NVDA, |

Nvidia |

|

AMC, |

AMC Entertainment |

|

GME, |

GameStop |

|

NIO, |

NIO |

|

AAPL, |

Apple |

|

TTOO, |

T2 Biosystems |

|

AMZN, |

Amazon.com |

|

MULN, |

Mullen Automotive |

|

NKLA, |

Nikola |

Random reads

On the bathroom? Stay off your telephone.

NASA has a severe plan to construct homes on the moon.

In bedbug-plagued Paris, accommodations will price 300% extra for the 2024 Olympics

Need to Know begins early and is up to date till the opening bell, however enroll right here to get it delivered as soon as to your e mail field. The emailed model might be despatched out at about 7:30 a.m. Eastern.

Listen to the Best New Ideas in Money podcast with MarketWatch monetary columnist James Rogers and economist Stephanie Kelton.

Source web site: www.marketwatch.com