It was the day earlier than payrolls, when all by way of the home, not an asset was stirring, not even a mouse. (We will for poetic license ignore the actions in Japan; extra on that later.)

| Date | Initially reported nonfarm payrolls (in 1000’s) | Economist expectations (in 1000’s) | S&P 500 response |

| 1/6/23 | 223 | 200 | 2.30% |

| 2/3/23 | 517 | 185 | -1% |

| 3/10/23 | 311 | 215 | -1.50% |

| 4/7/23 | 236 | 240 | 0.10% |

| 5/5/23 | 253 | 178 | 1.90% |

| 6/2/23 | 339 | 188 | 1.50% |

| 7/7/23 | 209 | 215 | -0.30% |

| 8/4/23 | 187 | 195 | -0.50% |

| 9/1/23 | 187 | 170 | 0.20% |

| 10/6/23 | 336 | 162 | 1.20% |

| 11/3/23 | 150 | 180 | 0.90% |

| Data: FactSet | |||

It’s price reviewing how markets have reacted to jobs numbers this 12 months. In the early a part of the 12 months, good news was dangerous news — blowout jobs progress spooked markets, fretful of extra charge hikes. That hasn’t at all times been the case, although — significantly, as within the report launched in October, when different sections of the report (common hourly earnings) had been extra bond pleasant.

Economists polled by the Wall Street Journal count on a 190,000 rise in nonfarm payrolls — bear in mind, there will likely be a lift from returning auto staff — an unchanged jobless charge of three.9% and a 0.3% rise in common hourly earnings.

John Flood, a managing director at Goldman Sachs who works in its buying and selling enterprise, says there’s a “new dynamic” in that the market will dislike excessive leads to both course.

An increase of greater than 250,000 would result in a sell-off within the S&P 500

SPX

of a minimum of 0.5%, however so will a achieve of fewer than 50,000, he mentioned. The candy spot can be an increase between 50,000 and 150,000, he says, which might set off a achieve of a minimum of 1%.

That mentioned, there’s at all times the likelihood another component of the roles report may take the highlight. It’s “worth noting our best macro people think the unemployment rate is most important slice of Friday’s report.”

The unemployment charge has already risen a half-point from its low. Note that the Sahm Rule recession indicator is when the three-month common of the unemployment charge is a minimum of a half level above its three-month minimal during the last 12 months, and the most recent studying is 0.33%.

It would take a very giant bounce within the jobless charge, to 4.3%, to set off the Sahm Rule with Friday’s report, although it looks like the recession indicator will likely be triggered early subsequent 12 months.

The market

Japanese shares

JP:NIK

fell and the yen

USDJPY,

rose Thursday after feedback from Bank of Japan officers helped stir expectations the nation may exit its decades-long damaging interest-rate coverage as early as subsequent week. Apart from that, inventory futures

ES00,

NQ00,

had been regular, oil

CL.1,

was proper round $70, and the 10-year

BX:TMUBMUSD10Y

was 4.13%.

For extra market updates plus actionable commerce concepts for shares, choices and crypto, subscribe to MarketDiem by Investor’s Business Daily.

The buzz

Alphabet’s

GOOGL,

Google launched Gemini, a brand new synthetic intelligence mannequin that will likely be included into its Bard chatbot and its Pixel 8 Pro smartphone.

Advanced Micro Devices

AMD,

rolled out new chips for AI utilization, in what often is the first problem to Nvidia

NVDA,

AbbVie

ABBV,

mentioned it’s going to purchase Cerevel Therapeutics

CERE,

in an $8.7 billion deal.

GameStop

GME,

missed income expectations within the third quarter, because the videogame retailer mentioned it will have the ability to spend money on shares, managed by new Chairman and CEO Ryan Cohen.

McDonald’s

MCD,

CosMc’s spinoff launches this month.

The economics calendar options jobless claims, and within the afternoon, the buyer credit score report.

Best of the net

A leaked memo exhibits Amazon’s plans to advance its California pursuits.

UFC house owners paid themselves lots of of hundreds of thousands yearly.

Crypto trade co-founder pleads responsible to U.S. cost and can dissolve trade

Top tickers

Here had been probably the most lively stock-market tickers on MarketWatch as of 6 a.m. Eastern.

| Ticker | Security identify |

|

TSLA, |

Tesla |

|

GME, |

GameStop |

|

NVDA, |

Nvidia |

|

NIO, |

Nio |

|

AMC, |

AMC Entertainment |

|

AAPL, |

Apple |

|

AMD, |

Advanced Micro Devices |

|

PLTR, |

Palantir Technologies |

|

AMZN, |

Amazon.com |

|

MLGO, |

MicroAlgo |

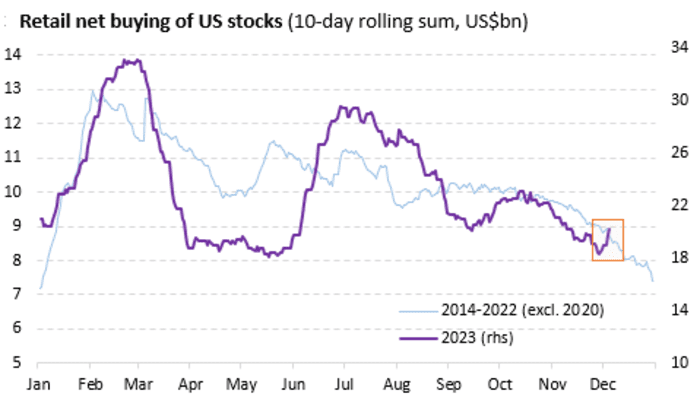

The chart

Vanda Research

Retail traders are shopping for shares — which is uncommon for this time of 12 months, in line with analysts at Vanda Research. That “has helped smaller cap names outperform big tech, especially those stocks tied to the crypto and the software/AI space,” say the analysts, who establish Marathon Digital

MARA,

Riot Platforms

RIOT,

and Coinbase Global

COIN,

among the many crypto names being bought, alongside different corporations together with PDD Holdings

PDD,

Workday

WDAY,

and Snowflake

SNOW,

Random reads

Brenda Lee could not see a lot cash from her No. 1 hit, “Rockin’ Around the Christmas Tree.”

“Purrson of the year” — Taylor Swift’s cat steals the limelight.

A lady was sentenced to work at a fast-food restaurant after hurling a burrito bowl at an worker’s face.

Need to Know begins early and is up to date till the opening bell, however join right here to get it delivered as soon as to your e mail field. The emailed model will likely be despatched out at about 7:30 a.m. Eastern.

Source web site: www.marketwatch.com