Shares of U.S. airways have posted double-digit losses in September, with shares of these centered on home, leisure air journey probably the most affected because the business enters one among its shoulder seasons.

So far, so predictable. What airways couldn’t have predicted is that rising gasoline costs are making an even bigger dent of their stability sheets.

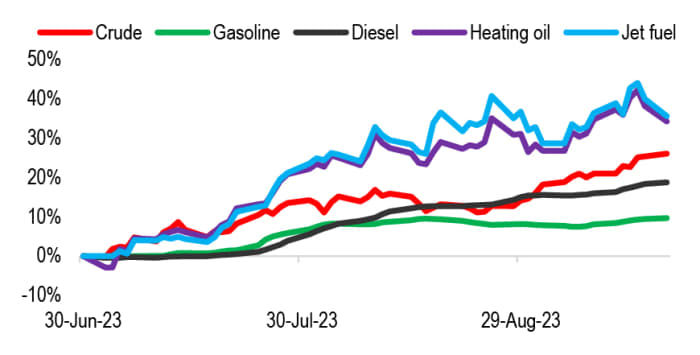

Oil costs have rallied 30% since early July, from a low of $72 a barrel to $94 a barrel to hit a 10-month excessive in current periods. And oil-product costs similar to gasoline and diesel are main the surge, as they did final 12 months, JP Morgan stated in a notice Wednesday.

Jet gasoline has risen probably the most, with its value on the Gulf Coast hovering greater than 40% since early July, JP Morgan stated. The JP Morgan notice had this chart exhibiting the will increase in jet gasoline in comparison with different oil merchandise:

JP Morgan

“The downward revision cycle for the airlines continues as rising fuel [prices] erodes margins while domestic pricing slips,” analysts at Mellius Research stated in a current notice.

The common airline inventory was down about 15% over the previous month, in contrast with a small advance for the S&P 500 index. This time of the 12 months, enterprise air journey normally gives some tailwind for airways and a bridge to vacation journey, one other demand peak for airways.

Airlines have struggled to “take advantage of an evolving demand environment, resulting in the loss of pricing power,” and in consequence, the group is falling out of favor with buyers, the analysts stated.

Last week, main U.S. airways together with Delta Air Lines Inc.

DAL,

and American Airline Group Inc.

AAL,

lower their revenue outlook for the 12 months, partially pinning it on gasoline costs.

See additionally: Southwest, United Airlines and Alaska Airlines increase estimates for gasoline prices

The U.S. Global JETS ETF

JETS

has misplaced about 8% this month, in contrast with a decline of 1.2% for the S&P 500 index

SPX.

In the 12 months thus far, the ETF has gained 4%, versus a achieve of greater than 16% for the broader index.

Source web site: www.marketwatch.com